"Living off the past" is not advisable. The crypto field cannot rely on network effects to build a holding moat

Author: Catrina , Crypto KOL

Compiled by: Felix, PANews

Revisiting Web2’s most popular Growth Hacking (PANews Note: Growth Hacking is the process of helping a company grow rapidly through certain means and strategies): Why network effects are no longer a lasting moat for Web3.

First, let’s understand the definition of network effects and why they are important in Web2. The following results are from ChatGPT:

Definition: A network effect occurs when a product or service gains additional value as more people use it. This means that each new user increases the overall value of the product or service to existing users.

Benefits of Network Effect (NE):

- Strengthening competitive moat – More users make the product more valuable, thus keeping out competitors.

- Lower user acquisition costs – existing users attract new users through word of mouth, integrations, or ecosystem effects.

- Create higher switching costs and retention – As a network grows, users become more integrated into the ecosystem (e.g., social connections, data, integrations). This makes it costly or inconvenient for them to leave, thereby increasing retention and pricing power.

Some may raise objections here, but this article emphasizes that network effects are not a durable moat in the crypto space. Because cryptocurrencies have the following characteristics, they cannot enable crypto companies to have the same staying power and sustainable competitive advantage as Web2 companies.

Characteristic 1: Crypto users tend to be more profit-driven

Developers as users: Developers are users/purchasers of blockchains (L1, L2, other “layers”). Blockchains offer developers a similar product: block space in an on-chain immutable database that records transaction history. Developers generally have common criteria when choosing where to build:

- Lowest transaction fees

- Fastest transaction processing

- Highest liquidity

- Most ecosystem/community support, including grants

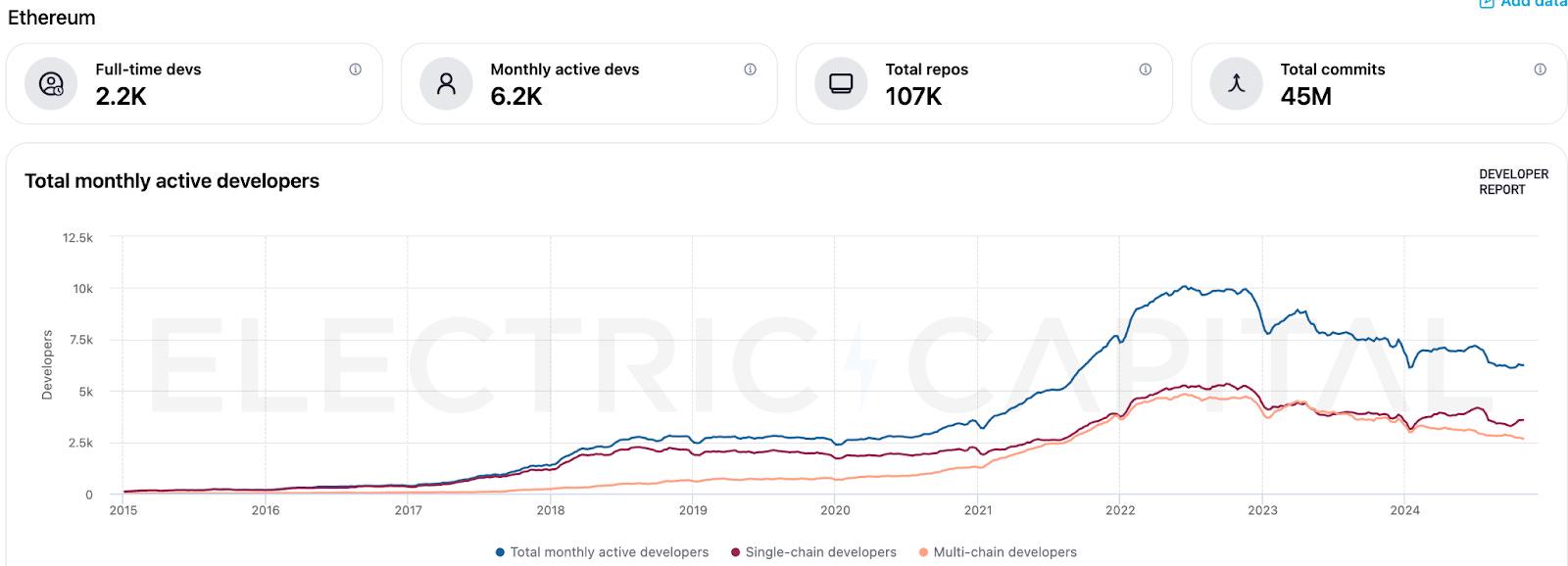

As shown in the Electric Capital developer report above, Ethereum initially benefited from network effects, attracting most developers to build exclusively on Ethereum ("single-chain developers"). However, in the face of competitors such as Solana and Base, the network effect failed to save Ethereum from poor performance and fragmented liquidity. As a result, the ratio of "single-chain developers" / "total number of monthly active developers" has dropped significantly since 2022. This shift shows the profit-seeking nature of developers. They will flow to where their needs are met, rather than staying for loyalty.

