BOOE: Why did the old meme on Ethereum attract Tom Lee’s attention?

Author: BUBBLE, Rhythm

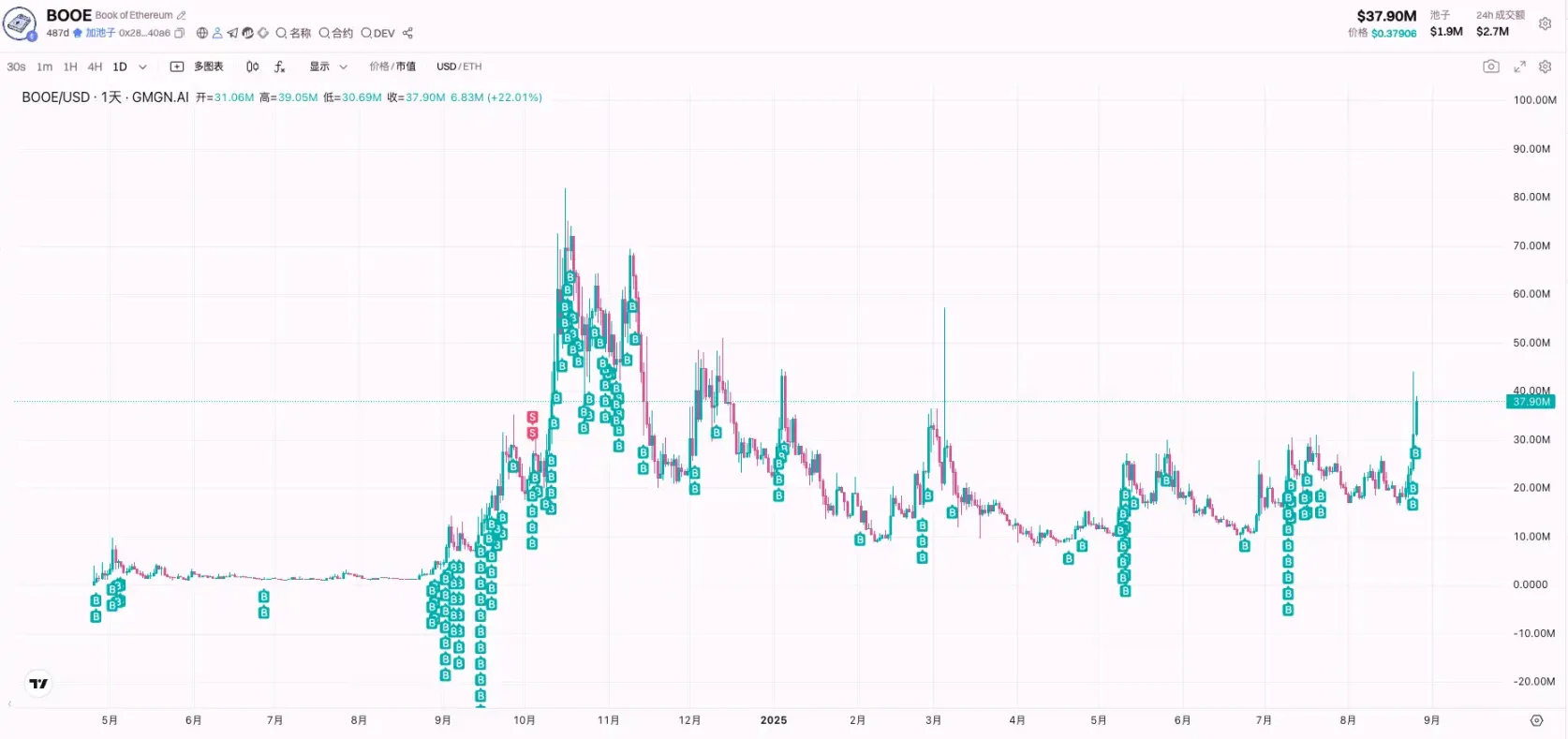

In August 2025, two prominent figures in the Ethereum ecosystem were almost simultaneously drawn into the memecoin narrative. On one side was Tom Lee, CEO of BitMine Immersion Technologies, which holds the world's largest corporate Ethereum treasury. On the other side was Joseph Lubin, CEO of ConsenSys and Ethereum co-founder, who also serves as chairman of SharpLink Gaming. The publicly listed companies behind them were the two largest holders of Ethereum, holding over $10 billion worth of ETH.

