Different Types of Spot Orders

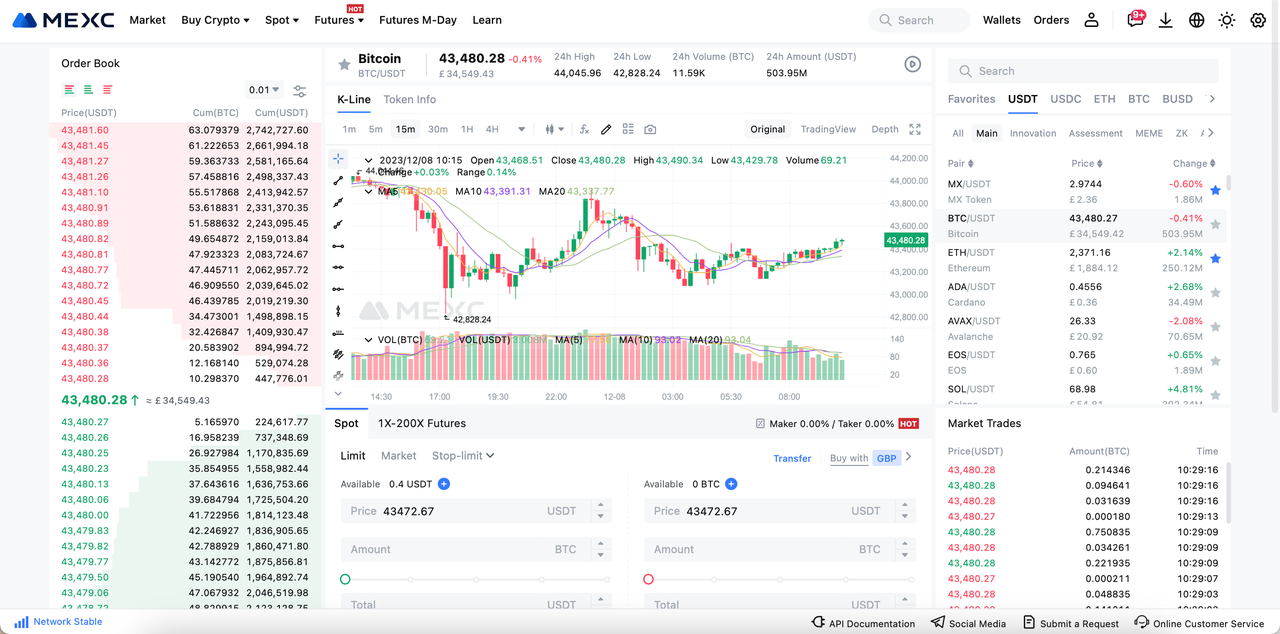

1. Limit Order

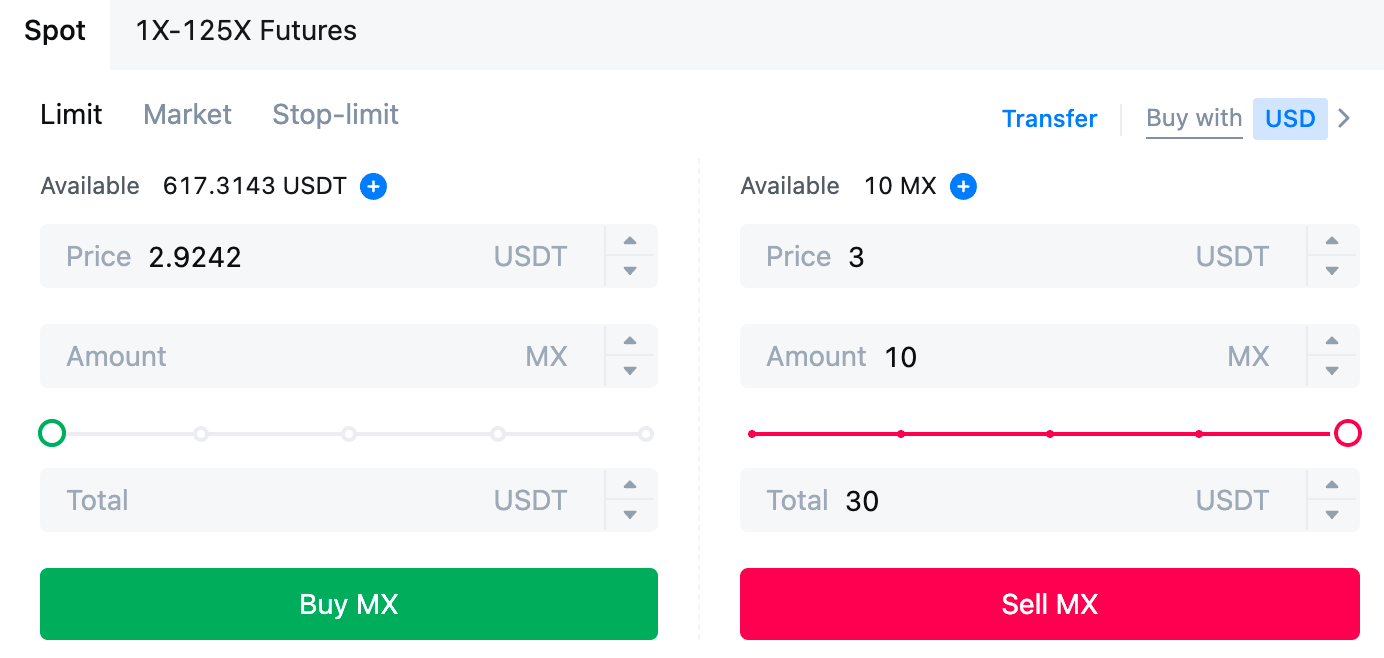

2. Market Order

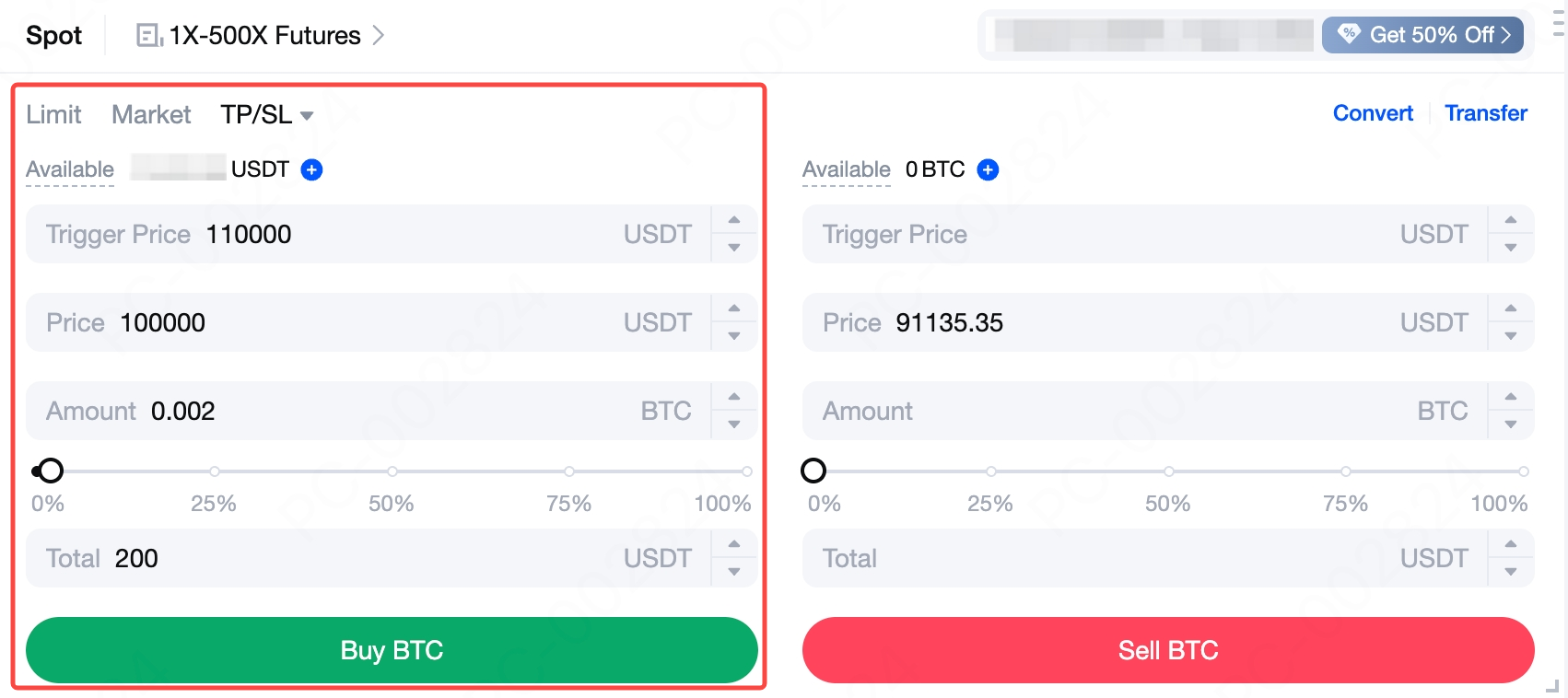

3. Take-Profit / Stop-Loss (TP/SL) Orders

- Limit TP/SL: You set both a trigger price and a limit price. When the market price reaches the trigger price, the system places a limit order at your preset price.

- Market TP/SL: You only need to set a trigger price. When the market price reaches the trigger price, the system submits a market order and executes at the best available price.

Example 1 (Stop-Limit + Stop-Loss)

You hold BTC and set a trigger price of 110,000 USDT with a limit sell price of 100,000 USDT. When the market price falls to 110,000 USDT, the system automatically places a limit sell order at 100,000 USDT, attempting to execute the stop-loss at that price.

Example 2 (Market Take-Profit)

You hold ETH and set a trigger price of 5,000 USDT. When the market price rises to 5,000 USDT, the system submits a market sell order and executes at the best available price to lock in profits.

To learn more about TP/SL orders, refer to: What Is a Take-Profit/Stop-Loss Order?

