5 Undervalued Stocks to Buy Now, According to Grok

TLDR

- The market rallied on November 20, 2025, with Nasdaq up 2%, Dow up 600 points, and S&P 500 up 1.5%

- Salesforce trades 50% below fair value at $229 with analysts projecting 41% upside to $323.51

- Merck is undervalued by 50% at $95 with a consensus Hold rating and $104.88 price target

- PayPal and Adobe show undervaluation in fintech and creative software sectors with Hold ratings

- Comcast trades 62% below fair value at $27 with streaming growth through Peacock

The stock market experienced strong gains on November 20, 2025. The Nasdaq Composite climbed over 2% after Nvidia reported strong earnings. The Dow Jones Industrial Average rose more than 600 points while the S&P 500 advanced 1.5%.

A stronger jobs report added to positive sentiment. Investors are watching for potential Federal Reserve rate cuts ahead. Five S&P 500 stocks are trading well below their estimated fair values based on cash flow and growth metrics.

Salesforce (CRM)

Salesforce is trading about 50% below its estimated fair value. Shares are currently around $229. The company’s Customer 360 platform continues to help businesses with digital transformation.

Salesforce, Inc., CRM

The cloud-based CRM software provider is integrating AI features. Analysts have assigned a Moderate Buy consensus from 39 ratings. The breakdown includes 25 Buy ratings, 13 Hold ratings, and 1 Sell rating.

The average price target sits at $323.51. This implies a 41% potential upside from current levels. Two analyst downgrades occurred in the past 90 days due to competitive pressures in the SaaS space.

Merck (MRK)

Merck appears undervalued by roughly 50% with shares near $95. The pharmaceutical company’s oncology drug Keytruda remains a major revenue driver. Merck maintains a diverse pipeline in vaccines and animal health products.

Merck & Co., Inc., MRK

Analyst sentiment leans toward Hold based on 18 ratings. The breakdown shows 2 Strong Buy, 5 Buy, 10 Hold, and 1 Sell rating. The average target price is $104.88, suggesting a modest 10% gain.

Recent activity includes one upgrade and one downgrade in the last 90 days. Analysts are balancing views on patent cliffs against the company’s innovation pipeline.

PayPal (PYPL)

PayPal trades below fair value with shares in the mid-$70s range. The digital payments company faces rising competition in the fintech sector. Its ecosystem benefits from increasing online transactions and merchant partnerships.

PayPal Holdings, Inc., PYPL

The consensus from 37 analysts is Hold. The rating breakdown includes 15 Buy, 18 Hold, and 4 Sell ratings. The average target price stands at $82.56 with highs reaching $107.

The rating has softened from Moderate Buy over the year. DBS Bank recently cut its target to $70 while Truist raised its target slightly to $66 in November 2025.

Adobe (ADBE)

Adobe is undervalued by about 39% at around $318 per share. The company’s creative software suite dominates the market for digital content creation. Adobe’s AI tools like Firefly are attracting new users.

The subscription-based business model provides steady revenue. Analysts rate it Hold overall from 29 opinions. The breakdown shows 1 Strong Buy, 13 Buy, 12 Hold, and 3 Sell rating.

The target average is $433.41, pointing to 36% potential upside. Two downgrades occurred in the past quarter over valuation concerns in the tech sector.

Comcast (CMCSA)

Comcast is down 62% from fair value at around $27 per share. The company provides broadband services and owns media assets like NBCUniversal. Streaming growth through Peacock is offsetting some cord-cutting losses.

The consensus is Hold from 34 analysts. The rating breakdown includes 11 Buy, 21 Hold, and 2 Sell ratings. The average target price is $35.92, representing 34% potential upside.

The past 90 days saw four downgrades and two upgrades. Analysts have mixed views on the media sector outlook as streaming competition intensifies.

The post 5 Undervalued Stocks to Buy Now, According to Grok appeared first on CoinCentral.

You May Also Like

Trump expected to sign executive order for TikTok U.S. deal on Thursday

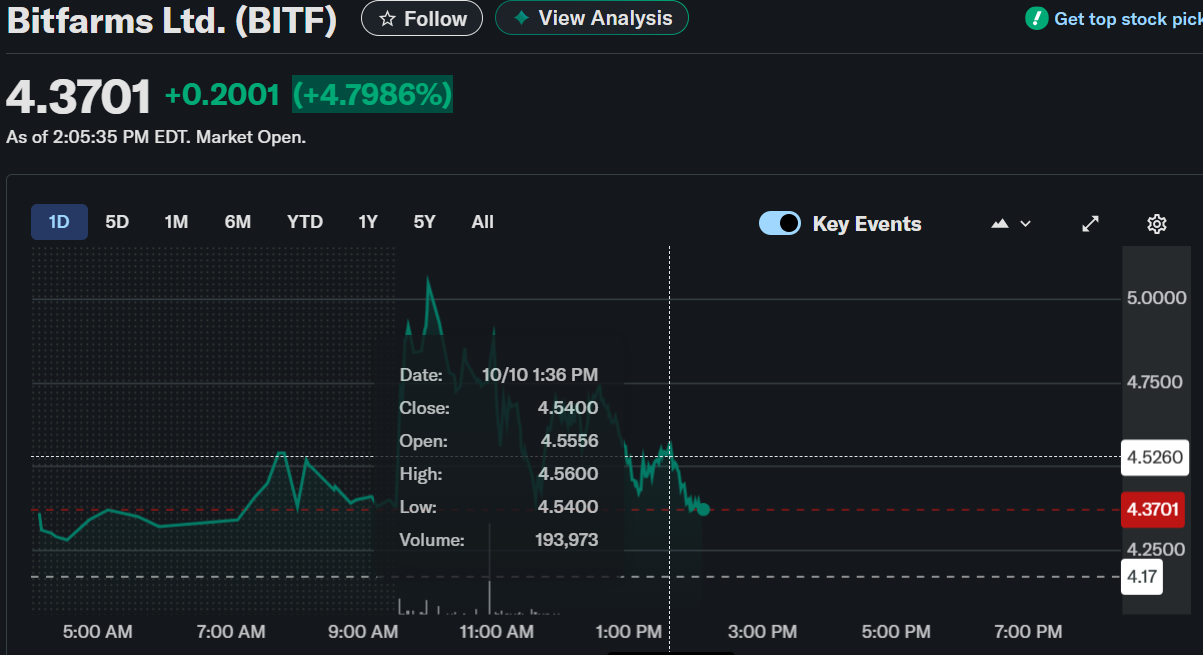

Bitfarms Ltd. (BITF) Stock Rises as AI Data Center Plans Accelerate with $50M Drawdown