Is LivLive the Top Crypto to Buy in 2026? $LIVE Presale Signals 100x as BNB Hits $900 and XRP ETFs Flow

Cryptocurrency markets are shifting into high gear as investors chase projects with real-world adoption, robust tokenomics, and measurable growth. Major assets are showing that usage, not hype, is driving value: BNB is gaining on surging network activity, while XRP attracts strong institutional inflows through ETFs and enterprise adoption. These moves highlight a market that rewards execution and engagement, signaling that 2026 could be a turning point for adoption-driven crypto.

LivLive is emerging as a standout project that connects digital rewards to real-world actions through gamified experiences and XP-based incentives. With verified participation driving token distribution and sustainable growth, early adoption is accelerating quickly. These factors position LivLive squarely as the top crypto to buy in 2026, offering investors exposure to a behavior-driven ecosystem with strong upside potential.

LivLive ($LIVE): The Top Crypto to Buy in 2026 Turning Real-Life Actions Into Digital Value

LivLive is redefining what the top crypto to buy in 2026 represents by aligning token rewards with real-world behavior. The platform operates through a layered gamification and XP ecosystem that tracks verified movement, visits, and participation. Users earn XP and $LIVE through active engagement rather than passive holding. This structure encourages consistent usage and limits speculative churn. Growing interest in the LivLive presale reflects confidence in a model built around measurable activity.

The project also introduces sustainable tokenomics designed to support long-term value. Rewards are distributed based on verified actions, while access levels depend on reputation and contribution. This approach creates organic demand for $LIVE without excessive emissions. With the LivLive presale priced well below its projected listing range, early participants are positioning ahead of broader market exposure.

A Smart Referral Flywheel That Rewards Real Participation, Not Empty Hype

LivLive’s referral system is designed to scale responsibly by prioritizing quality over volume. Referral rewards are linked to verified activity, ensuring incentives flow toward genuine users rather than short-term promoters. This structure supports organic growth while preserving token value. As participation increases, the referral economy strengthens network effects without creating artificial pressure. The LivLive presale has already benefited from this model, as community-driven expansion continues to outperform traditional referral schemes.

A 2026 Investment Scenario Where Adoption, Not Speculation, Drives $LIVE Demand

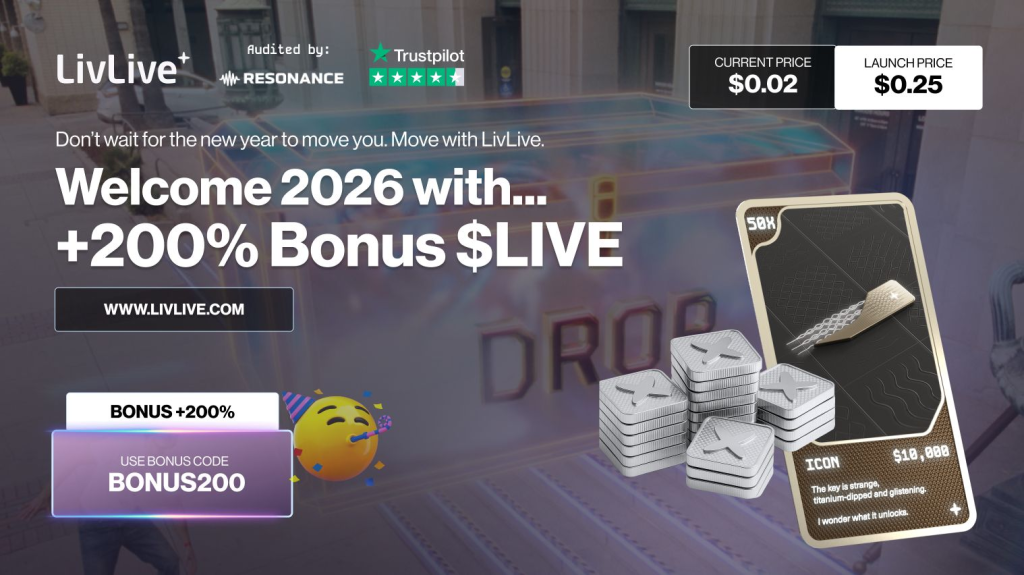

Investing in LivLive at the Stage 1 presale price of $0.02 per $LIVE offers a structured growth opportunity, with a target listing range of $0.20–$0.25 and a fixed supply of 5 billion tokens. A $1,000 contribution would secure 50,000 $LIVE, which could triple to 150,000 $LIVE using the BONUS200 code, potentially worth $30,000–$37,500 at listing, a 30–37.5x return if adoption scales as planned. Token demand grows naturally through LivLive’s XP-driven gamification, referral economy, and tiered access, which means active users continually mobilize $LIVE, reducing the circulating supply. With over $2.21 million raised and 400+ participants, early traction is strong, positioning $LIVE as a participation-driven asset where ROI is tied to real-world engagement, not speculative hype.

BNB ($BNB) Rallies as Network Activity and Institutional Confidence Rise

BNB increased by 2.38% in the last 24 hours, reaching $901.32 as network usage continues to strengthen. The price move follows expanding decentralized exchange activity and growing application deployment across BNB Chain. These usage-driven metrics have reinforced BNB’s role as an infrastructure asset rather than a speculative token. Market participants are responding to consistent demand signals supported by on-chain data.

Institutional confidence has further supported recent momentum. Ongoing integrations and network growth continue to reduce circulating supply through structured burn mechanisms. As activity increases, scarcity intensifies, reinforcing BNB’s long-term value proposition. The current BNB price action reflects renewed confidence in its utility-driven fundamentals.

XRP ($XRP) Advances as ETF Inflows and Ripple Treasury Fuel Confidence

XRP rose 1.93% in the last 24 hours, trading at $1.91 amid sustained institutional interest. ETF-linked inflows continue to support liquidity, positioning XRP among the most actively accumulated large-cap assets. Analysts point to deep order books and steady capital movement as indicators of long-term participation. This stability highlights XRP’s role as a mature asset within regulated market structures.

Momentum has also been reinforced by Ripple’s expanding enterprise strategy. The launch of Ripple Treasury strengthens XRP’s utility by integrating liquidity management and payment solutions for institutions. As adoption grows across regulated jurisdictions, XRP’s price action reflects increasing confidence in its infrastructure role.

LivLive Is Officially The Top Crypto To Buy Today

Recent developments across BNB and XRP highlight a market increasingly driven by usage and institutional demand. BNB’s price gains reflect expanding on-chain activity and structured scarcity, while XRP’s steady advance underscores ETF inflows and enterprise adoption. These trends reinforce a broader shift toward assets with measurable fundamentals, shaping investor expectations for the next cycle. Within this environment, identifying the top crypto to buy in 2026 requires a focus on real engagement rather than speculation.

LivLive stands out by combining presale accessibility with a behavior-driven economic model. With a Stage 1 price of $0.02, a projected listing range of $0.20–$0.25, and over $2.21 million raised, the LivLive presale offers early exposure to a participation-based ecosystem. Its layered gamification, XP rewards, and sustainable tokenomics position $LIVE as a differentiated asset built for long-term adoption.

Find Out More Information Here

Website | X | Telegram Chat

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.

The post Is LivLive the Top Crypto to Buy in 2026? $LIVE Presale Signals 100x as BNB Hits $900 and XRP ETFs Flow appeared first on CaptainAltcoin.

You May Also Like

Will Huge $8.3B Bitcoin Options Expiry Trigger Another Dump?

Why Staffing Agencies Need Hot Desk Booking Software to Scale Smarter