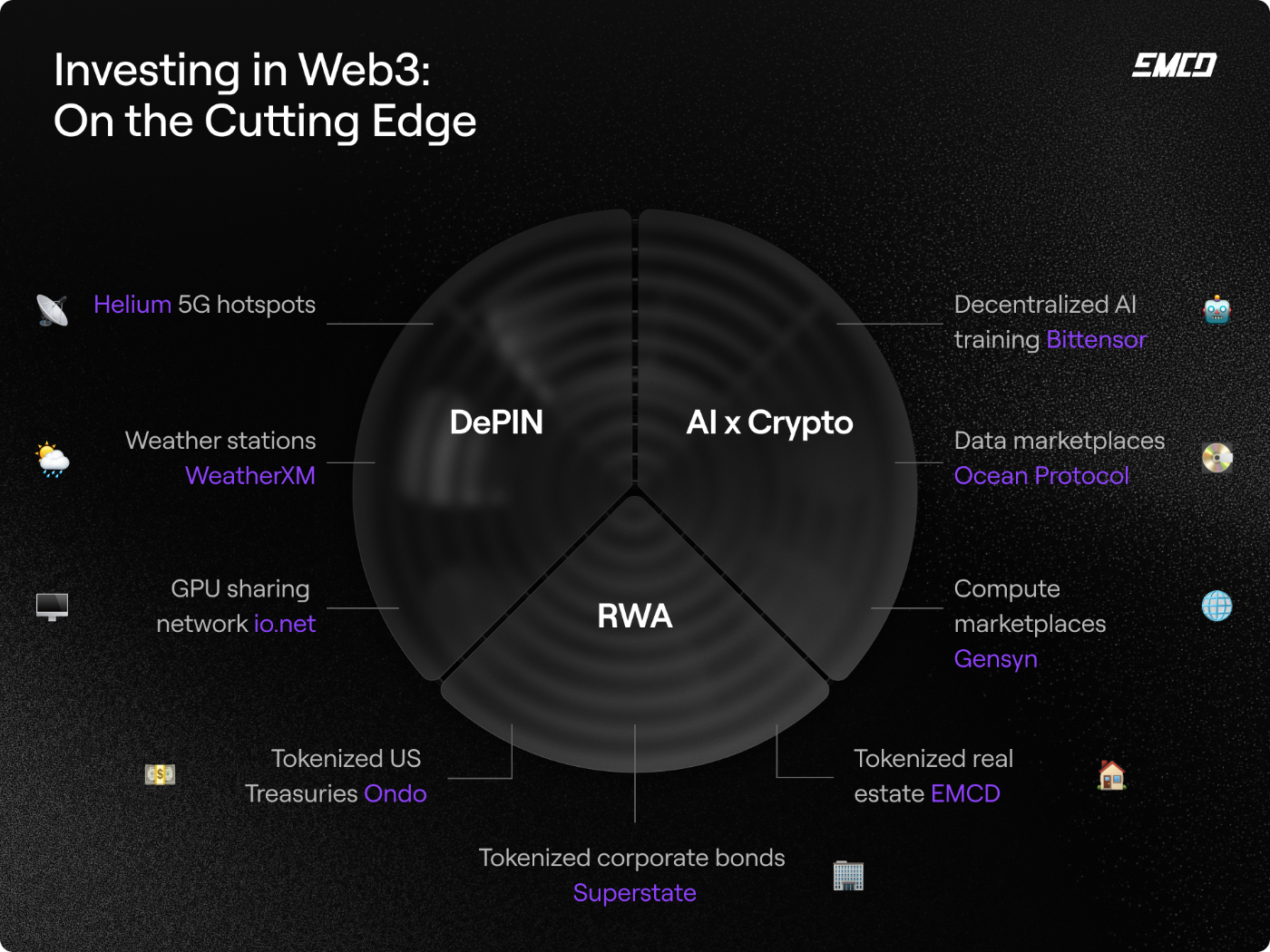

What to Invest in Within Web3 in 2025: From DePIN to Tokenized Assets

DePIN: Decentralized Infrastructure

DePIN (Decentralized Physical Infrastructure Networks) has become one of the major stories of recent years. Instead of giant corporations spending billions to build telecom networks, maps or weather stations, thousands of individuals install the hardware themselves and earn tokens in return. This model enables infrastructure to roll out faster, more flexibly and at lower cost.

Today DePIN runs on more than 13 mln active devices, and the sector’s market cap is estimated at about $50 bln. By 2028 it is projected to reach $3.5 trln. Helium 5G shows how users build mobile networks where carriers find it uneconomical.

Hivemapper turns dashcams into a decentralized alternative to Google Maps. WeatherXM makes weather station owners data providers for farmers, insurers, and logistics firms. And io.net connects idle GPUs from miners and gamers into a global computing market for AI.