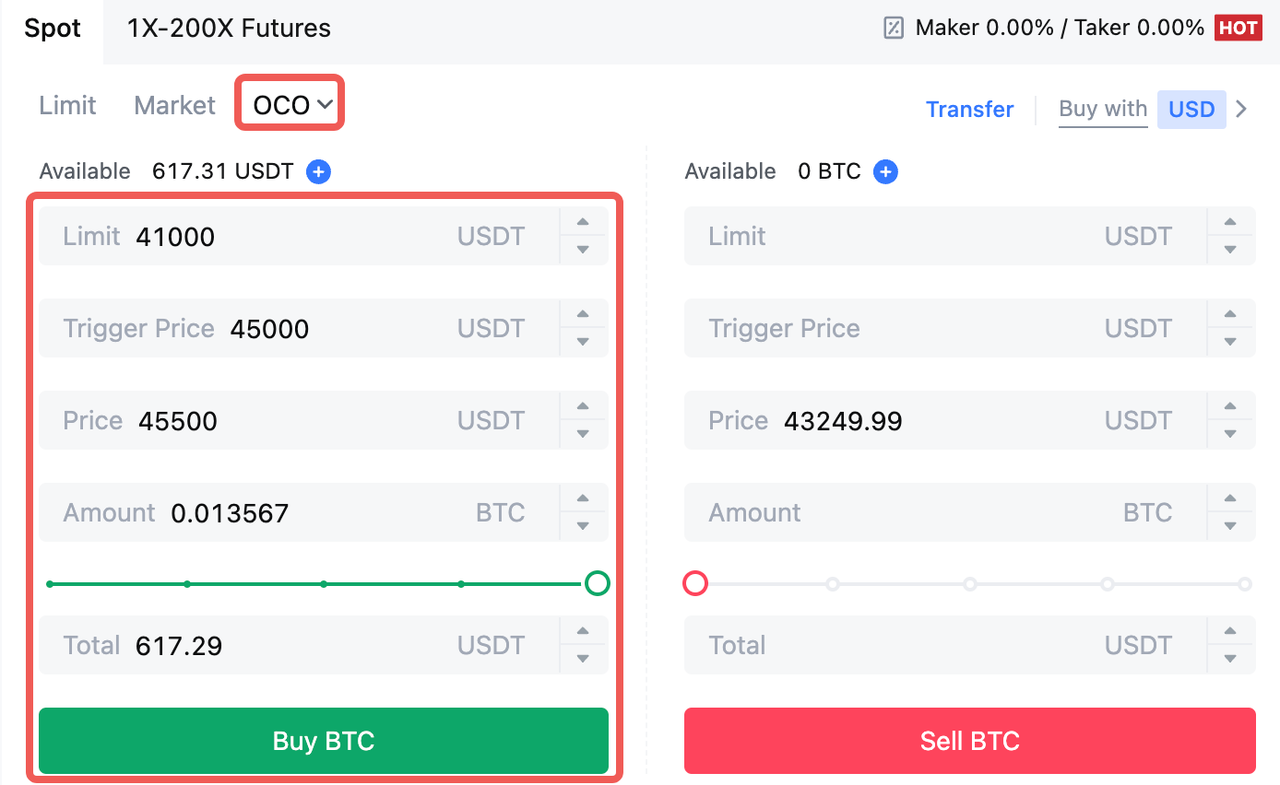

4. One-Cancels-the-Other (OCO) Order

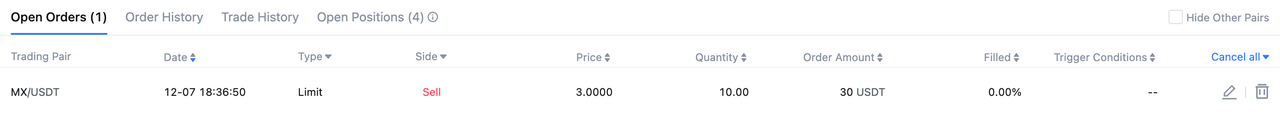

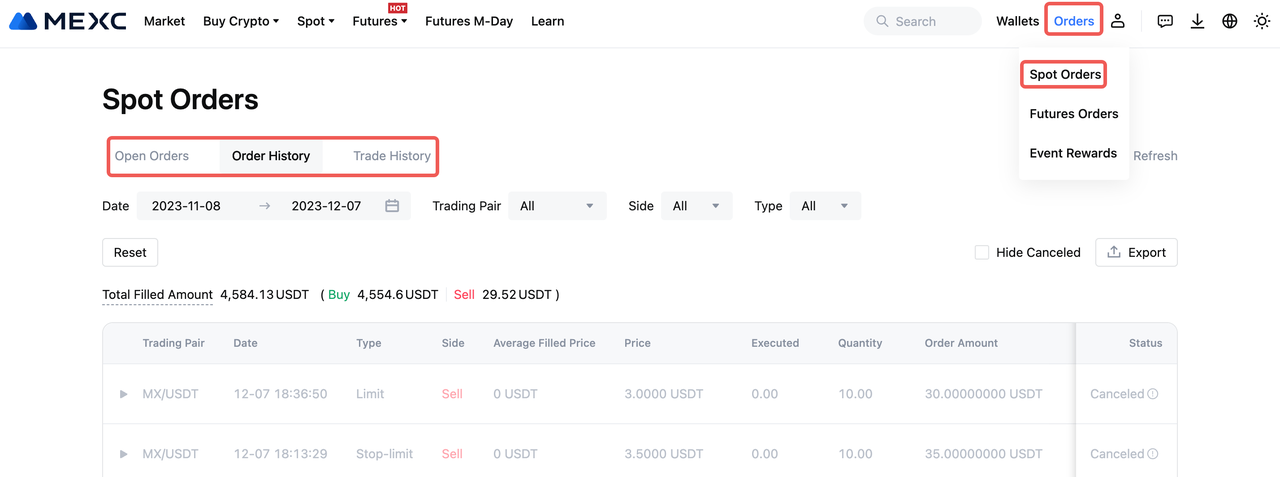

5. How To Check Order History

Popular Articles

US Stocks Rally as Jan CPI Hits 2.4%: Why the Fed Pivot is Now in Play

The "Soft Landing" is no longer a dream—it is the data.On Friday, the US Bureau of Labor Statistics (BLS) released the January 2026 CPI report, delivering exactly what Wall Street bulls wanted: Cooler

