AI Startup Surge Risks Repeating Tech’s Last Funding Mania

Silicon Valley has a notoriously short memory. In 2023, we were recovering from the 2020-2022 zero-interest-rate policy (ZIRP), a period during which startup fundraising and valuations were irrational. (Remember when Fast raised at 1B+ valuation, hired 500 people but only generated $600K in revenue?)

Then, the correction hit hard. A record number of startups shut down in 2023–2024 after running out of money, failing to find product-market fit, or growing too slowly to raise again. Even soft landings were off the table as M&A stalled due to economic uncertainty and focus on AI.

In the public markets, many of the 2020–2023 tech IPOs and SPACs now trade at a fraction of what they raised, with uncertain paths to growth or profitability (e.g., BuzzFeed, OpenDoor, Rivian).

Crypto also experienced its speculative run during that same period. This led to the funding of many “zombie” Web3 companies that still lack customers and viable use cases.

What is happening now

Artificial intelligence is hot. It’s still early, but the potential is massive and the implications are profound. AI is already changing industries today and will transform even more tomorrow.

AI is moving at light speed with new technologies, models, papers, and startups emerging daily. 80%+ of YCombinator's batches are AI startups.

AI will reshuffle the deck the same way other breakthrough technologies did; some businesses will become stronger with AI, others will be disrupted, and new giants will emerge.

Remake of the 2020-2022 fundraising frenzy?

Once again, FOMO and herd mentality are driving investors to aggressively back AI startups and lead "monster" rounds to avoid being left behind, often at very optimistic (which then becomes delusional in a couple of years) valuations, disconnected from actual traction or stage. There is a running joke on Twitter that if you put LLM, GenAI, or Agent on a pitch deck, someone will knock at your door with a term sheet.

Startups raising too much or pivoting too fast: many Series A+ rounds closed with offerings still behind a waitlist, pre-product-market fit, questionable moats, or little to no revenue. Others are abandoning years of product, research, and customer insights to pivot into something completely different just to wear the “AI-powered X” label.

Some startups are using AI as a "get out of jail free" card: I know of a SaaS company that raised a large seed in 2020. Fast-forward to last year, they had little traction, limited runway, and couldn't raise the next round. Then, they added a thin AI layer to their product and rebranded as an AI company. They were still solving the same problem. Their metrics didn’t improve, but the new positioning got them two Series A term sheets within weeks. You could call it smart or opportunistic, but the reality will catch them later.

My advice to founders

No matter the hype, round size, and press coverage, all startups will eventually be measured using the same scorecard: activation, retention, monetization, and growth. Startups might raise once based on a narrative and grandiose vision, but their next round will be grounded on fundamentals reflecting the reality of their business.

Do not build a company or seek validation from VCs or the tech press. Build for customers. Talk to them, understand their problem, and offer an exceptional product that solves that problem. Great companies take decades to build, so ignore the noise and play the long-term game. Sooner or later, the AI novelty will fade, and only companies with products loved by customers and with durable, profitable, and defensible business models will survive.

AI won’t magically 2x your retention, monetization, or get you to product-market fit overnight. But it can help in two powerful ways. Internally, it can boost your team’s productivity, speeding up experiments and shipping features to market faster. Externally, it can help customers get to your product’s value faster through better automation, streamlined workflows, or capabilities that weren’t feasible before. The goal isn’t to sprinkle AI for the sake of it but to use it where it can help you solve real problems.

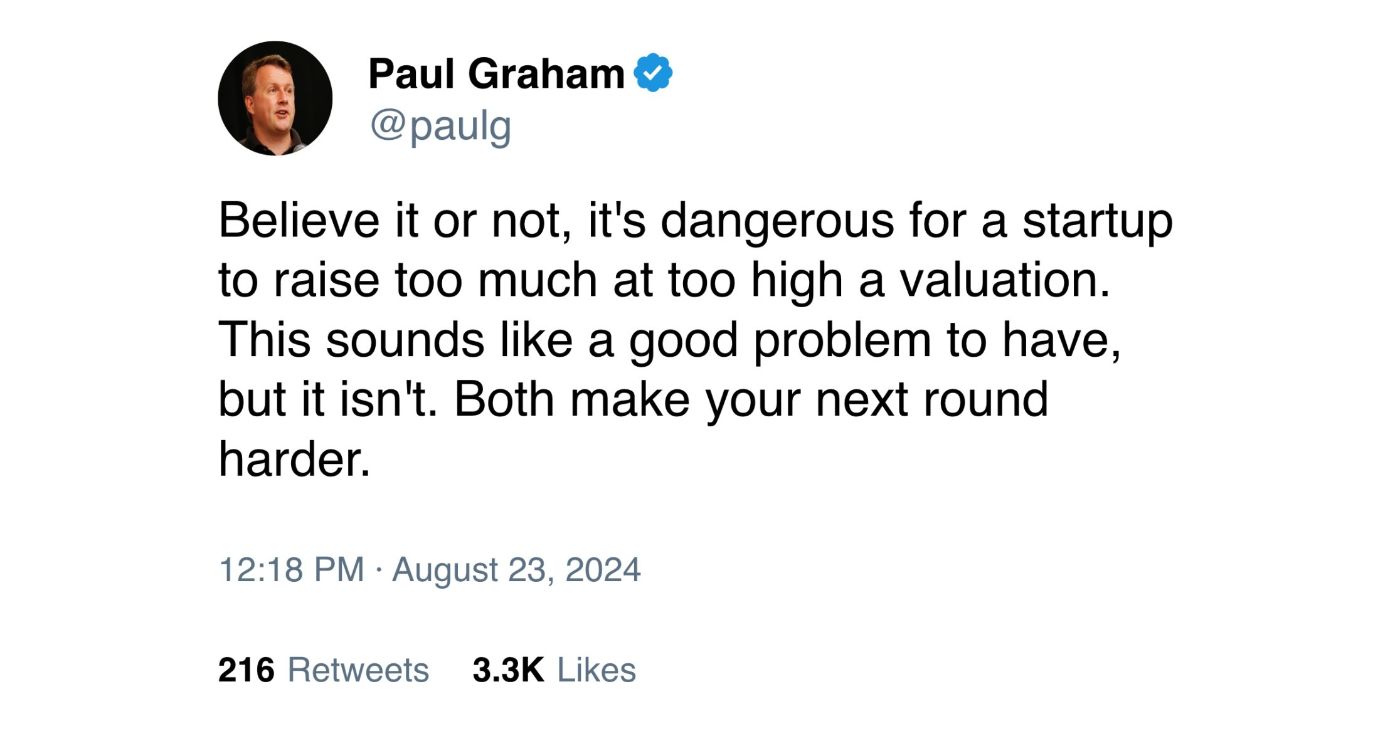

If you're being offered more money than you planned to raise, pause, and think before taking it. Can you realistically grow and "deserve" a multiple of that valuation with actual traction and revenue? Is scaling prematurely your headcount and burn going to set up your company and team for long-term success? Will you be happy with your equity after all the possible dilution? Resource constraints (time, money, team size, etc.) can be your greatest advantage, forcing focus, creativity, and discipline. Otherwise, if you prefer to take as much capital now, throw money and headcount at your problems, and figure things out later, you are in for the ride of your life, and I wish you the best.

I host weekly office hours to help startups with product, growth, and company strategy. I occasionally open a few slots to founders outside my portfolio. DM me!

You May Also Like

The Channel Factories We’ve Been Waiting For

Ethereum Price Prediction: ETH Targets $10,000 In 2026 But Layer Brett Could Reach $1 From $0.0058