Ethereum Short-Term Price Outlook: Where Is ETH Headed From Here?

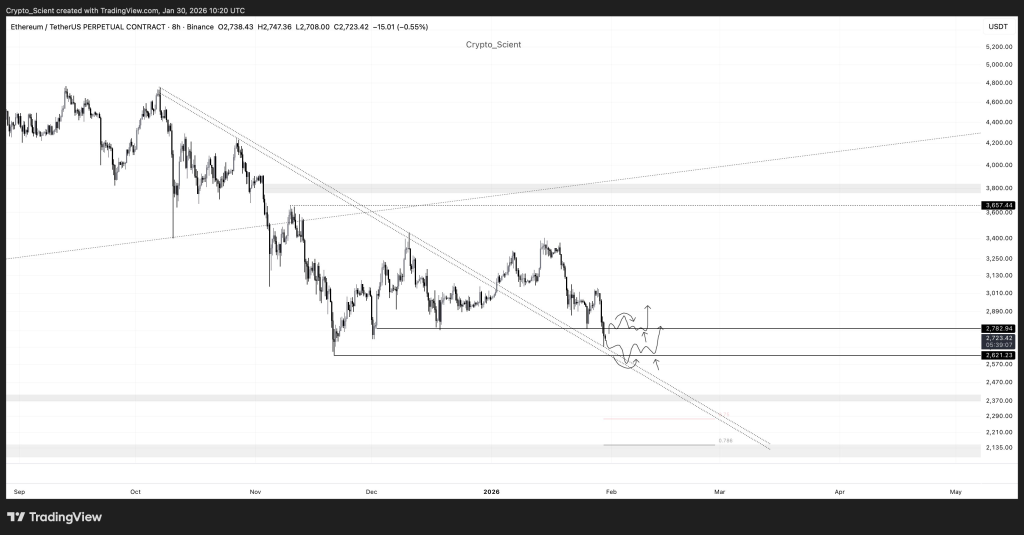

Ethereum price has spent recent sessions pressing into uncomfortable territory, with ETH price hovering near levels that already rejected several upside attempts this year. The chart shared by Crypto_Scient on X captures this tension clearly. Price continues to respect a broader downward structure, yet it is also approaching zones that historically invite sharp reactions rather than quiet continuation.

ETH now sits near a critical decision area where short-term direction could become clearer, even if volatility remains uneven through early February.

Ethereum price structure shows ETH moving within a tightening range that has been developing for weeks. Lower highs continue to form beneath a falling diagonal trendline, limiting upside progress. At the same time, downside moves have struggled to sustain follow-through below key horizontal demand.

Crypto_Scient notes $2,780 as a short term pivot for ETH price. This level previously acted as support before flipping into resistance. A clean break and hold above this zone would signal that sellers are losing control of the range. ETH reclaiming this area would place price back inside prior value and open room for further recovery attempts.

@Crypto_Scient / X

@Crypto_Scient / X

Failure to reclaim $2,780 keeps Ethereum price exposed to deeper tests. The structure suggests compression rather than immediate collapse. That setup often precedes sharper moves once liquidity is cleared.

ETH Price Liquidity Zone Near $2,620 Remains Critical

Attention shifts lower toward the $2,620 area, another level emphasized by Crypto_Scient. This zone sits beneath current price and aligns with visible liquidity from previous lows. ETH price dipping into this region would likely trigger stops clustered below support.

Crypto_Scient describes this as a potential stop hunt rather than a breakdown. The chart supports that view, showing diagonal trend support converging near this zone. A sweep below $2,620 followed by a quick reclaim would signal absorption rather than panic selling.

Such behavior would suggest sellers are exhausting themselves into demand. ETH price holding back above this level would reset risk and improve reward conditions for upside continuation.

Ethereum Price Structure Points Toward Expansion After Resolution

The broader chart structure hints that Ethereum price may be preparing for expansion once one of these triggers resolves. Compression between diagonal resistance and horizontal support rarely persists indefinitely. ETH price is nearing the apex of this structure.

Crypto_Scient notes that a successful liquidity sweep and base near trend support could fuel a larger expansion. The projected upside zone sits near $3,700 to $3,800 into February or March if conditions align. That target aligns with previous resistance zones visible on the chart.

A reclaim of $2,780 without a downside sweep would also change momentum dynamics. That outcome would indicate strength returning sooner than expected.

Read Also: $5,000 in Hedera Now, What Could It Be Worth by 2027? HBAR Price Prediction

Ethereum price remains reactive rather than decisive at this stage. ETH continues to trade within a framework defined by clear technical levels rather than narrative momentum. Crypto_Scient emphasizes patience until one of the outlined triggers fires, a view supported by current structure.

The coming sessions will likely determine whether ETH price resolves through strength above resistance or liquidity clearance below support. Either path offers clarity once confirmed.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post Ethereum Short-Term Price Outlook: Where Is ETH Headed From Here? appeared first on CaptainAltcoin.

You May Also Like

Your Trusted Plumber in Sunnyvale, CA: Professional Plumbing You Can Rely On

Dogecoin Rally Sparks Meme Coin Frenzy