EUR/CHF Forecast: UBS Reveals Stunning 2026 Projection Amid European Growth Surge

BitcoinWorld

EUR/CHF Forecast: UBS Reveals Stunning 2026 Projection Amid European Growth Surge

In a bold move that’s shaking up the forex market, UBS has dramatically revised its EUR/CHF forecast for 2026, signaling potential opportunities for traders and investors monitoring European currency pairs. This surprising development comes as analysts reassess the European growth trajectory and its impact on the Swiss franc’s traditional safe-haven status.

Understanding UBS’s EUR/CHF Forecast Revision

UBS’s updated EUR/CHF forecast reflects a fundamental shift in how financial institutions view the European economic landscape. The bank’s analysts point to several key factors driving this revision, including stronger-than-expected recovery in Eurozone economies and changing monetary policy dynamics. The EUR/CHF forecast now incorporates more optimistic projections about European growth, suggesting the currency pair could see significant movement in the coming years.

European Growth Driving Currency Movements

The European growth story is becoming increasingly compelling for forex traders. Here’s what’s driving the optimism:

- Manufacturing resurgence across Germany and France

- Service sector expansion in Southern Europe

- Infrastructure investments supporting long-term growth

- Consumer confidence reaching multi-year highs

This robust European growth environment is creating favorable conditions for the euro against traditional safe havens like the Swiss franc.

UBS’s Analysis Methodology

UBS employs a comprehensive approach to currency forecasting that combines quantitative models with qualitative assessment. Their EUR/CHF forecast considers:

| Factor | Weight in Analysis | Current Trend |

|---|---|---|

| Economic Indicators | 40% | Positive |

| Monetary Policy | 30% | Neutral to Positive |

| Political Stability | 20% | Stable |

| Market Sentiment | 10% | Improving |

Swiss Franc in the Changing Landscape

The Swiss franc has long been considered a safe-haven currency, but UBS’s analysis suggests this dynamic might be shifting. As European growth accelerates, the Swiss franc could face headwinds against the euro. The bank’s research indicates that traditional safe-haven flows might diminish as investors seek higher returns in growing European economies.

Forex Market Implications

The forex market is closely watching these developments, as UBS’s revised EUR/CHF forecast could signal broader trends in currency trading. Key implications include:

- Potential repositioning of institutional portfolios

- Increased volatility in EUR/CHF trading pairs

- New opportunities for carry trade strategies

- Revised risk management approaches for European exposure

Actionable Insights for Traders

Based on UBS’s EUR/CHF forecast, traders might consider:

- Monitoring European economic data releases more closely

- Reassessing hedging strategies involving Swiss franc exposure

- Exploring options strategies to capitalize on potential EUR/CHF movements

- Diversifying European currency exposure beyond major pairs

Challenges and Considerations

While the revised EUR/CHF forecast presents opportunities, traders should remain aware of potential challenges. Geopolitical risks, unexpected economic data, and central bank policy shifts could all impact the accuracy of long-term forecasts. The forex market remains highly sensitive to global developments, and the Swiss franc’s safe-haven status could quickly reassert itself during periods of market stress.

Conclusion: Navigating the New Currency Landscape

UBS’s updated EUR/CHF forecast for 2026 represents a significant shift in how major financial institutions view European growth prospects and their impact on currency markets. The stunning projection highlights the potential for substantial movements in the EUR/CHF pair as economic dynamics evolve. While forecasts provide valuable guidance, successful navigation of the forex market requires continuous monitoring of economic indicators, policy developments, and market sentiment. The coming years promise to be particularly interesting for traders focused on European currencies and the Swiss franc’s evolving role in global finance.

To learn more about the latest forex market trends, explore our article on key developments shaping currency pairs and institutional adoption.

Frequently Asked Questions

What is UBS’s current stance on EUR/CHF?

UBS has raised its EUR/CHF forecast for 2026 based on improved European growth outlook. Visit UBS official website for their latest research.

How does European growth affect currency forecasts?

Stronger European growth typically supports the euro against safe-haven currencies like the Swiss franc, influencing long-term forex forecasts.

What factors does UBS consider in currency forecasting?

UBS analyzes economic indicators, monetary policy, political stability, and market sentiment in their currency forecasts.

How reliable are long-term currency forecasts?

While based on thorough analysis, long-term forecasts should be used as guidance rather than absolute predictions due to market volatility.

Where can I find UBS’s official research publications?

UBS regularly publishes research on their official website and through their global research division.

This post EUR/CHF Forecast: UBS Reveals Stunning 2026 Projection Amid European Growth Surge first appeared on BitcoinWorld.

You May Also Like

Trump expected to sign executive order for TikTok U.S. deal on Thursday

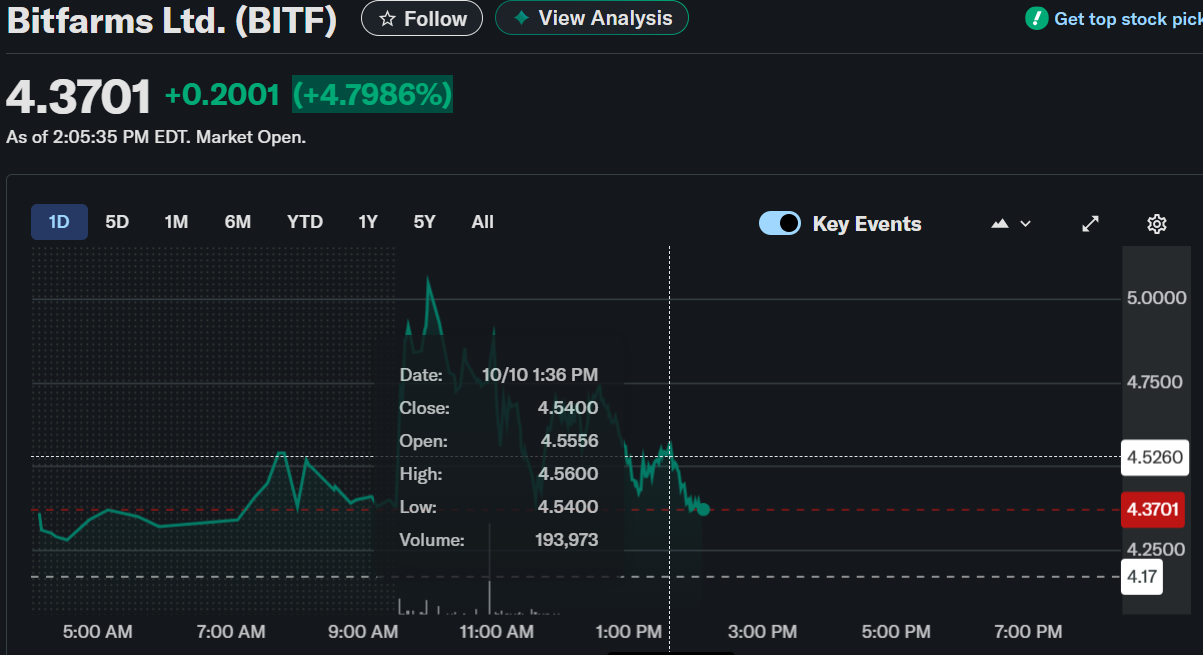

Bitfarms Ltd. (BITF) Stock Rises as AI Data Center Plans Accelerate with $50M Drawdown