Bitcoin Price Prediction 2025, 2026 – 2030: How High Will BTC Price Go?

The post Bitcoin Price Prediction 2025, 2026 – 2030: How High Will BTC Price Go? appeared first on Coinpedia Fintech News

Story Highlights

- Bitcoin is currently trading at: $ 82,524.93895947

- Predictions suggest BTC could reach $175K in 2025.

- Long-term forecasts estimate BTC prices could hit $900K by 2030.

The Bitcoin price prediction for 2025 is becoming aggressively bullish as in the year’s second half, July, a new ATH has been marked, smashing previous all-time highs of $112K.

As a wave of bullish momentum sweeps into the market, investors and traders are intrigued by its next stop, as it has entered a price discovery mode.

This optimism has been directly fueled by massive inflows into spot Bitcoin ETFs, skyrocketing institutional adoption, much clearer regulations, and unwavering political support from figures like President Trump.

It’s now seen as “a hedge against inflation” more than ever, and the cryptocurrency is capturing global attention. Major players like MicroStrategy, Metaplanet, Trump Media, and several other entities are boldly adding BTC to their balance sheets, signaling unshakable adoption and confidence in its future.

With the Federal Reserve hinting at future rate cuts and market enthusiasm at a fever pitch, investors are buzzing with questions: “Can Bitcoin sustain its meteoric rise?” and “Will it redefine the financial landscape in the next five years?” This Bitcoin price prediction dives deep into the trends driving this historic rally. Read on for the full scoop.

The BTC price may range between $96,071.89 and $103,285.62 today.

Table of Contents

- Story Highlights

- CoinPedia’s Bitcoin (BTC) Price Prediction

- Bitcoin Price Analysis 2025

- Bitcoin Price Prediction November 2025

- Bitcoin AI Price Prediction For October 2025

- Bitcoin Price Prediction 2025: Onchain Outlook

- Bitcoin Crypto Price Prediction 2026 – 2030

- BTC Price Forecast 2026

- BTC Price Prediction 2027

- Bitcoin Predictions 2028

- BTC Price 2029

- Bitcoin Price Prediction 2030

- Bitcoin Price Prediction 2031, 2032, 2033, 2040, 2050

- Bitcoin Prediction: Analysts and Influencer’s BTC Price Target

- FAQs

Bitcoin Price Today

| Cryptocurrency | Bitcoin |

| Token | BTC |

| Price | $82,524.9390 |

| Market Cap | $ 1,646,422,047,204.90 |

| 24h Volume | $ 121,906,353,195.84 |

| Circulating Supply | 19,950,600.00 |

| Total Supply | 19,950,600.00 |

| All-Time High | $ 126,198.0696 on 06 October 2025 |

| All-Time Low | $ 0.0486 on 14 July 2010 |

CoinPedia’s Bitcoin (BTC) Price Prediction

Firstly, at CoinPedia, we feel optimistic about Bitcoin’s price increase. Hence, we expect the BTC price to create a 2025 high of ~$168,000.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $71,827.81 | $119,713.02 | $167,598.22 |

Bitcoin Price Analysis 2025

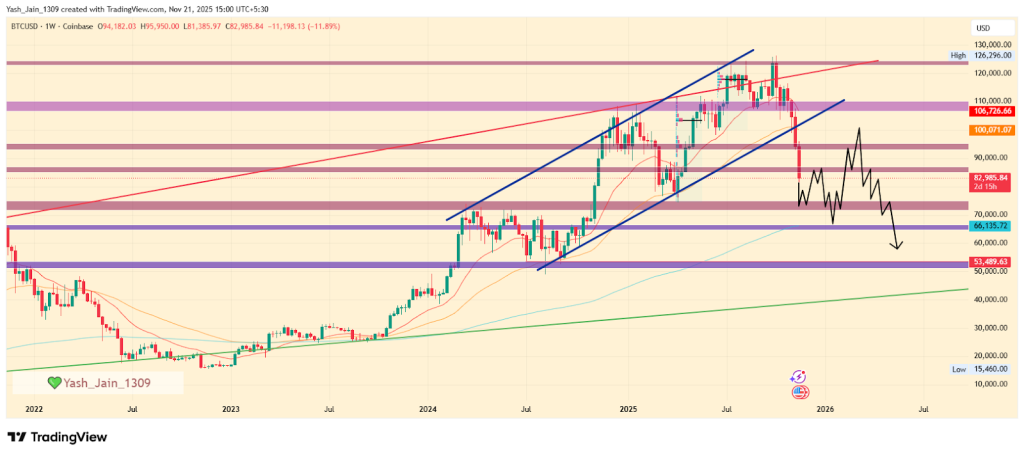

The Bitcoin price performance observed since 2024 has demonstrated an upward trend within a defined upward channel. But the initial swing low was made in 2023 around $16,000 area.