The statements from these two industry leaders not only demonstrate institutional recognition of Ethereum's long-term value but also garner new attention for the related memecoin. On social media, some investors noticed that Tom Lee and Lubin's social media accounts had followed the memecoin project, Book of Ethereum (BOOE).

Driven by market sentiment, BOOE has become a hot topic. This article will discuss the concept, history, and related projects of this established project, while also delving into the whale behind the token, fbb4.

The Concept and History of BOOE: Religious Narratives and Community Economy

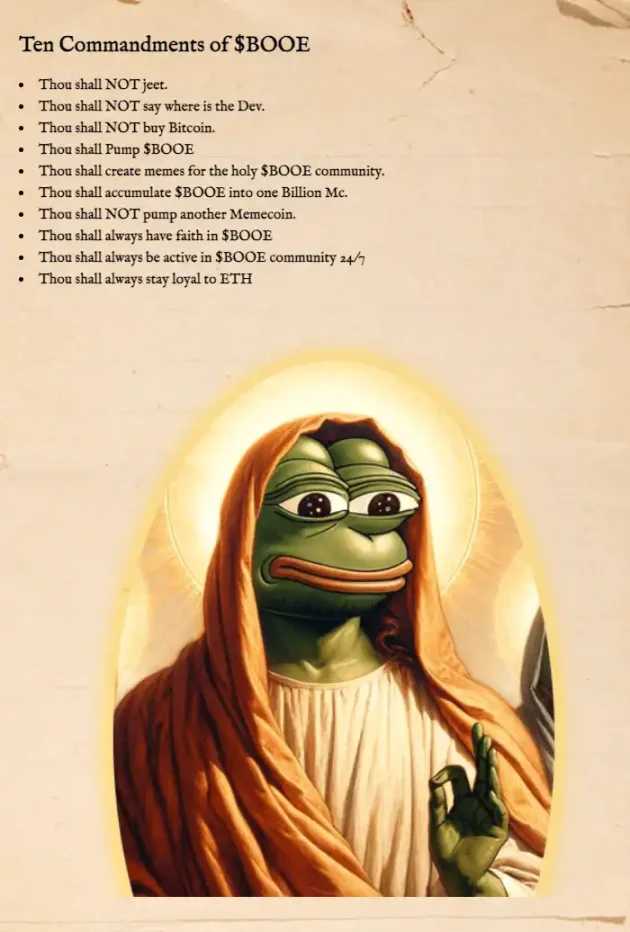

BOOE was launched on the Ethereum mainnet on April 24, 2024, and the project has positioned it as the "Bible" of the Ethereum ecosystem. The official website uses religious symbolism to construct a virtual universe, listing "Ten Commandments" such as prohibitions on buying Bitcoin and shorting BOOE, emphasizing loyalty and community awareness. Furthermore, the "Sacred Economics" section of the website states that BOOE has a total supply of 100 million, the contract has been audited and control has been permanently relinquished, all liquidity is locked for 1,337 years, and there are no transaction taxes or fees. This economic model makes it more difficult for holders to withdraw their investment, reinforcing the symbolism of long-term faith.

Complementing this religious narrative is the development of a community culture. A Medium post written by the BOOE team describes coin holders calling themselves "believers," claiming the Ethereum Book is a refuge for those deceived and encouraging investors to gather and wait for "opportunities" during a bear market. While the post carries obvious propaganda overtones, it reflects the project's strategy of using religious language to rally the community and downplay speculative overtones.