How to Invest in DePIN

-

**Choose a project \ Research DePIN ecosystems and their tokens. Look at the team, the idea and the network’s growth potential. Buy tokens of the chosen project through an exchange or wallet.

-

**Plug in resources \ Join the network by providing what is needed: compute power, storage or bandwidth. The more resources you contribute, the larger your share of rewards.

-

**Earn rewards \ The network automatically issues tokens for participation. This is passive income tied to your resources and user activity inside the ecosystem.

-

**Boost yield \ Stake your earned tokens and use reward models. This way your income comes not only from base rewards but also from staking bonuses.

-

**Act on time \ At early stages, returns are higher: competition is lower and the network is growing fast. The earlier you join and stay active, the greater the upside.

\

AI + Crypto: An Ecosystem with Real Cash Flows

After the hype wave, it became clear: AI and blockchain deliver value only together.

Bittensor (TAO) builds a market where developers get paid for useful models. Ocean Protocol lets companies monetize data while keeping it private. Gensyn matches ML workloads with GPU owners, and Ritual makes neural networks transparent and verifiable.

How to Invest in AI + Crypto

-

**Choose a project \ Look into ecosystems like Bittensor, Ocean Protocol, Gensyn or Ritual. Understand the problems they solve and buy their tokens via exchange or wallet.

-

**Track usage \ Here token value grows not on speculation but on real demand. The more requests for compute and data, the higher the yield for holders.

-

**Join the community \ Even without coding skills, you can engage through DAOs, voting, and initiatives. This helps networks grow and increases the value of your investment.

-

Boost yield

Use staking and reward programs to add income on top of token growth.

-

**Act on time \ Early-stage projects scale faster. The earlier and more actively you participate, the higher your potential return.

RWA: Tokenization as a ‘Silent Revolution’

One of the year’s main trends is moving traditional financial instruments onto blockchain. RWA (Real World Assets) turn bonds, funds and other assets into digital form. What used to be an experiment is now a regulated market: MiCA is live in Europe, and the US has issued first licenses.

BlackRock and Franklin Templeton are already issuing tokenized debt products, Ondo is working with US Treasuries, and Superstate plus Matrixdock are digitizing corporate debt. For investors this means higher yields than banks, 24/7 liquidity and low entry barriers.

The early adopter factor is critical: those entering RWA now get premium terms and early access to products before institutions. EMCD is also active in this space, showing how tokenization of real assets becomes a new investment class bridging traditional finance and Web3.

How to Invest in RWA

- **Choose a project \ Look at platforms already tokenizing real assets: bonds, funds, corporate debt. Consider players like BlackRock, Franklin Templeton, Ondo, Superstate or Matrixdock.

- **Buy tokenized assets \ Access them through specialized services or DeFi platforms. Unlike banks, entry is lower and liquidity is around the clock.

- **Watch regulation \ This market is shaping within legal frameworks: MiCA in Europe, first licenses in the US. Knowing the rules helps minimize risk.

- **Use yield advantages \ Tokenized bonds and funds pay more than bank deposits while keeping flexibility and the ability to sell quickly.

- **Be an early adopter \ Enter the RWA market now while products are scaling. Early investors get premium terms and tools before institutions.

- **Join the ecosystem \ Engage in initiatives that develop tokenization. For example EMCD is building new solutions in this field, merging traditional finance and Web3.

What Clearly Doesn’t Work in 2025

2025 proved the market no longer forgives empty promises. NFT collections without real demand collapse fast. Tokens launched just for AI or metaverse hype disappear as quickly as they arrive. GameFi with weak player activity shuts down, and coins without use cases lose most of their value after unlocks.

For investors this means a simple truth: money works only where there is a product, customers, and revenue.

Bottom Line: A Mature Market with Real Money

Web3 is no longer a chaotic ‘sandbox’ but a mature ecosystem where technology delivers practical value.

In 2025, it became clear: value comes from decentralized networks for connectivity and mapping, compute power for AI, data exchange platforms, and tokenized financial instruments.

For investors, this marks a shift from speculation to strategies built on real demand and sustainable growth.

Top Ways to Profit in Web3 in 2025

- DePIN – income from infrastructure (Helium, Hivemapper, io.net) → stake + reward + token growth

- AI + Crypto – data and compute economy (Bittensor, Ocean, Gensyn) → GPU and data demand drives price

- RWA – asset tokenization (Ondo, Franklin Templeton, EMCD) → yields above banks, liquidity 24/7

- Yield 2.0 – new DeFi strategies → automation and combined yield

- Community x Tokens – DAOs and communities → airdrops, early access to deals

👉 Follow me on HackerNoon. There’s a lot more ahead.

\n

\n

You May Also Like

Eric Trump bets Fed rate cut will send crypto stocks skyrocketing

Vlna BitcoinFi boomu sa začína s HYPER