Bitcoin Hyper Rockets Past $24.4M — Analysts Eye $HYPER as the Next Layer-2 Breakout Gem

KEY POINTS:

While $BTC is on the rebound consolidating near $110K (despite a slight drop to $107K now), its blockchain lags due to slow TPS, high fees, and lack of native support for smart contracts.

While $BTC is on the rebound consolidating near $110K (despite a slight drop to $107K now), its blockchain lags due to slow TPS, high fees, and lack of native support for smart contracts.

Bitcoin Hyper ($HYPER) steps up as a Layer-2 scalability solution built to upgrade Bitcoin’s outdated blockchain with faster, cheaper, and cross-chain transactions, alongside support for dApps and smart contracts.

Bitcoin Hyper ($HYPER) steps up as a Layer-2 scalability solution built to upgrade Bitcoin’s outdated blockchain with faster, cheaper, and cross-chain transactions, alongside support for dApps and smart contracts.

Analysts predict $HYPER could hit $0.2 by 2025, a 1,422% gain, making it a potential 1000x crypto with long-term upside.

Analysts predict $HYPER could hit $0.2 by 2025, a 1,422% gain, making it a potential 1000x crypto with long-term upside.

Bitcoin has been the OG coin that started the entire crypto revolution, becoming the top choice for both beginners and experienced traders even today. The coin has remained #1 in terms of market cap and boast a market dominance of 57.01% until now.

Even despite the market crash two weeks back, $BTC has reclaimed some lost ground and is stabilizing around the $110K mark, with experts eyeing the next potential rally between $113K–$115K.

And despite being one of the most secure blockchains today, the blockchain’s weaknesses far outweigh it:

- The blockchain processes 2-3 transactions per second, meaning the network would lag significantly under high traffic

- As of October 13, Bitcoin’s average confirmation time sits at 45.34 mins, compared to Solana’s 400-600 milliseconds, making everyday payments and on-chain interactions painfully slow for Bitcoin users

- Slow TPS and confirmation times drives up on-chain fees, making small-value transactions very costly

- No native support for smart contracts and DeFi applications

These constraints have plagued the blockchain’s growth and discouraged any innovation or user engagement, diminishing $BTC’s appeal compared to its faster and cheaper contemporaries like Solana and Ethereum.

While there are numerous scaling solutions (like Lightning Network), they often trade off security and decentralization in the process. So, can Bitcoin users also get a taste of what Solana and Ethereum users rave about?

Indeed they can. Bitcoin Hyper ($HYPER) – the next-generation Layer 2 upgrade that promises better speed, more scalability, and DeFi programmability for developers. Bitcoin Hyper has already smashed $24.4M in presale, sending signals across the crypto world as the best crypto to buy now!

Introducing Bitcoin Hyper — The Layer-2 Revolution Igniting Bitcoin’s Revival

Bitcoin Hyper is on a mission to supercharge the Bitcoin blockchain by equipping it with advanced tools that will unlock lightning-fast transactions for minimal fees.

While it may sound like an impossible deal, Bitcoin Hyper has developed a plausible solution to tackle Bitcoin’s limitations head on!

