Strategy Can Fully Cover $6 Billion In Debt if Bitcoin Drops 90%, But What Happens Below That Line?

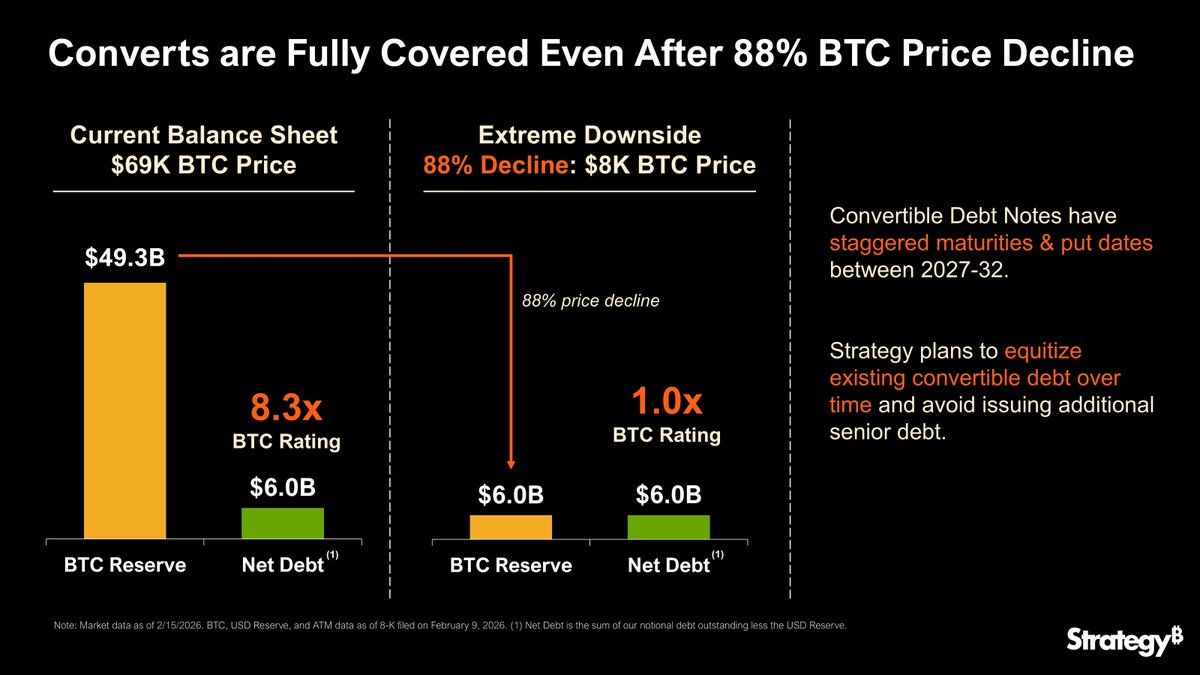

Strategy (MicroStrategy) today asserted it can fully cover its $6 billion debt even if Bitcoin falls 88% to $8,000. However, the bigger question is what happens if the Bitcoin price falls below that line?

The company’s post highlights its $49.3 billion Bitcoin reserves (at $69,000/BTC) and staggered convertible note maturities running through 2032, designed to avoid immediate liquidation.

Strategy Reiterates What Happens If Bitcoin Price Drops to $8,000

Only days after its earnings call, Strategy has reiterated the $8,000 prospective Bitcoin price and what would happen to the company in such an event for the second time.

At first glance, the announcement signals resilience in the face of extreme volatility. However, a deeper dive reveals that $8,000 may be more of a theoretical “stress floor” than a true shield against financial peril.

MicroStrategy’s infographic shows debt coverage at various Bitcoin price levels (Strategy via X)

MicroStrategy’s infographic shows debt coverage at various Bitcoin price levels (Strategy via X)

At $8,000, Strategy’s assets equal its liabilities. Equity is technically zero, but the firm can still honor debt obligations without selling Bitcoin.

Convertible notes remain serviceable, and staggered maturities give management breathing room. The firm’s CEO, Phong Le, recently emphasized that even a 90% decline in BTC would unfold over several years, giving the firm time to restructure, issue new equity, or refinance debt.

