Best Crypto Presales to Buy as Novogratz Says Bitcoin Needs to Reclaim $125K Before $250K

KEY POINTS:

While Bitcoin naps at $107K, Novogratz warns it needs $125K before dreaming of $250K.

While Bitcoin naps at $107K, Novogratz warns it needs $125K before dreaming of $250K.

Bitcoin Hyper ($HYPER) has raised over $24.6M as a Layer-2 solution, bringing DeFi to Bitcoin.

Bitcoin Hyper ($HYPER) has raised over $24.6M as a Layer-2 solution, bringing DeFi to Bitcoin.

Best Wallet Token ($BEST) offers over $16.6M in presale funding for the fastest-growing crypto wallet ecosystem.

Best Wallet Token ($BEST) offers over $16.6M in presale funding for the fastest-growing crypto wallet ecosystem.

Bitcoin’s hanging out between $100K and $125K like it can’t decide whether to commit.

Meanwhile, Galaxy Digital CEO Mike Novogratz just dropped a cold reality check: forget those $250K pipe dreams by year-end unless ‘crazy stuff’ happens.’ With Bitcoin at about $108K, hitting $250K would require a 133% surge in 10 weeks, which is optimistic, to say the least, and unrealistic at the worst.

Source: CNBC on YouTube

But not all hope is lost, as there are still opportunities to get ahead in the market.

Consolidation phases like these are the perfect time to position yourself in high-potential presales before the next leg up. While Bitcoin decides its next move, smart money flows into projects that could explode once $BTC starts pumping.

The beauty of crypto presales is that you’re buying at ground-floor prices while everyone else is paralyzed by indecision. We’re talking legitimate projects with actual utility.

So while Novogratz preaches patience for that $125K breakthrough, let’s dive into three of the best crypto presales that could turn this consolidation into your best 2025 decision.

1. Bitcoin Hyper ($HYPER) — The Layer-2 That’s Making Bitcoin Useful

Bitcoin Hyper ($HYPER) is here to inform you that $BTC can actually do things, such as DeFi, smart contracts, and transactions that don’t cost more than your coffee.

This Layer-2 solution has raised over $24.6M, showing how hungry the market is for a Bitcoin that works like it’s 2025, not 2009.

While Novogratz talks about Bitcoin needing to reclaim $125K to accelerate, Bitcoin Hyper is on its way to accelerating Bitcoin’s capabilities come next year, once the L2 launches.

Built on the Solana Virtual Machine, it will process thousands of transactions per second with near-instant confirmations. Through a Canonical Bridge, you’ll be able to send $BTC and receive 1:1 wrapped $BTC that you can use on the L2 for dApps.

Read our Bitcoin Hyper review to get a better understanding of its plans.

Read our Bitcoin Hyper review to get a better understanding of its plans.

The presale token is currently $0.013155 per $HYPER token, and whale wallets have been accumulating with purchases of $379.9K and $274K.

With a Q4 2025 launch on Uniswap and eventual CEX listings, timing is perfect. Bitcoin Hyper price predictions range from $0.03 at listing to $1.2 by 2030, which would mean a prospective gain between 128% and over 9,000% in five years.

Get your Bitcoin Hyper ($HYPER) tokens now.

2. Best Wallet Token ($BEST) — The Token That Cuts Your Wallet Fees While Paying Staking Rewards

Crypto wallets are basically fancy password managers. But Best Wallet Token ($BEST) is the official of the non-custodial wallet that actually works for you.

With $16.6M raised and over 250K active users, $BEST proves utility tokens can be both useful and profitable, which is rarer in crypto than honest influencers.

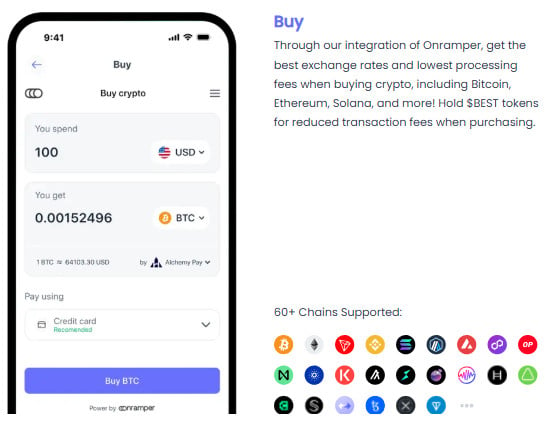

At $0.025835 in presale right now, $BEST is the token for the fastest-growing non-custodial wallet in an $11B market. Holding $BEST slashes transaction fees, bumps staking rewards, and grants early access to new presales.

Best Wallet supports over 1K tokens across 6+ major blockchains (with plans for 60+ in the future), with cross-chain swaps, fiat on-ramps, and a crypto cashback card offering 8% returns.

The Coinsult and Solidproof security audits found zero vulnerabilities, which means it’s extremely unlikely for investors to lose their money due to internal foul play.

The Coinsult and Solidproof security audits found zero vulnerabilities, which means it’s extremely unlikely for investors to lose their money due to internal foul play.

Best Wallet Token price predictions go from as low as $0.026953 by the end of 2025 to as high as $0.813232 by 2030. That’s a potential 3,084% increase by the end of the decade, and only if the project delivers on its promises.

Retail investors are pretty confident in the project’s prospects, though, considering the whale activity for this project. Throughout the presale’s lifespan, whales have made transactions worth $70K and $50K.

Join Best Wallet Token ($BEST) presale now.

3. BlockchainFX ($BFX) — The Trading Platform That Makes You Money

Most crypto exchanges keep your trading fees. BlockchainFX ($BFX) gives 70% back to users. With $9.8M raised from over 15K participants at the current $0.028 presale price, $BFX proves a multi-asset trading platform can be both profitable and generous.

While Bitcoin bounces between levels, BlockchainFX users trade 500+ assets, including crypto, stocks, ETFs, forex, and commodities in one place, and up to 70% of fees get redistributed daily in $BFX and $USDT.

BFX Visa cards (Gold, Green, Metal) let you spend crypto anywhere, and they have multiple bonus tiers based on your investment amount. For some of these tiers, you even get trading credits and daily $USDT rewards, alongside staking rewards.

CertiK-audited, the presale started at $0.01, and it’s now at $0.028, with price increases every Monday.

There’s also a BlockchainFX Demo available right now where you can see an analyst trading crypto, ETFs, CFDs, and stocks, all on one single platform.

Read more about BlockchainFX ($BFX).

So here you have three presales worth your attention while Bitcoin plays ‘will it, won’t it’ with the $125K level.

Novogratz might be preaching patience on Bitcoin, but that doesn’t mean sitting on the sidelines. When Bitcoin does reclaim $125K and makes that run toward $250K, these presales could already be trading at multiples of their current prices. And wouldn’t it be nice to be the one who got in early for once?

You May Also Like

Unlocking Massive Value: Curve Finance Revenue Sharing Proposal for CRV Holders

Best Crypto To Buy Now: Pepeto vs BlockDAG, Layer Brett, Remittix, Little Pepe, Compared