XRP Could Rally Hard in 2025, Yet Ozak AI Forecast Shows a More Aggressive Trajectory

Crypto market momentum continues building as XRP strengthens around the $2 range and analysts begin projecting a major expansion for the asset heading into 2025. With increasing institutional interest, clearer regulatory positioning, and renewed on-chain activity, XRP is shaping up as one of the most dependable large-cap performers of the next cycle. Many forecasts place XRP in a realistic $7–$12 range during peak market conditions — a strong multi-fold return driven by global settlement utility.

Yet even with XRP preparing for a powerful breakout, long-term ROI models highlight another project with a far more aggressive growth curve: Ozak AI (OZ). As an AI-native intelligence engine capable of processing blockchain data in milliseconds and refining its predictive models autonomously, Ozak AI introduces exponential upside that far surpasses even top-tier institutional tokens. Its early valuation window and rapidly evolving AI infrastructure place it at the top of nearly every high-growth projection for 2025–2026.

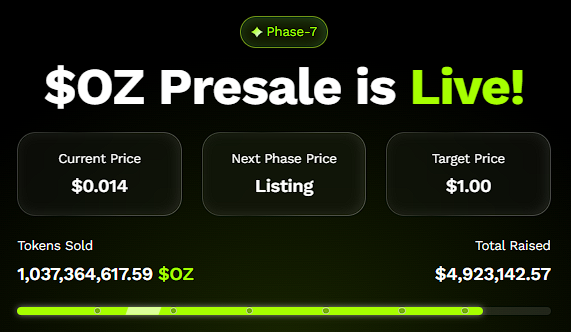

Ozak AI (OZ)

Ozak AI’s trajectory continues accelerating because it enters the market with fully functional AI systems, not speculative concepts. Its intelligence engine operates using HIVE’s ultra-fast 30ms execution signals, giving it instant insight into liquidity shifts, volatility triggers, and multi-chain movements. SINT-powered autonomous agents build on this data foundation, constantly scanning networks, interpreting conditions, and adjusting strategies without human intervention.

Perceptron Network’s 700K+ nodes feed continuous multi-chain data into Ozak AI’s learning model, making the system sharper, more adaptive, and more capable every day. This compounding intelligence effect — intelligence that improves simply by running — is why analysts assign Ozak AI realistic 50x–100x potential for 2025–2026. With OZ presale raising over $4.9 million, investors clearly understand that Ozak AI is more than a token; it is a foundational AI infrastructure layer entering the market at an early-stage valuation.

XRP

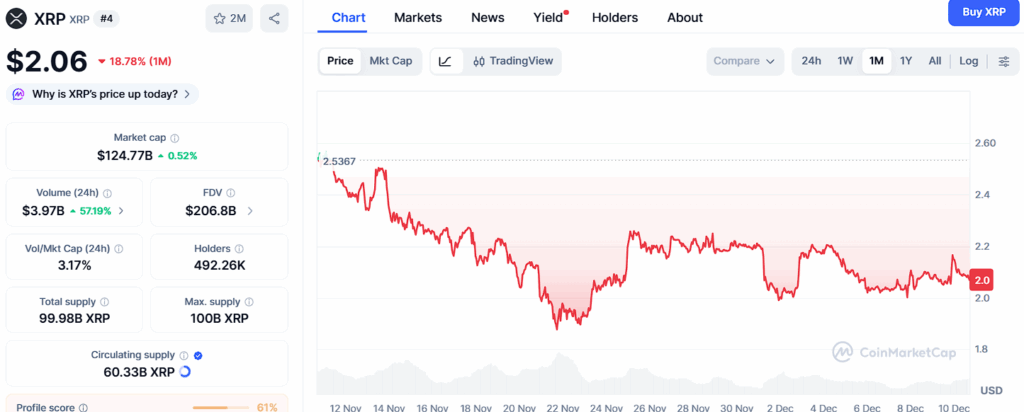

XRP trades near $2 and continues forming an increasingly bullish long-term structure. Support builds around $1.96, providing immediate stability, while deeper foundational support appears at $1.90 and $1.84 — historically important accumulation zones where institutions tend to step in.

On the upside, XRP approaches resistance at $2.10, followed by additional challenge regions at $2.16 and $2.23. Breakouts through these levels typically lead to strong multi-week momentum, especially when global settlement narratives align with market liquidity. Analysts widely expect XRP to rally hard in 2025, with projections ranging from $7 on the conservative end to as high as $12 in a peak cycle scenario. XRP’s combination of institutional positioning and utility-driven adoption makes it one of the safer large-cap growth plays.

Yet even with this powerful outlook, XRP’s multiplier potential remains naturally capped by its scale — a constraint that does not apply to early-stage AI-native assets like Ozak AI.

Why Ozak AI Shows a More Aggressive Trajectory

XRP grows through adoption, enterprise integration, and macro liquidity cycles. Ozak AI grows through intelligence refinement — a far more exponential mechanism.

Ozak AI’s trajectory does not depend on hype cycles or market sentiment — it strengthens automatically as the AI learns. This creates a parabolic curve of capability expansion that directly translates into long-term token value.

XRP may be 4x–6x in a strong cycle. Ozak AI may be 50x–100x because its value compounds through computation. XRP’s growth is powerful but linear. Ozak AI’s growth is exponential — and accelerating. This distinction is why analysts consistently rank Ozak AI above XRP in pure ROI models.

XRP Looks Strong—Ozak AI Looks Transformational

XRP is poised for one of its strongest cycles in years, with a clear path toward multi-dollar expansion. But Ozak AI represents an entirely different class of asset — a self-improving, real-time intelligence network entering the market early enough to capture exponential upside.

XRP may rally hard in 2025, but Ozak AI’s forecast points toward a trajectory that is wider, steeper, and significantly more aggressive. For investors seeking the highest long-term ROI potential heading into the 2025–2026 cycle, Ozak AI continues to stand out as the most compelling opportunity in the entire market.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a technology platform that specializes in predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized network technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the correct decisions.

For more, visit:

- Website: https://ozak.ai/

- Telegram: https://t.me/OzakAGI

- Twitter: https://x.com/ozakagi

Disclaimer: TheNewsCrypto does not endorse any content on this page. The content depicted in this Press Release does not represent any investment advice. TheNewsCrypto recommends our readers to make decisions based on their own research. TheNewsCrypto is not accountable for any damage or loss related to content, products, or services stated in this Press Release.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

Forward Industries Bets Big on Solana With $4B Capital Plan