Jefferies report: Tether becomes a major new buyer of gold, driving the recent surge in gold prices.

PANews reported on November 21st that, according to Cryptopolitan, investment bank Jefferies stated on Thursday that Tether is a major new buyer of gold and a primary reason for the recent surge in gold prices, indicating that traditional factors are no longer the main drivers of gold prices. The report revealed that verification data and on-chain activity show that Tether has accumulated a large amount of gold in recent months, tightening the gold supply and driving up precious metal prices. Investors told Jefferies that Tether plans to purchase approximately 100 tons of gold this year, and its CEO, Paolo Ardoino, has publicly stated that the company will increase its gold reserves and expects gold prices to soar to $1,000 per ounce.

According to a team of analysts led by Andrew Moss, Tether held approximately 116 tons of gold as of the end of the third quarter. They also revealed that the company had 12 tons of gold backing its XAUt token (worth approximately $1.57 billion) and another 104 tons backing its stablecoin USDT (worth approximately $13.67 billion). Jefferies points out that Tether continues to increase its gold accumulation efforts, adding approximately 26 tons in the third quarter alone, representing about 2% of global gold demand in that quarter. With business expansion, gold is expected to account for about 7% of its reserves. If half of Ardoino's projected $1.5 billion profit by 2025 were invested in gold, it could add nearly 60 tons annually.

You May Also Like

Trump expected to sign executive order for TikTok U.S. deal on Thursday

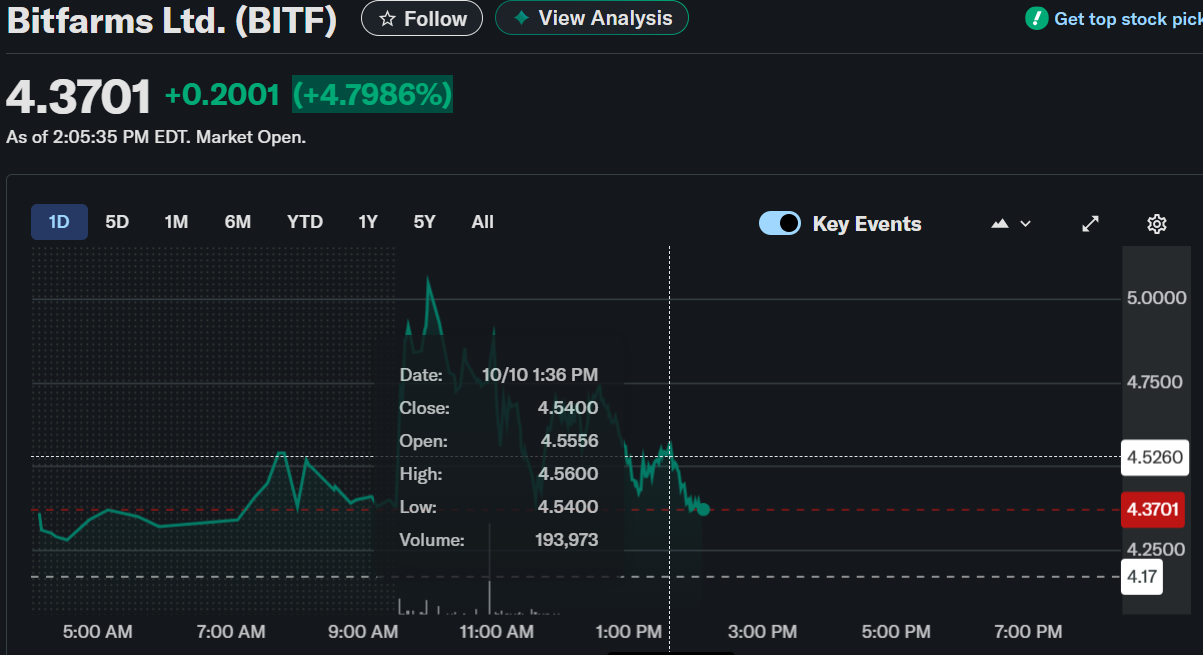

Bitfarms Ltd. (BITF) Stock Rises as AI Data Center Plans Accelerate with $50M Drawdown