Gold Analysis: Why It's the "Ultimate Credit Asset" & How to Trade on MEXC

For decades, modern portfolio theory dismissed Gold as a "zero-yield" relic. Wall Street argued: why hold a heavy metal that pays no dividends when stocks and bonds offer cash flow?But as Spot Gold (X

Amazon (AMZN) Enters Bear Market: Why Wall St Is Selling & How to Short 24/7

Amazon (AMZN) Enters Bear Market: Why Wall St Is Selling & How to Short 24/7When the closing bell rang at the NYSE this Friday, the ticker $198.79 wasn't just a price—it was a warning signal.Amazon.co

How Tether Maintains Its 1:1 Peg: Mechanics of USDT Reserves

Tether (USDT) is a stablecoin pegged 1:1 to the US Dollar, meaning each USDT is backed by an equivalent amount of reserves. Tether maintains its peg by holding a mix of fiat assets, cash equivalents,

Hot Crypto Updates

View More

OVERTAKE (TAKE) Futures Trading: Risks and Rewards

Introduction to OVERTAKE (TAKE) Futures Trading OVERTAKE (TAKE) futures contracts allow traders to buy or sell TAKE at a predetermined price on a future date without owning the actual tokens. Unlike

A Complete Guide to the OVERTAKE (TAKE) Transaction Process

Introduction to OVERTAKE (TAKE) Transactions Understanding the basics of OVERTAKE (TAKE) transactions Importance of transaction knowledge for investors and users Overview of OVERTAKE (TAKE)

OVERTAKE (TAKE) Price History: Patterns Every Trader Should Know

What is Historical Price Analysis and Why It Matters for OVERTAKE (TAKE) Investors Historical price analysis in cryptocurrency markets is a fundamental research methodology that examines past price

OVERTAKE (TAKE) Volatility Guide: How to Profit from Price Swings

Understanding OVERTAKE (TAKE) Volatility and Its Importance Price volatility in cryptocurrency refers to the rapid and significant changes in token prices over short periods. This is a defining

Trending News

View More

How to Get 3% Deposit Bonus on Kraken: Complete Tutorial

The famous crypto exchange Kraken launches its biggest promotion to date with the February Deposit Match: a fixed 3% bonus on all eligible deposits, up to $30,

Coinbase CEO: Stablecoin Rewards Ban Would Be ‘More Profitable’ for the Exchange

The post Coinbase CEO: Stablecoin Rewards Ban Would Be ‘More Profitable’ for the Exchange appeared on BitcoinEthereumNews.com. Brian Armstrong, CEO of Coinbase,

Founders admit blockchain transparency is the only defense

The post Founders admit blockchain transparency is the only defense appeared on BitcoinEthereumNews.com. Prediction markets are increasingly being framed not as

Ex-Trump ally warns GOP on Epstein: 'Good luck getting women to vote for Republicans'

Former Congresswoman Marjorie Taylor Greene has a warning for MAGA influencers and the GOP more generally for the midterms.Greene, who over the weekend said Trump

Related Articles

Spot Trading vs. Futures Trading: A Beginner's Guide to Determining Which is Right for You

As the cryptocurrency market continues to mature, the diversification of trading tools has become a key factor in building robust investment strategies. Among global mainstream crypto exchanges, MEXC

MEXC Spot Trading Fees: Maker & Taker Rates Calculator

Key Takeaways MEXC charges 0% maker fees and 0.05% taker fees for spot trading, making it highly cost-effective for liquidity providers. MX token holders with 500+ tokens for 24 hours receive a 50

Spot Market Trading Rules

In cryptocurrency spot trading, beyond price analysis and strategy selection, understanding and following the trading platform's market rules is equally crucial. For MEXC users, each trading pair not

What is Launchpad?

MEXC Launchpad is an innovative token issuance platform that provides guaranteed access to high-quality projects and established tokens at favorable prices. Users can participate by completing certain