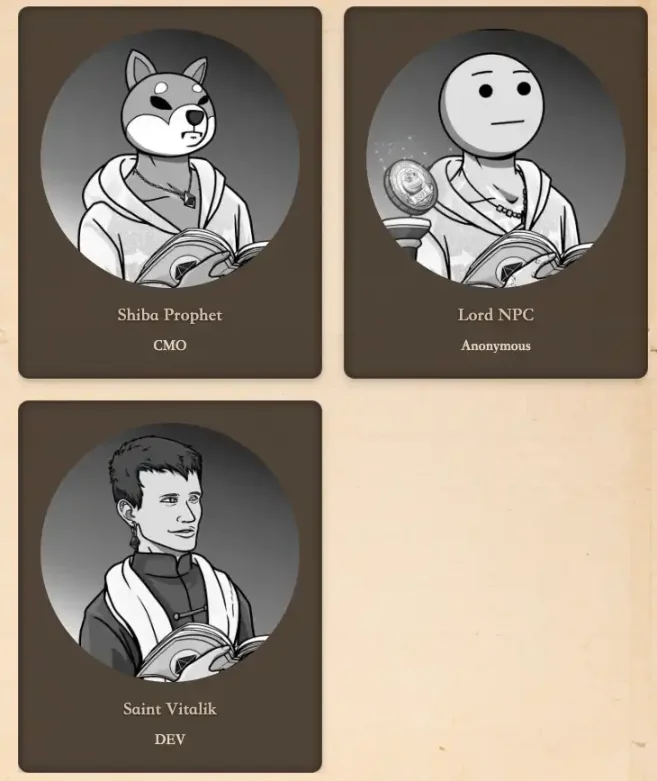

During BOOE's development, the project launched two collaborative tokens: HOPE and PROPHET. HOPE's official website states that its total supply is 1 billion, its contract has been abandoned and audited, and its team members use the pseudonyms Shiba Prophet, Lord NPC, and Saint Vitalik. The project's mission is to "bring hope" and encourage collaboration among different memecoin communities, such as Pepe and Doge. PROPHET, also with a supply of 1 billion, promises permanent liquidity lock-in and no transaction tax. The BOOE website refers to the three tokens as the "Trinity of Faith," attempting to expand the boundaries of the community through this trinity structure.

