Russia’s Top Stock Exchanges Ready to Launch Crypto Trading by 2026

Moscow Exchange and St. Petersburg Exchange have confirmed readiness to launch regulated crypto trading once Russia’s legislative framework takes effect by mid-2026.

According to local reports, the exchanges’ announcements came following the Bank of Russia’s December 23 release of a regulatory concept that sets July 1, 2026, as the deadline for developing comprehensive cryptocurrency legislation.

Moscow Exchange stated it is “actively working on solutions to service the cryptocurrency market,” while St. Petersburg Exchange emphasized it already possesses “the necessary technological infrastructure for trading and settlements.“

From Resistance to Regulated Markets

Russia’s path toward crypto regulation began gaining momentum in mid-2024, when the Ministry of Finance first proposed allowing qualified investors to trade digital currencies on licensed exchanges.

Anatoly Aksakov, head of the State Duma Financial Market Committee, said at the time that major exchanges were “already actively involved in developing the cryptocurrency market and organizing the necessary infrastructure.“

The regulatory framework divides market access between qualified and non-qualified investors under sharply different conditions.

Non-qualified investors will be limited to purchasing liquid cryptocurrencies from a defined list after passing mandatory knowledge tests, with annual purchases capped at 300,000 rubles (approximately $3,800) through a single intermediary.

Qualified investors face no volume restrictions but must demonstrate understanding of crypto risks through testing, though they will be barred from purchasing anonymous tokens that conceal transaction data.

Despite the forthcoming trading infrastructure, Russian authorities maintain their ban on using cryptocurrencies for domestic payments.

State Duma Committee Chairman Anatoly Aksakov reinforced this position on December 17, declaring that cryptocurrencies “will never become money within our country” and can only function as investment instruments, with all domestic payments required in rubles.

The Bank of Russia originally called for a total ban on crypto exchanges and token trading, but Western sanctions prompted a policy shift.

Mining Boom Drives Economic Integration

Russia’s crypto ecosystem has expanded dramatically beyond trading speculation.

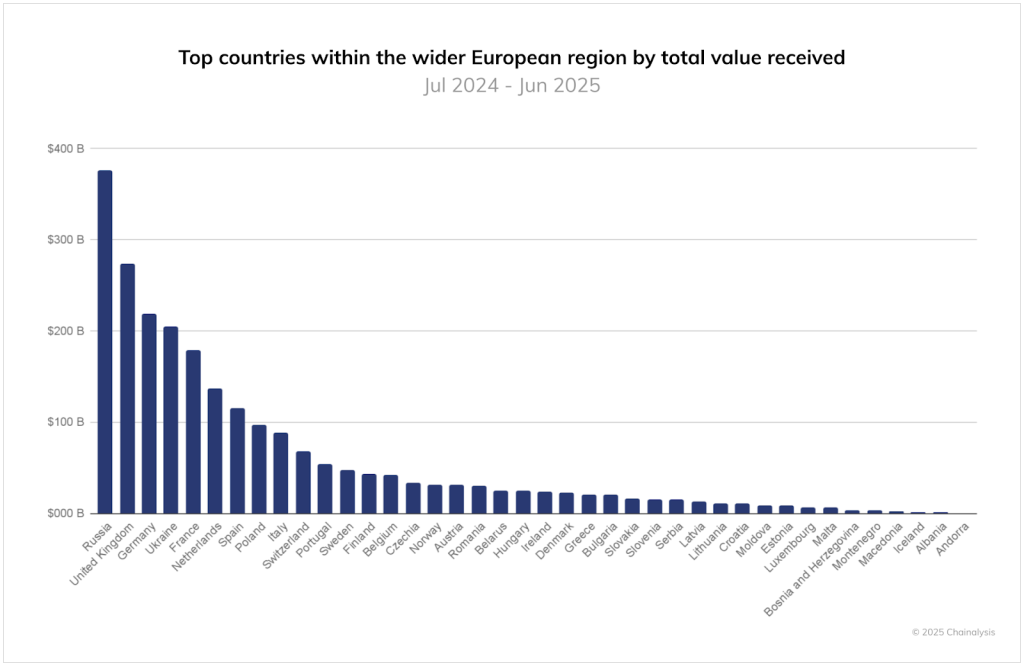

The country recorded $376.3 billion in received crypto transactions between July 2024 and June 2025, surpassing the United Kingdom’s $273.2 billion and making Russia Europe’s largest crypto market by transaction volume, according to Chainalysis data.

Source: Chainalysis

Source: Chainalysis

Large-scale transfers exceeding $10 million grew 86% in Russia during this period, nearly double the 44% growth seen across the rest of Europe, while DeFi activity surged eightfold in early 2025 before stabilizing at three and a half times the mid-2023 baseline.

Much of this growth has been tied to A7A5, a ruble-pegged stablecoin that reached $500 million in market capitalization despite Western sanctions, becoming the world’s largest non-dollar stablecoin.

The mining sector has also become particularly significant for Russia’s economy.

Senior Kremlin official Maxim Oreshkin recently argued that crypto mining should be classified as export activity since mined assets effectively flow abroad even without crossing physical borders.

Industry estimates suggest Russia produces tens of thousands of Bitcoins annually, generating approximately 1 billion rubles in daily mining revenue, and that the country accounted for over 16% of global hashrate during the summer months.

In fact, Central Bank Governor Elvira Nabiullina also recently acknowledged that crypto mining contributes to the ruble’s strength.

However, she noted that quantifying its exact impact remains difficult, as much of the industry operates in gray areas, with illegal mining costing Russia billions of dollars annually through stolen electricity and unpaid taxes.

Russia legalized crypto mining on November 1, 2024, requiring legal entities to register with the Federal Tax Service.

Banks Enter Digital Assets Market

Russia’s largest lender, Sberbank, has begun offering regulated crypto-linked investments totaling 1.5 billion rubles in structured bonds and digital financial assets tied to Bitcoin, Ethereum, and broader crypto portfolios.

Deputy Chairman Anatoly Popov confirmed “active dialogue” with the Bank of Russia on integrating crypto services within regulated frameworks while building proprietary blockchain infrastructure.

As it stands now, the regulatory timeline calls for legislative frameworks to be completed by July 1, 2026, with liability for illegal crypto intermediary activities taking effect from July 1, 2027.

You May Also Like

Social engineering kost crypto miljarden in 2025

Christmas Stocking Stuffers? Don't Ignore These Bitcoin Mining Stocks That Gave Impressive Returns In 2025