PANews reported on November 21 that Ki Young Ju, founder and CEO of CryptoQuant, wrote on the X platform: "The market weakness is greater than expected. If this situation continues, Bitcoin may not see a strong rebound in the next 3-6 months. The real bull market will not start until liquidity recovers next year." Furthermore, it cited macroeconomic expert @LukeGromen's view that "foreign demand for US Treasuries is weak, and without new liquidity injections, the US Treasury market will become unstable; once liquidity recovers next year, the prices of scarce assets such as gold and Bitcoin should rise."PANews reported on November 21 that Ki Young Ju, founder and CEO of CryptoQuant, wrote on the X platform: "The market weakness is greater than expected. If this situation continues, Bitcoin may not see a strong rebound in the next 3-6 months. The real bull market will not start until liquidity recovers next year." Furthermore, it cited macroeconomic expert @LukeGromen's view that "foreign demand for US Treasuries is weak, and without new liquidity injections, the US Treasury market will become unstable; once liquidity recovers next year, the prices of scarce assets such as gold and Bitcoin should rise."

CryptoQuant CEO: Crypto Market Unlikely to See Strong Rebound in the Next 3-6 Months

PANews reported on November 21 that Ki Young Ju, founder and CEO of CryptoQuant, wrote on the X platform: "The market weakness is greater than expected. If this situation continues, Bitcoin may not see a strong rebound in the next 3-6 months. The real bull market will not start until liquidity recovers next year."

Furthermore, it cited macroeconomic expert @LukeGromen's view that "foreign demand for US Treasuries is weak, and without new liquidity injections, the US Treasury market will become unstable; once liquidity recovers next year, the prices of scarce assets such as gold and Bitcoin should rise."

Disclaimer: The articles reposted on this site are sourced from public platforms and are provided for informational purposes only. They do not necessarily reflect the views of MEXC. All rights remain with the original authors. If you believe any content infringes on third-party rights, please contact service@support.mexc.com for removal. MEXC makes no guarantees regarding the accuracy, completeness, or timeliness of the content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be considered a recommendation or endorsement by MEXC.

You May Also Like

Trump expected to sign executive order for TikTok U.S. deal on Thursday

Trump will sign an executive order on Thursday approving the TikTok U.S. deal.

Share

Cryptopolitan2025/09/25 18:09

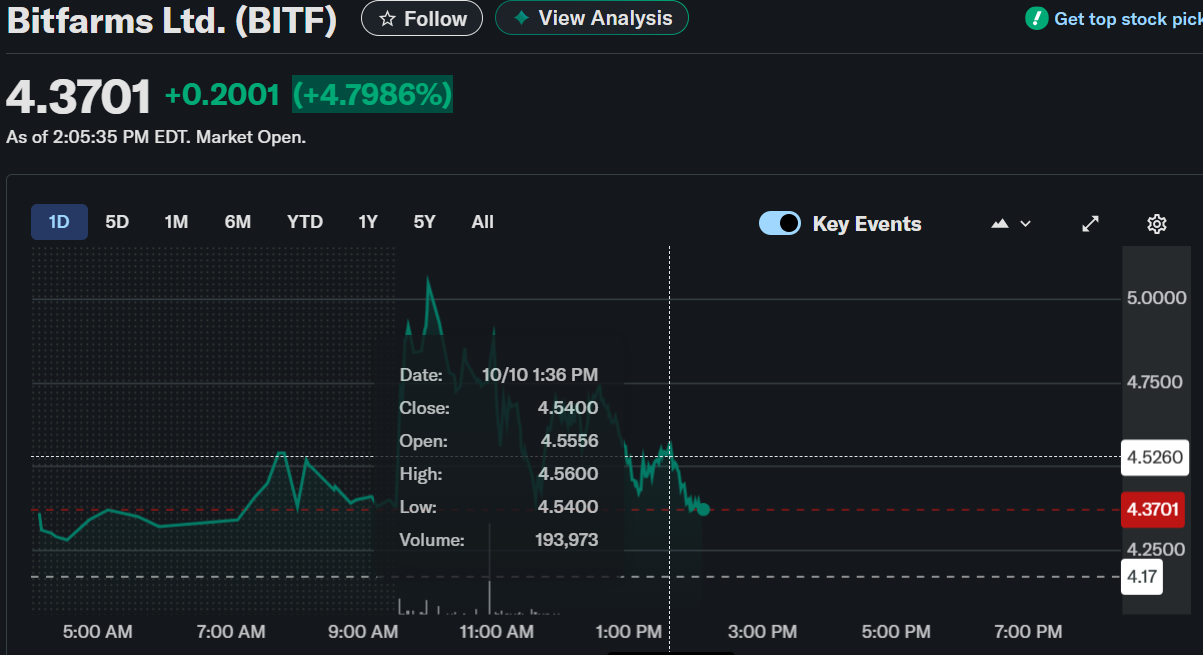

Bitfarms Ltd. (BITF) Stock Rises as AI Data Center Plans Accelerate with $50M Drawdown

TLDR Bitfarms fuels U.S. AI growth with $300M facility revamp and $50M drawdown Bitfarms boosts AI push, tapping $50M for Pennsylvania data center build Bitfarms converts $300M debt to drive 350 MW AI campus in Pennsylvania Bitfarms accelerates U.S. AI expansion with new project-focused financing Bitfarms powers ahead—$50M drawdown advances 350 MW AI data campus [...] The post Bitfarms Ltd. (BITF) Stock Rises as AI Data Center Plans Accelerate with $50M Drawdown appeared first on CoinCentral.

Share

Coincentral2025/10/11 02:28

UK Writers Warn AI Could Soon Dominate Fiction Publishing Market

TLDRs: Over half of UK novelists fear AI could replace their work entirely, affecting income. AI-generated books flood platforms like Amazon, impacting sales and copyright protections. Authors demand informed consent and compensation for AI use of their writing. Provenance tools may help distinguish human-authored works amid rising AI content. A recent study by the University [...] The post UK Writers Warn AI Could Soon Dominate Fiction Publishing Market appeared first on CoinCentral.

Share

Coincentral2025/11/21 20:22