In this article:

1. Guide to completing activities

2. Conclusion

Gopher is a Layer-1 data network that allows users to own, share, and earn from their data for AI.

Recently, the team launched a testnet where users can farm points that will later be converted into GOAI tokens.

The project was developed by the Masa team, which previously raised over $17.7 million from investors such as Digital Currency Group (DCG), FBG Capital, and others.

In this guide, we’ll look at which activities to complete in the testnet to become eligible for the future airdrop.

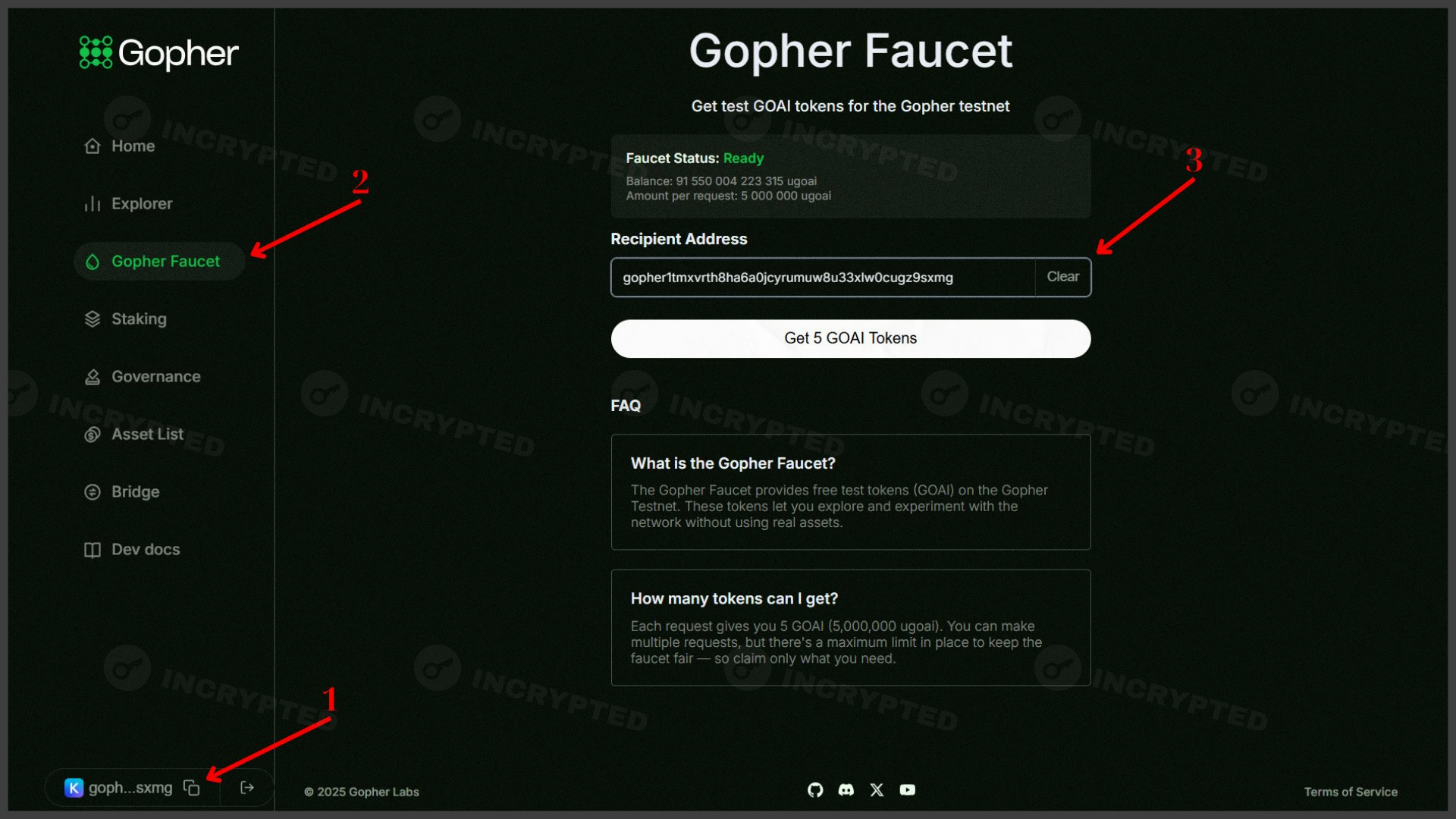

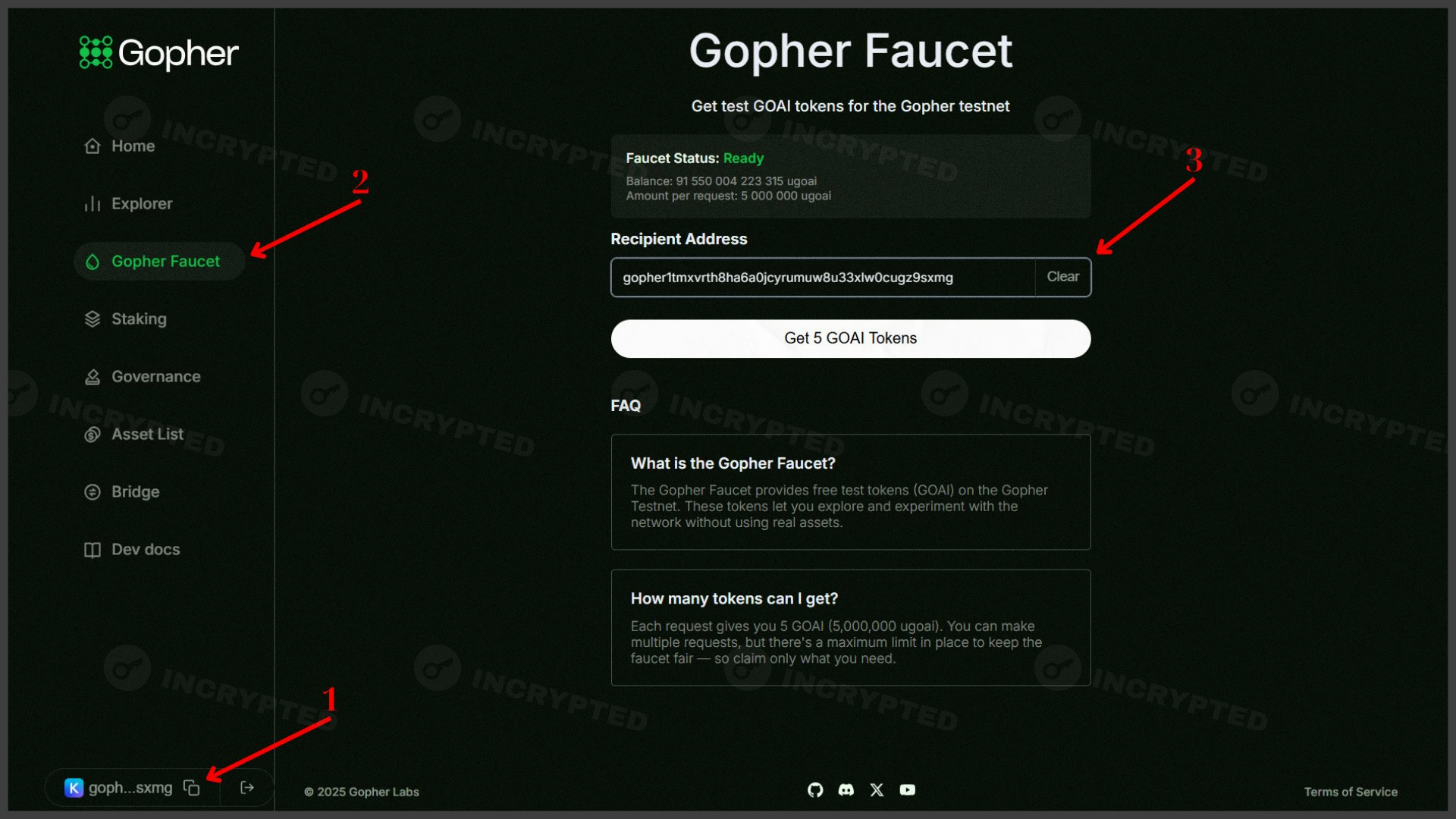

- Go to the website and connect your Keplr or Leap wallet. Then, in the Faucet section, claim the test tokens:

Claim test tokens. Data: Gopher.

- Stake tokens in the Staking tab. The Governance and Bridge sections will also be launched soon:

Staking section. Data: Gopher.

- Complete social tasks on the Galxe platform and claim points:

Campaign page. Data: Galxe.

- Join the project’s Discord, get the Gopher role, and stay active.

At the time of writing, the project is in its early stage. You can now make a few transactions for early activity, complete tasks on Galxe, and get a role in Discord. New activities will be added soon — follow the project’s social media to stay updated.

Highlights:

- be active in the testnet;

- complete tasks on Galxe.

If you have any questions while completing activities, you can ask them in our Telegram chat.

Useful links: Website | X | Discord

Disclaimer: The articles reposted on this site are sourced from public platforms and are provided for informational purposes only. They do not necessarily reflect the views of MEXC. All rights remain with the original authors. If you believe any content infringes on third-party rights, please contact service@support.mexc.com for removal. MEXC makes no guarantees regarding the accuracy, completeness, or timeliness of the content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be considered a recommendation or endorsement by MEXC.

Claim test tokens. Data: Gopher.

Claim test tokens. Data: Gopher.

Staking section. Data: Gopher.

Staking section. Data: Gopher.

Campaign page. Data: Galxe.

Campaign page. Data: Galxe.