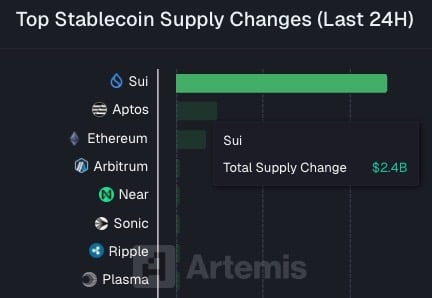

Sui Records $2.4 Billion Stablecoin Inflow in 24 Hours Amid Growing Sui Staking Options

According to data from Artemis, a website that publishes metrics for digital assets, Sui has seen a staggering $2.4 billion worth of stablecoins flow into its network within the last 24 hours.

This is significantly more than the second and third place coins, Aptos and Ethereum, which registered $472 million and $345.8 million respectively.

What is SUI?

Sui is its own stand-alone blockchain, it is not a layer 2 built on Ethereum, and it uses a different programming language known as Move, whereas Ethereum uses Solidity. Sui staking is available as it runs a Proof of Stake consensus.

Bitcoin staking is also possible on Sui through LBTC, a liquid staking token representing staked Bitcoin, allowing users to earn staking rewards without locking up BTC directly.

Why Has So Much Money Flowed Into Sui?

Launch of Two New Stablecoins

It looks like there are a few reasons however the main one is that in October Sui announced that it would be launching two stablecoins on its network by the end of 2025.

These stablecoins are suiUSDe and USDi. SuiUSDe will be powered by Ethena and will offer a staking yield, whereas USDi is backed by a BlackRock fund.

The huge inflow of $2.4 billion in stablecoins could be in preparation for the launch of these new stablecoins by the end of 2025, especially as suiUSDe will pay yield to holders.

Yield Opportunities on SUI

Staking on SUI has been offering high returns lately, especially through protocols, this inflow of stablecoins could be a move to take advantage of high yield returns.

Rotation from Other Chains

Some capital has been rotating from Solana and Ethereum into newer high speed chains. Whenever a chain starts gaining momentum, funds test it with stablecoins first because they carry no market risk. The stablecoin remains pegged to the Dollar, whereas other coins can fluctuate in price significantly.

Sui is generally faster than Ethereum, partly because its programming language allows parallel transactions whereas Ethereum blocks are processed one at a time.

Speculation

Hype around a chain can attract billions in stablecoins even before a specific product launches. This appears to be happening with Sui as its growth charts have been trending upward.

Sui Staking Alternatives

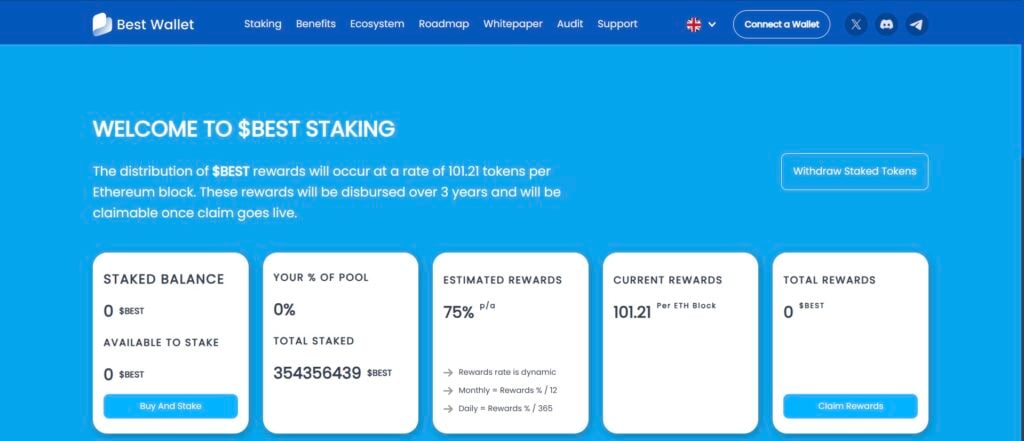

With stablecoin inflows surging and Sui staking attracting attention, the focus on high-yield opportunities in emerging coins is only growing. Another token gaining traction in this space is BEST, which also offers staking rewards for holders.

Although its token sale is billed to end in a few days, early investors are still accumulating up to 75% staking yields, giving the project the kind of traction that could drive significant growth after listing.

BEST’s impressive staking perks, coupled with the fact that it is part of a rapidly growing DeFi wallet make it one of the best picks for early movers looking to maximize their investments this year. The token powers Best Wallet, one of the most popular self-custodial wallets around, with over 500,000 users and 50% MoM growth.

One of the key highlights of this wallet is that it encompasses all the features one needs to effectively manage and grow their assets, from fiat payment, self-custodial storage, and multichain functionality to iGaming perks, portfolio management, staking, and a token launchpad, making it a comprehensive hub for both day-to-day traders and long-term investors.

Being the utility token of this platform, BEST enhances all of these features. Holders will enjoy high-yield APYs not only through its native staking program but also through third-party facilities supported by the wallet. In addition to this, holding BEST unlocks low transaction fees, access to other high-potential tokens, and governance rights.

Crypto YouTubers like Alessandro De Crypto have highlighted how BEST’s multi-utility design could make it a suitable crypto investment in 2025.

Download Best Wallet | Visit BEST Token Sale

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Coinbase CEO advocates for crypto legislation reform in Washington DC

Forex Expo 2025 Redefines the Trading Landscape