Retail Investors as Users: As long as DeFi remains the primary use case for cryptocurrencies, liquidity providers and DeFi users will continue to seek:

- Highest liquidity return

- Minimum slippage in transactions

- The most types of tokens

- The most attractive mining rewards

This behavior is generally not related to user experience or platform preference.

In addition, the emergence of wallets makes switching between platforms such as Uniswap and Hyperliquid smooth and easy.

Validators as users: Validators naturally seek the highest notional value block rewards — either from their stake (in PoS networks) or from services provided (as DePIN providers).

The choice of continuing to use or supporting alt L1, L2, application chain or DePIN projects depends on a simple cost-benefit calculation. When making this choice, validators will evaluate the economic value and sustainability of block rewards.

Feature 2: Cryptocurrency is open source by default, greatly reducing the entry barrier for imitators

“Vampire Attack”: SushiSwap copied the Uniswap code and provided the exact same user experience, then designed a more profitable token incentive to siphon off Uniswap’s liquidity providers and users.

It would be much harder to pull off a similar attack in Web2. Someone would have to steal Facebook’s entire codebase, launch an identical or better product, and then offer money to all of Facebook’s users to entice them to use the new platform.

Feature 3: Cryptocurrencies are interoperable by default, minimizing switching costs for developers and retail investors

Take USDC, for example, which arguably has the highest network effect in the crypto space, comparing it to one of its Web2 peers, the Visa network. If USDC is not accepted, it doesn’t take much time to exchange it for USDT, USDe, or PYUSD on a DEX or CEX.

However, it is much more troublesome for users to switch their cards from the Visa network to MasterCard.

Now back to the main point of this article, why network effects don’t give crypto companies the same advantages as their Web2 counterparts:

Network effects do not increase competitive moats: Due to the forkability and open source nature of cryptocurrencies, coupled with Bertrand competition between undifferentiated products (yield, block space, liquidity) (PANews Note: that is, the products of different manufacturers are completely substitutable, so the oligopoly with the lower price will win the entire market, and the one with the higher price will not get any benefits at all), network effects do not necessarily make the first mover with more users more "competitive".

Network effects cannot reduce the cost of acquiring crypto users: Crypto users (whether retail or developers) are inherently more profit-driven than Web2 users. Retail investors prefer optimal trading returns and yields. Developers prefer the best performance and deepest liquidity. Regardless of whether there is a network effect, as long as the returns are profitable for LPs, liquidity will remain in the ecosystem.

Some even argue that cryptocurrencies have the opposite effect of network effects: the more LPs in a pool, the lower the returns; the more users on a chain, the higher the fees and the more congestion.

Network effects do not create higher switching costs and retention rates in crypto: Due to the default composability and interoperability of blockchains, switching costs in crypto are extremely low.

There is no data moat in the crypto space. No data on the chain can be considered "proprietary data", which is key for large technology companies to retain users.

Finally, let’s look at a case study on Ethereum, which is widely considered to be the epitome of network effects in the crypto space. Since Ethereum is regarded as the “world computer”, it combines blockchain innovation with programmable currency and benefits from early network effects:

- Developer adoption: Ethereum attracted the largest blockchain developer community in its early days, primarily because its EVM became the industry standard for initial blockchain development.

- Liquidity and DeFi Dominance: Ethereum hosted the majority of crypto liquidity via DeFi platforms — until recently surpassed by Solana. More liquidity attracts more users → easier and cheaper to trade/borrow → more liquidity.

- Security: The increase in Ethereum usage has enhanced its security, attracting more projects and users.

However, this trend was broken this year. Ethereum played a good hand badly: delaying product improvements and over-fragmenting its ecosystem by supporting L2 that cannibalized its own liquidity. As a result:

- A large outflow of developers: The number of monthly active developers decreased by 17% in 2024, while the number of new developers on Solana increased by about 83%.

- Liquidity outflow: According to DeFiLlama data, DeFi’s dominance has dropped from 100% to 50%).

And Ethereum’s so-called network effects cannot reverse this trend.

In contrast, the Web2 giants (i.e. Meta and Twitter) have similarly slacked off on innovation and delivery, yet continue to easily dominate their respective markets. Why? Because the Web2 version of network effects really works and has staying power:

- Competitors cannot fork their code and offer a similar product.

- Twitter and Facebook data is truly proprietary and irreplaceable

- Unable to interoperate with any project except within its own ecosystem.

Given this, traditional network effects that provide long-term moats for Web2 companies do not apply in crypto.

Related reading: Ethereum’s growing pains: From ETF “bleeding” to on-chain weakness, can ETF staking boost the market?

You May Also Like

SBI VC Trade Adds Litecoin to Japanese Lending Program

Work Dogs TGE Is Running — Is WD About to Drop in Q2 After March 30?