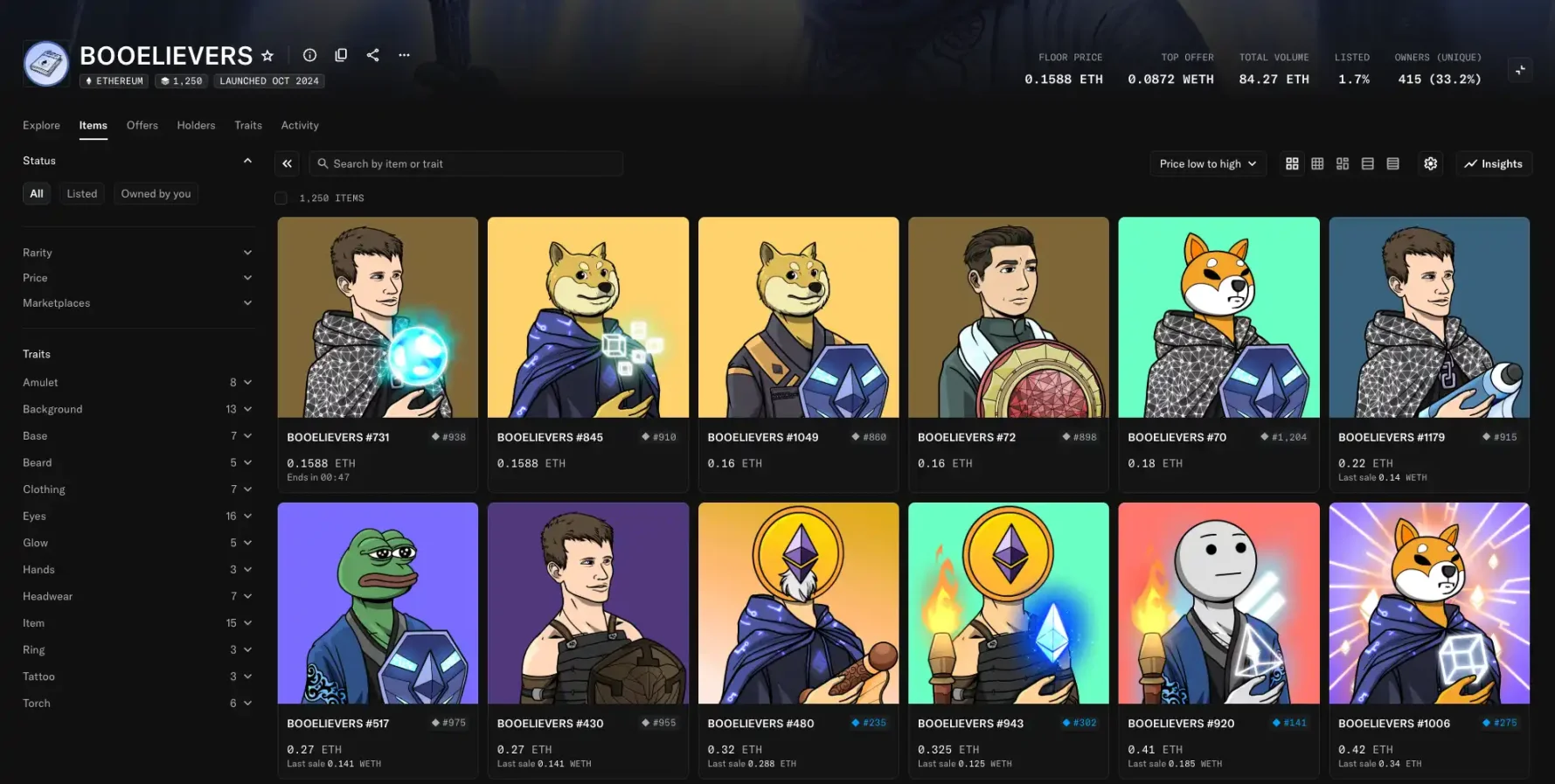

In addition to building a story universe, the BOOE community has also experimented with NFTs. On OpenSea, there's a collection called Booelievers, which features artwork and derivatives related to BOOE themes. While limited in scale, this type of asset provides the project with additional cultural symbols and revenue streams.

Overall, BOOE leverages religious narratives and decentralized finance concepts to build a unique community economic model. Amidst the widespread Solana meme, the sustainability and diffusion of this narrative are crucial to the project's vitality. A key figure behind this is fbb4, known among E-guards as "Diamond Hand."

fbb4, the driving force behind BOOE

Since the launch of BOOE, the movements of anonymous whale fbb4 have attracted much attention. As one of the most well-known "trendsetters" of the Ethereum meme, his earlier successes in tokens such as Pepecoin and GME have greatly increased his fame.

fbb4's trading style differs significantly from that of the current P-jung. Media personality Brian Fanzo wrote an analysis emphasizing that fbb4's wallet is valued between $28 million and $40 million, and that he generated approximately $9 million in profits in just one month. Overall, fbb4's trading model is straightforward and can be summarized as "buy, provide liquidity, hold, and maintain market momentum while shifting the narrative." He typically begins by transferring ETH from a centralized exchange or performing multiple cross-chain transactions before purchasing the target coin in batches to minimize slippage. He then provides liquidity to stabilize prices, and ultimately rotates investments based on the popularity of the narrative.

The most noticeable thing is that he almost never sells the tokens he purchased. Of course, this does not rule out the possibility that he also has other "small wallets" for selling. However, this open and transparent long-term holding strategy still attracts many retail investors to imitate his behavior. Often, after his public wallet "fbb4" makes a purchase, there will be a "rising green column".

fbb4 has been buying since BOOE launched

This trading style has drawn comparisons to Michael Saylor and Roaring Kitty, the leader of the GameStop retail investor-Wall Street short-sale war. Community member Roar4Kitty even compared the two's movements, expressing his suspicion that fbb4 is Roaring Kitty.

fbb4 and Roaring Kitty's major event action line, source: Roar4Kitty

Of course, this isn't entirely unfounded; fbb4 is indeed incredibly loyal to GameStop. According to the New York Post, in August of this year, to support GameStop culture, he spent $250,000 at auction on a stapler and the GameStop CEO's underwear. A few days later, he tweeted about another $100,000 GameStop purchase. In the same post, he announced a partnership with the charity CMN Hospitals, donating another $100,000 to raise funds for 170 children's hospitals in the US and Canada.

fbb4 purchased GME "stapler" and CEO underwear, source: NewYork Post

Fanzo's article also documents fbb4's investments in multiple memecoins, including Pepecoin, the Ethereum-based GameStop token $GME, BasedAI, KEK, BOOE, and KPOP. These projects share distinct narratives, active communities, and ample liquidity. fbb4, known as a "narrative curator," drives narrative momentum by personally authoring posts and engaging with the community.

fbb4's success has its limitations. His strategy relies heavily on personal credibility and community sentiment. If the narrative loses steam or he changes his strategy, investors could be left stranded. Furthermore, his role as a market promoter in multiple projects has fueled discussions of price manipulation. From a regulatory perspective, large holders engaging in concentrated buying and selling without oversight could potentially reach the boundaries of market manipulation. For BOOE, fbb4's involvement undoubtedly brought in funding and attention, but whether this translates into sustained growth remains to be seen.

For investors, understanding fbb4's strategies and institutional trends is crucial, but even more crucial is discerning the true value and risks behind these narratives. As Lubin noted, while Ethereum's long-term value cannot be ignored, memecoin's bubble cycles and regulatory risks also warrant vigilance. Between faith and bubbles, rational judgment is the key to navigating market noise.

You May Also Like

Vitalik Buterin Withdraws 16,384 ETH to Fund Open-Source Technology and Privacy Projects

What is the most promising crypto right now? A practical checklist