Fastest Bitcoin Layer-2 in History Raises $25.7M: Bitcoin Hyper to Soar Next?

Quick Facts:

Bitcoin’s base layer limits DeFi. Low TPS, minutes-long finality, fee spikes and minimal programmability push liquidity to EVM and Solana, fragmenting $BTC-native activity.

Bitcoin’s base layer limits DeFi. Low TPS, minutes-long finality, fee spikes and minimal programmability push liquidity to EVM and Solana, fragmenting $BTC-native activity. Reliance on liquidity silos deters builders and users, making seamless $BTC collateral use across dApps difficult.

Reliance on liquidity silos deters builders and users, making seamless $BTC collateral use across dApps difficult. Bitcoin Hyper’s SVM Layer 2 batches to Bitcoin, delivering near-instant, low-fee dApps while anchoring security to $BTC, using a canonical bridge for movement.

Bitcoin Hyper’s SVM Layer 2 batches to Bitcoin, delivering near-instant, low-fee dApps while anchoring security to $BTC, using a canonical bridge for movement. Transparent presale with no private rounds, in-app staking and a developer SDK position $HYPER as a credible and promising $BTC DeFi project.

Transparent presale with no private rounds, in-app staking and a developer SDK position $HYPER as a credible and promising $BTC DeFi project.

There’s no doubt that Bitcoin is unmatched as a store of value, yet its original design struggles to handle modern on chain activity.

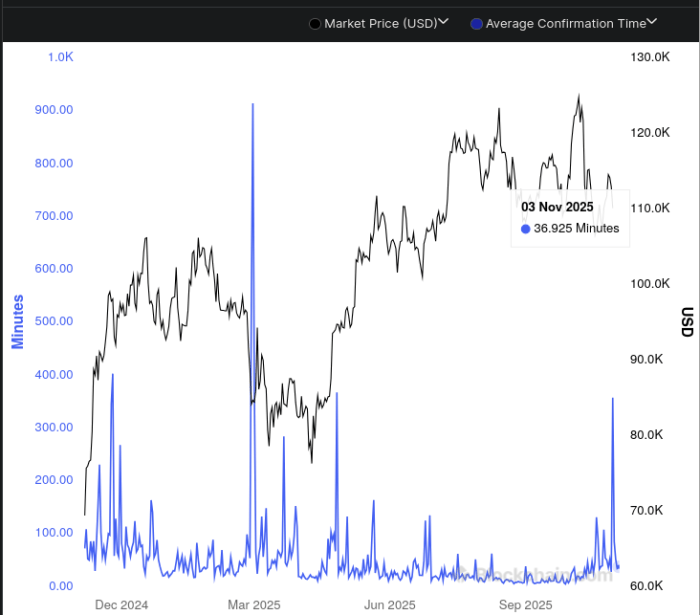

Throughput sits in the single digits per second (around 7) and confirmation time sits at ~36 minutes as of two days ago, so market makers and retail users face slow settlement and slippage during volatility.

And this is far below what consumer applications or global financial rails expect.

When activity spikes, fees climb and push out smaller transfers, which makes on chain swaps and micropayments impractical.

This bottleneck reduces the appeal of building interactive services directly on $BTC.

Moreover, limited programmability further constrains builders, as Bitcoin lacks the flexible smart contract logic that powers lending markets, DEXs and gaming on other chains.

This also means developers either accept narrow functionality or move liquidity away from $BTC to access modern tooling.

As a result, $BTC liquidity often leaves the network via wrapped assets and custodial bridges, fragmenting collateral and adding counterparty risk. This is the core DeFi gap on Bitcoin today.

The net effect is a split where Bitcoin captures savings like a digital gold while the activity layer lives elsewhere.

Projects that bridge this gap must increase speed and lower costs without weakening Bitcoin’s final settlement or adding custodial risks that negate decentralization benefits.

Bitcoin Hyper ($HYPER) proposes a Layer 2 that keeps Bitcoin for settlement while moving execution to a high throughput environment. Transactions run on a fast virtual machine and are batched, then committed back to Bitcoin for finality.Unlike external custodial bridges, Hyper uses a canonical, programmatic bridge verified by an SVM relay and commits state to Bitcoin L1, aiming to keep BTC activity consolidated above Bitcoin rather than scattered across external chains.

Specifically, the project integrates the Solana Virtual Machine so developers can deploy Rust smart contracts and run dApps at low latency. A canonical bridge locks $BTC on Layer 1 and mints equivalent assets on Layer 2, letting users move value in and out while retaining Bitcoin settlement.

If delivered, this real time Layer 2 could make payments, DeFi, NFTs and gaming on Bitcoin feel fast and inexpensive without sacrificing the assurances that make $BTC valuable.

Read more about Bitcoin Hyper in our comprehensive guide.

Read more about Bitcoin Hyper in our comprehensive guide.

How Bitcoin Hyper Works And Why It Matters for Bitcoin’s Future

Bitcoin Hyper’s design centers on a performant execution layer plus a Canonical Bridge. Users deposit $BTC to a monitored address, proofs of the deposit are verified by an SVM program, and equivalent wrapped $BTC is minted on the Layer 2.

Activity happens with near instant finality, while batches are periodically committed back to Bitcoin. This keeps the Layer 2 state synchronized with Layer 1 security.

This flow aims to deliver speed and low fees without divorcing from Bitcoin-native settlement.

The whitepaper highlights an SVM environment optimized for low latency and supporting decentralized exchanges, lending, payments, NFTs and games.

Developers will get Rust tooling and a planned SDK and API to accelerate integrations, while users pay gas in $HYPER inside the ecosystem.

But utility extends beyond raw throughput, as $HYPER powers transaction fees, staking access and ecosystem permissions. And best of all, $HYPER is positioned to fund developer grants so teams can ship early dApps on the network.

The Layer 2 validator network uses proof of stake to process transactions while anchoring to Bitcoin for settlement, which keeps energy use low relative to Bitcoin itself because only batched commitments touch Layer 1.

For users who value sustainability, this is a practical side benefit.

Holding $HYPER puts you at the forefront of this new Layer-2 development, as it’s the main currency to be used in the ecosystem.

The presale has now raised almost $26M, with one whale $130K just an hour ago. In fact, the project has seen massive attention from crypto whales over the months:

- $161K on August 12

- $379K on October 3

- $247K on October 6

In recent months, Bitcoin Hyper has been hailed as one of 2025’s most promising presales, especially since it follows in Bitcoin’s footsteps. It might just become one of the next crypto to explode at this rate.

Our guide on buying $HYPER will help you join the presale in 4 simple steps.One token is now priced at $0.013225, with the next price increase in one day. Joining now will give you an early-bird edge over others, and coupled with the dynamic 45% staking APY, the potential profits are clear.

Get your $HYPER now before the next price increase!

Authored by Ben Wallis, Bitcoinist – https://bitcoinist.com/bitcoin-hyper-to-soar-fastest-bitcoin-layer2-presale

Disclaimer: This is informational content, not financial advice. Always do your own research on audits, tokenomics, staking terms and bridge risks before purchasing.

You May Also Like

Trump foe devises plan to starve him of what he 'craves' most

Why Bitcoin Is Struggling: 8 Factors Impacting Crypto Markets