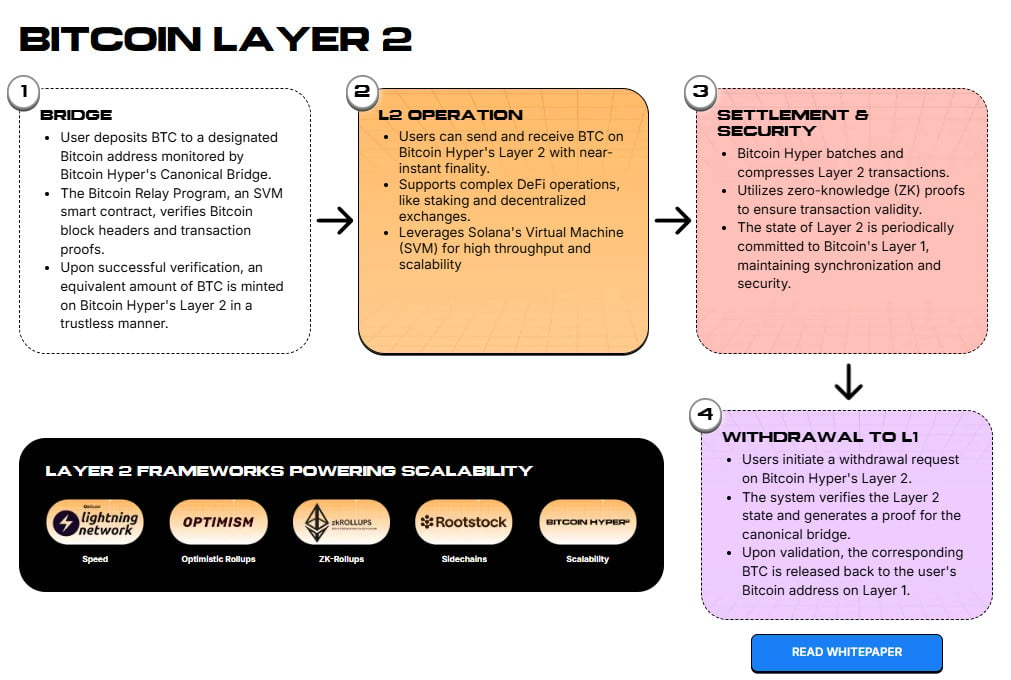

The project also introduces the Canonical Bridge, which will support seamless cross-chain operability while maintaining the integrity and security of Bitcoin’s Layer 1.

Check out our ‘What Is Bitcoin Hyper’ guide for a comprehensive analysis of $HYPER’s utility. But the way this works is simple. You deposit your $BTC into the Canonical Bridge, which mints and equivalent amount of wrapped $BTC on the L2 network that you can use for DeFi and NFT interactions.

If you want out of the L2, you can burn the wrapped tokens, and you’ll receive your Bitcoin back on the main chain.

The best part? Bitcoin Hyper preserves Layer 1’s security through all of this, and without congesting the main network. It achieves this by batching L2 transactions and compressing them into succinct zero-knowledge proofs before securely committing them to Bitcoin’s base chain.

At the heart of this futuristic ecosystem is $HYPER, its native token that powers everything, including dApps, DeFi tools like yield farming and staking, and gas fees for smart contracts and trading.

By reviving the oldest blockchain, $HYPER sits on the precipice of explosive potential. If its plans succeed, it could skyrocket to untold heights, following Bitcoin’s price performance.

Presale Explosion: $HYPER Skyrockets in Demand

In a powerful show of investor confidence, Bitcoin Hyper has raised $24.4M in its presale so far. One $HYPER token currently sits at $0.013145, with a dynamic staking APY of 49%. That means your money starts working for you from Day 1 — earning you passive income even before the Token Generation Event (TGE) kicks off.

Whales are already circling in with one major wallet scooping up $HYPER worth $36,520 just yesterday.

Learn how to buy $HYPER in our detailed guide.

Learn how to buy $HYPER in our detailed guide.

Considering the current market volatility, investors are exploring safer presale bets with solid upside potential to redirect their capital, and $HYPER stands out as a clear winner.

So, what kind of gains are on the table?

If our expert Bitcoin Hyper price prediction holds true, we’re looking at a potential 1,422% increase, hitting $0.20 by 2025’s end. And that’s without factoring in the passive staking income – a breakout opportunity in a market on the mend.

With such explosive growth potential, this utility-driven token could be the next 1000x crypto, paving the way for Bitcoin’s evolution into the web3 era.

Join the $HYPER revolution — secure your token now!

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

VectorUSA Achieves Fortinet’s Engage Preferred Services Partner Designation