U.S. Treasury Buys Back $2.8 Billion in Debt Securities

The post U.S. Treasury Buys Back $2.8 Billion in Debt Securities appeared first on Coinpedia Fintech News

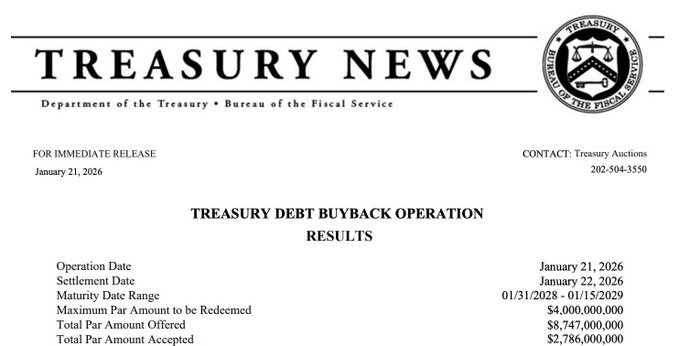

The U.S. Treasury recently repurchased $2.8 billion of its own debt, a move that sent a strong signal across bond markets. While bond yields stayed steady near 4.25%, showing no panic or stress.

These buybacks help manage liquidity, but also change how investors think about the crypto market next.

U.S. Treasury Buys Back $2.8 Billion

The U.S. Treasury is again buying back its own debt, including a recent $2.8 billion purchase of bonds due in 2028–2029. However, the dealer has offered about $8.7 billion, but the Treasury accepted only 32%, showing a careful and targeted approach to improve trading in less active bonds.

The Treasury has not always used buybacks. Between 2000 and 2002, the Treasury bought back over $67.5 billion in debt to improve liquidity and manage maturities. After many quiet years, buybacks returned as market conditions changed.

Last year, in 2025, the Treasury carried out its largest buyback ever, repurchasing $10 billion in debt from $22.87 billion in offers.

This showed strong demand from institutions and a growing use of buybacks to manage the bond market.

Bond Yields Remain Stable at 4.25%

After the buyback, Treasury yields stayed near 4.25%. This showed that markets were not shocked by the move. Some investors saw it as a sign of strength, while others raised concerns about long-term demand for U.S. debt.

Still, the steady yield suggests confidence that the government is managing its debt carefully.

Unlike Federal Reserve actions such as quantitative easing, this buyback used existing cash, not newly created money.

What This Means For Crypto Market

Many in the crypto community see these moves as part of “macro liquidity conditions” that influence crypto prices. When liquidity tightens and yields rise, crypto often weakens.

But if bond markets show stress or if yields fall, capital can rotate back into Bitcoin and other digital assets.

Meanwhile, U.S. debt buybacks don’t just affect bonds. They change how money flows in global markets, and that flow reaches crypto, too. As of now, the total crypto market cap has seen a slight rise to $3.2 trillion

You May Also Like

Republic Europe Offers Indirect Kraken Stake via SPV

cpwrt Limited Positions Customer Support as a Strategic Growth Function