Since then, a bull market began that reached 2021’s high around $70,000 by early 2024, with a decent pullback rally that continued flipping this high and reached $108,000 in early 2025, and Q3 of 2025 marked an ATH of $126,296.

This advancement marked a huge 675% surge in 1008 days when it reached ATH, but this price action of multi-year was happening inside a broadening ascending wedge. And Q4 2025 is seeing a decline from this reliable old pattern’s upper border, having slipped below $85,000, which represents a fall of over 30% in 49 days after a magnificent 1008 days of rally.

The two-year parallel ascending channel has also confirmed a breakdown from the lower border, suggesting a significant decline is forthcoming.

Since the price action doesn’t fall in one direction only in normal circumstances, and the year is also about to conclude next month. So, bulls would present a fight around the $70,000 to $75,000 support area, which is the 2024 high based on demand. So the rest of the year seems like BTC would fall more around 10% to 15%, or could show faint bullish momentum of recovery or consolidation around $70,000 area, and after making a price action and trapping long buyers, it could fall more towards $53,489 in the first half of next year.

Reason for decline: In November, the price of BTC and other risk assets declined primarily due to the U.S. Federal Reserve’s hawkish stance and renewed geopolitical tensions, particularly related to Russia and Ukraine.

A peace proposal from the U.S. was met with skepticism from Ukrainian President Zelensky regarding Russia’s commitment to ending the war. This led to a significant drop in BTC prices because A wave of liquidations occurred, with $1.93 billion in positions liquidated within 24 hours.

Bitcoin Price Prediction November 2025

The Bitcoin price USD has dropped beneath a key support level in November, around $85,000, which was crucial for a potential reversal. But the price seems to have broken down from an ascending parallel channel that was in place for the last two years. This suggests that the fall could extend towards the $70,000-$75,000 area, where it would attract buyers and consolidate. This consolidation may occur in the first half of 2026 and could even continue its downward trend.

| Month | Potential Low | Potential Average | Potential High |

| November 2025 | $80,000-$95,000 | $100,000 – $108,000 | $115,000 – $118,000 |

Bitcoin AI Price Prediction For October 2025

| Source / Platform | Low Price (USD) | Average Price (USD) | High Price (USD) |

| Gemini (AI-assisted) | $110,000 – $125,000 | $130,000 – $150,000 | $160,000 – $180,000+ |

| ChatGPT (OpenAI) | $92,000 | $117,000 | $138,000 |

| BlackBox AI | $100,000 | $125,000 | $150,000 |

Bitcoin Price Prediction 2025: Onchain Outlook

A Bitcoin price analysis using on-chain data led to a key finding that it has consistently demonstrated a powerful ability to translate short-term geopolitical shocks into multi-month, long-term bullish catalysts.

According to Santiment’s Q2 insights by BrianQ, this pattern can be traced back to the 2024 Israel-Palestine conflict and the Q1 2025 tensions between Ukraine and Russia. Both events caused social volume spikes and initial price dips, followed by sharp recoveries that liquidated panic sellers.

Likewise, the Q2 Israel-Iran conflict was another definitive signal that generated the highest social volume ever in times of panic. After the price briefly dipped to $98,000 in June, the BTC price USD turned aggressively bullish, marking a new all-time high. The Bitcoin price prediction for 2025 suggests that the year could end on a positive note, with higher odds of a potential rally extending into 2026.

Moreover, this strong market outlook is underpinned by robust fundamental and on-chain metrics. Evidence confirms a firm link between BTC crypto and global liquidity (M2) is clear. It has been observed that as global M2 increases, price surges often follow.

Even the other on-chain data supports this thesis, with CryptoQuant indicating rising accumulation and sustained declines in exchange reserves. Crucially, this confirms the elevated institutional commitment, which is evident even in the US Spot ETFs data figures, which have grown significantly from their net assets, from $27.81 billion in early 2024 to a record $149.96 billion by Q4 2025.

