Ethereum Options Expiry Reveals Risks Below $2,900 Level

Ethereum (ETH) Struggles to Maintain Above $3,400 Amid Options Expiry and Market Sentiment

Ethereum has faced difficulty sustaining prices above the $3,400 mark over the past month, raising concerns about prolonged bearish momentum among traders. With a significant options expiry looming on December 26, market participants are closely watching price levels that could influence the broader outlook for ETH heading into the year-end.

Key Takeaways

-

Approximately $6 billion worth of Ether options are set to expire on December 26, with call (buy) options outnumbering put (sell) options by 2.2 times.

-

The market remains vulnerable unless ETH convincingly surpasses $3,100, which could shift the balance in favor of bullish traders.

-

Most of the $4.1 billion in call options are targeted at year-end prices between $3,500 and $5,000, many of which are likely to expire worthless.

-

Despite an overall optimistic outlook from some traders, fewer than 25% of call options are below the $3,200 strike, indicating limited downside protection for bears.

Market Dynamics and Trader Positioning

The upcoming options expiration on December 26 could intensify price volatility, as traders evaluate the likelihood of ETH breaking key resistance or support levels. Deribit accounts for approximately 70% of open interest, followed by the Chicago Mercantile Exchange (CME) with 20%. Most bullish bets are concentrated between $3,500 and $5,000, but many of these positions are likely to lapse without value, especially with ETH trading below $3,400 recently.

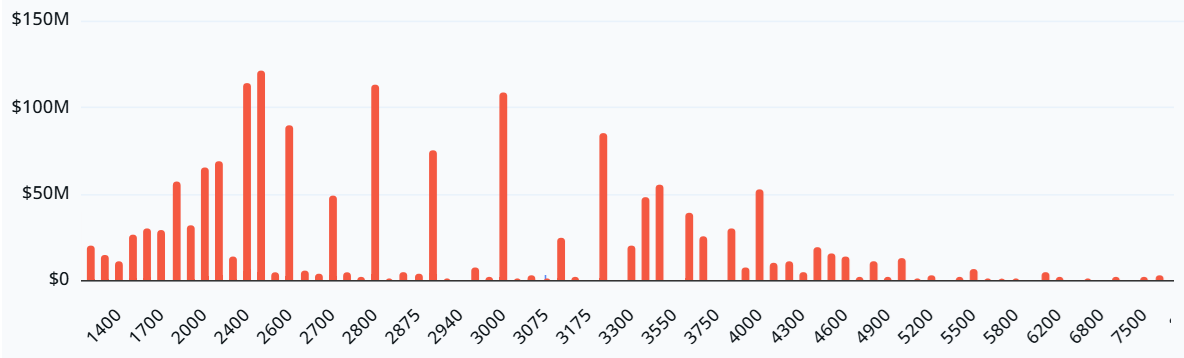

Aggregate Dec. 26 ETH call options open interest, USD. Source: laevitas.chData indicates that less than 15% of call options are set at or below $3,000, and traders often sell covered calls at strike prices of $8,000 and $10,000, reflecting limited expectations of reaching these levels in the near term. Conversely, bearish strategies, including put spreads targeting $2,200 to $2,900, suggest traders remain cautious, especially if ETH remains under $3,200.

Aggregate Dec. 26 ETH put options open interest, USD. Source: laevitas.ch

Aggregate Dec. 26 ETH put options open interest, USD. Source: laevitas.ch

Analysts note that if ETH closes above $2,950 on Friday, more than 60% of the $1.9 billion in put options will expire worthless, providing a potential uplift. However, maintaining below $3,200 keeps bearish positions more favorable, adding pressure on ETH’s price trajectory.

External Market Factors and Investor Sentiment

Recent reports indicating setbacks in US chip manufacturing, notably Intel’s failure to advance its production capabilities in competition with Taiwan Semiconductor (NASDAQ: TSM), have added to cautious sentiment. Nvidia (NASDAQ: NVDA) reportedly halted certain production tests dependent on Intel’s manufacturing processes, highlighting broader concerns about semiconductor supply chains and technology investments.

Increased Hedging and Risk Perception

As traders reassess their exposure amid subdued prospects for artificial intelligence’s economic impact in the US, demand for bearish Ether options has surged. Strategies including bear diagonal spreads and bear put spreads dominate the recent activity, especially after multiple failed attempts to reclaim the $3,400 level over recent weeks.

Implications for Next Week’s Price Action

Based on current trends, there are several possible scenarios for Ether’s price around the options expiry: a dip toward $2,700–$2,900 could favor puts by $580 million; a move between $2,901 and $3,000 favors puts by $440 million; while prices between $3,101 and $3,200 are expected to balance out. If ETH holds above $3,100, it could help traders reset their positions and improve sentiment heading into the new year.

This article was originally published as Ethereum Options Expiry Reveals Risks Below $2,900 Level on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Metaplanet raises $1.4B to fuel BTC purchases and U.S. subsidiary launch