Yet beneath this headline figure lies a network of financial pressures that could quickly intensify if Bitcoin drops further.

Below $8,000: Covenant and Margin Stress

The first cracks appear at roughly $7,000. Secured loans backed by BTC collateral breach LTV (Loan-to-Value ratio) covenants, triggering demands for additional collateral or partial repayment.

If markets are illiquid, Strategy may be forced to sell Bitcoin to satisfy lenders. This reflexive loop could depress BTC prices further.

At this stage, the company is technically still solvent, but each forced sale magnifies market risk and raises the specter of a leverage unwind.

Insolvency Becomes Real at $6,000

A further slide to $6,000 transforms the scenario. Total assets fall well below total debt, and unsecured bondholders face likely losses.

Equity holders would see extreme compression, with value behaving like a deep out-of-the-money call option on a BTC recovery.

Restructuring becomes probable, even if operations continue. Management could deploy strategies such as:

- Debt-for-equity swaps

- Maturity extensions, or

- Partial haircuts to stabilize the balance sheet.

Below $5,000: The Liquidation Frontier Comes

A decline below $5,000 crosses a threshold where secured lenders may force collateral liquidation. Combined with thin market liquidity, this could create cascading BTC sell-offs and systemic ripple effects.

In this scenario:

- The company’s equity is likely wiped out

- Unsecured debt is deeply impaired, and

- Restructuring or bankruptcy becomes a real possibility.

Speed, Leverage, and Liquidity As The Real Danger

The critical insight is that $8,000 is not a binary death line. Survival depends on:

- Speed of BTC decline: Rapid drops amplify margin pressure and reflexive selling.

- Debt structure: Heavily secured or short-dated debt accelerates risk below $8,000.

- Liquidity access: Market closures or frozen credit exacerbate stress, potentially triggering liquidation spirals above the nominal floor.

What Would It Mean for the Market?

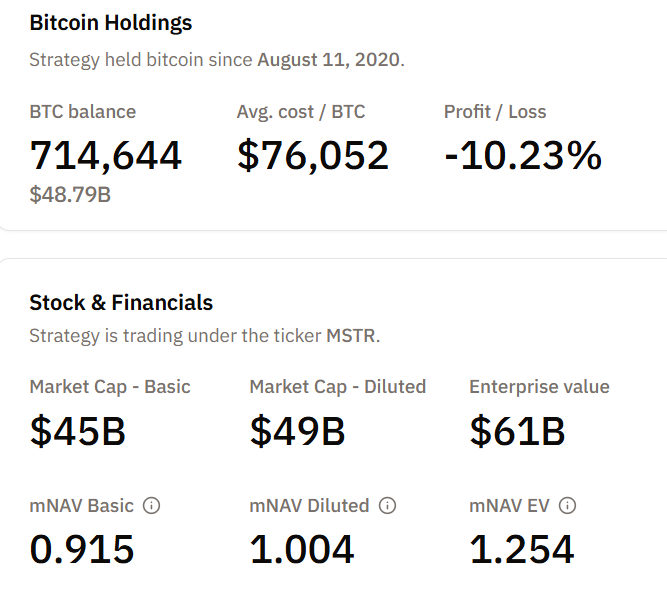

Strategy is a major BTC holder. Forced liquidations or margin-driven sales could ripple through broader crypto markets, impacting ETFs, miners, and leveraged traders.

Strategy BTC Holdings. Source: Bitcoin Treasuries

Strategy BTC Holdings. Source: Bitcoin Treasuries

Even if Strategy survives, equity holders face outsized volatility, and market sentiment could shift sharply in anticipation of stress events.

Therefore, while Strategy’s statement today suggests the firm’s confidence and balance-sheet planning, below $8,000, the interplay of leverage, covenants, and liquidity defines the real survival line beyond price alone.

You May Also Like

Vincent Deluard: Inflationary pressures mirror the late 90s, the gig economy’s tax impact is significant, and stocks may thrive amid fiscal stimulus

IP Hits $11.75, HYPE Climbs to $55, BlockDAG Surpasses Both with $407M Presale Surge!