Academic Publishing and Fairness: A Game-Theoretic Model of Peer-Review Bias

Table of Links

Abstract and 1. Introduction

-

A free and fair economy: definition, existence and uniqueness

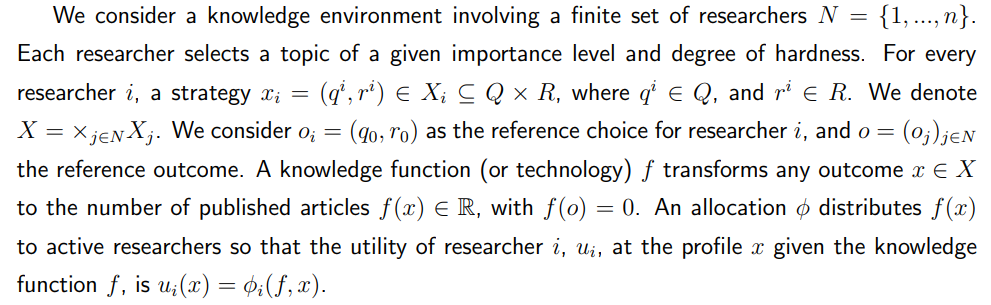

2.1 A free economy

2.2 A free and fair economy

-

Equilibrium existence in a free and fair economy

3.1 A free and fair economy as a strategic form game

3.2 Existence of an equilibrium

-

Equilibrium efficiency in a free and fair economy

-

A free economy with social justice and inclusion

5.1 Equilibrium existence and efficiency in a free economy with social justice

5.2 Choosing a reference point to achieve equilibrium efficiency

-

Some applications

6.1 Teamwork: surplus distribution in a firm

6.2 Contagion and self-enforcing lockdown in a networked economy

6.3 Bias in academic publishing

6.4 Exchange economies

-

Contributions to the closely related literature

-

Conclusion and References

Appendix

6.3 Bias in academic publishing

\

\

\

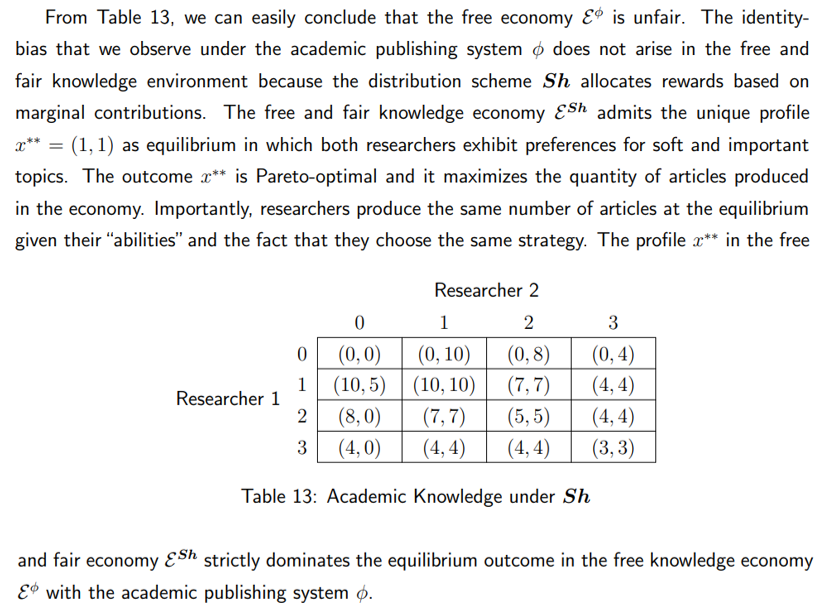

\ Well, it is straightforward to show that the researchers are symmetric under the knowledge function f. Using Anonymity and the other principles of merit-based justice, Table 13 below describes the allocation of academic articles under the allocation Sh.

\

\

:::info Authors:

(1) Ghislain H. Demeze-Jouatsa, Center for Mathematical Economics, University of Bielefeld (demeze jouatsa@uni-bielefeld.de);

(2) Roland Pongou, Department of Economics, University of Ottawa (rpongou@uottawa.ca);

(3) Jean-Baptiste Tondji, Department of Economics and Finance, The University of Texas Rio Grande Valley (jeanbaptiste.tondji@utrgv.edu).

:::

:::info This paper is available on arxiv under CC BY 4.0 DEED license.

:::

[10] Tough the trade-off between the two quality dimensions can be viewed as a rational decision, the consequences can be detrimental to economics, as a discipline and profession. For instance, some general interest journals suffer from the “incest factor” [Heckman et al., 2017], and Akerlof [2020] shows that the tendency of rewarding “hard” topics versus“ soft ”topics in economics results in “sins of omissions” where issues that are relevant to the literature and can not be approached in a “hard” way are ignored.

\

You May Also Like

China Launches Cross-Border QR Code Payment Trial

The "1011 insider whale" has accumulated 148,000 ETH from CEXs since yesterday, and its long positions in contracts have decreased to $680 million.