Clearly, the corporate adoption reinforces this trend, with public company holdings nearly doubling from 476,000 BTC to a massive 869,000 BTC since the start of the year.

Ultimately, a Bitcoin price analysis for 2025 suggests that the future potential depends strictly on how sustained buying demand remains, as well as geopolitical stability and regulatory clarity.

If the current bullish sentiment persists, the BTC price is expected to reach a cycle high target of $175,000. Conversely, should global uncertainty intensify and sentiment turn negative, the downside risk is projected to find strong support around the $70,000 mark.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $70K | $120K | $175K |

Also Read: What is Bitcoin? An In-Depth Guide To The King Of Digital Currencies

Bitcoin Crypto Price Prediction 2026 – 2030

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| BTC Price Forecast 2026 | 150K | 200K | 230K |

| BTC Price Prediction 2027 | 170K | 250K | 330K |

| Bitcoin Predictions 2028 | 200K | 350K | 450K |

| BTC Price 2029 | 275K | 500K | 640K |

| Bitcoin Price Prediction 2030 | 380K | 750K | 900K |

BTC Price Forecast 2026

The BTC price range in 2026 is expected to be between $150K and $230K.

BTC Price Prediction 2027

Subsequently, the Bitcoin price range can be between $170K to $330K during the year 2027.

Bitcoin Predictions 2028

With the next Bitcoin halving, the price will see another bullish spark in 2028. Specifically, as per our Bitcoin Price Prediction, the potential BTC price range in 2028 is $200K to $450K.

BTC Price 2029

Thereafter, the BTC price for the year 2029 could range between $275K and $640K.

Bitcoin Price Prediction 2030

Finally, in 2030, the price of Bitcoin is predicted to maintain a positive trend. Indeed, the BTC price is expected to reach a new all-time high, ranging between $380K and $900K.

Bitcoin Price Prediction 2031, 2032, 2033, 2040, 2050

Based on the historic market sentiments and trend analysis of the largest cryptocurrency by market capitalization, here are the possible Bitcoin price targets for the longer time frames.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2031 | $540,830.43 | $901,383.47 | $1,261,936.86 |

| 2032 | $757,162.60 | $1,261,936.86 | $1,766,711.60 |

| 2033 | $1,059,945.80 | $1,766,711.60 | $2,473,477.75 |

| 2040 | $5,799,454.28 | $9,665,757.13 | $13,532,059.98 |

| 2050 | $161,978,188.65 | $269,963,647.74 | $377,949,106.84 |

Bitcoin Prediction: Analysts and Influencer’s BTC Price Target

| Firm Name | 2025 |

| Standard Chartered | $200K |

| VanECk | $180K |

| 10x Reserach | $122K |

| Fundstrat | $250K |

| Blackrock | $700K |

- As per the Bitcoin price forecast by Blockware Solutions, the price of 1 BTC could hit $400,000

- Cathie Wood predicts the price of BTC to achieve the $3.8 million mark by 2030.

- Michael Saylor-led MicroStrategy expects Bitcoin to soar beyond $13 million by 2045.

- ARK Invest has increased its bullish BTC price target to $2.4 million by 2030.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

At the time of writing, 1 Bitcoin Price USD is $108,783.81.

If the sentiments remain bullish, the star crypto may continue gaining value tomorrow.

Hoping for positive market sentiments, the BTC token may test its $102k mark.

With a potential surge, the Bitcoin (BTC) price may close the month with a high of $110,000.

As per Coinpedia’s BTC price prediction, the Bitcoin price could peak at $168k this year if the bullish sentiment sustains.

With increased adoption, the price of Bitcoin could reach a height of $901,383.47 in 2030.

As per our latest BTC price analysis, Bitcoin could reach a maximum price of $13,532,059.98

By 2050, a single BTC price could go as high as $377,949,106.84

Bitcoin first hit $1 on February 9th, 2011. This historic milestone was achieved on the now-defunct Mt. Gox exchange.

You May Also Like

UK Fraud Office Makes First Major Crypto Arrests in $28M Basis Markets Rug Pull

Argentina’s Crucial Breakthrough: US Treasury Pledges Robust Financial Support