Animoca Seeks US IPO, Is GameFi Still Worth Betting On?

By Steven Ehrlich , Unchained

Compiled by: Felix, PANews

Cryptocurrencies are all the rage again. Bitcoin hit an all-time high of $111,814, Coinbase became the first cryptocurrency company to enter the S&P 500, and more crypto companies are looking to go public.

Among them is Animoca Brands, a Hong Kong-based Web3 company whose shares are traded in the private market and whose business scope covers various fields such as NFT and crypto games as well as investment platform (with a portfolio of more than 500 companies).

The company, which was delisted from the Australian Stock Exchange in 2020 due to its links to cryptocurrencies, has seen its valuation grow from $100 million to $5.9 billion in 2022, a dramatic turnaround during the pandemic. However, it faded from public view during the crypto winter, the NFT crash, and the subsequent memecoin craze. Adding insult to injury, the GameFi craze has failed to attract much attention to a $180 billion global gaming market estimated by Oppenheimer & Co.

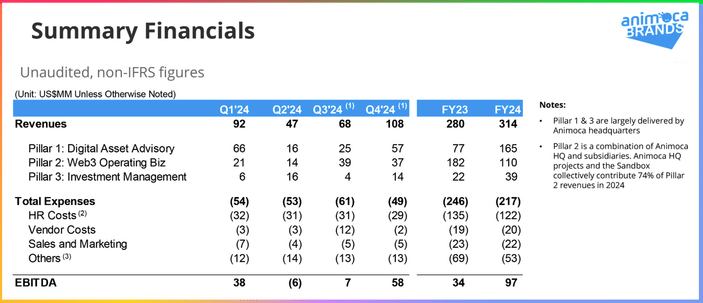

Now, under the leadership of CEO Yat Siu, Animoca has developed a profitable business strategy. According to unaudited financial statements published on the company's website, Animoca made $97 million in profit last year, an increase of 185% from 2023.

Now, Animoca has become one of many multinational companies seeking to strengthen business ties with the United States, including listing on the Nasdaq or New York Stock Exchange, as the Trump administration's crypto-friendly policies have swayed it. "We think the U.S. is going to be the largest crypto market in the world, so it would be foolish for us not to try to enter that market," Siu said in an interview. But he was careful to say that listing in the U.S. is just one of many opportunities the company is currently exploring.

What happens to Animoca? That will depend on how well GameFi and NFTs raise money, and whether investors buy into Animoca’s claims that it’s the best “shovel” investment in the GameFi movement.

Gaming industry faces a cold reception

Although the Trump administration's tariffs have little impact on the global gaming industry, the industry is still highly susceptible to changes in the macroeconomic situation. Martin Yang, senior analyst at Oppenheimer Equity Research, said: "Overall, the gaming industry is doing OK, but not as well as during the COVID-19 pandemic. The gaming industry has experienced two years of strong growth, but now the overall growth rate may only be 3% to 6% per year."

For GameFi, which primarily exists in the mobile gaming market, the situation is even more worrying. The market downturn may seem counterintuitive to outside observers due to the freemium model and relatively low costs of mobile games, but it is an important detail to understand about the gaming industry because it explains why crypto games have had difficulty catching on.

“The feeling was, ‘Oh, people either don’t pay for games at all or they pay very little,’ so the mobile model was thought to be viable and the macro environment was challenging,” Mike Hicke, senior analyst at The Benchmark Company, said in an interview. “But in fact, starting a few years ago, we found that this is the most vulnerable market.” He also said that even many large independent mobile game studios, such as Zynga, have been acquired, and many studios are facing layoffs.

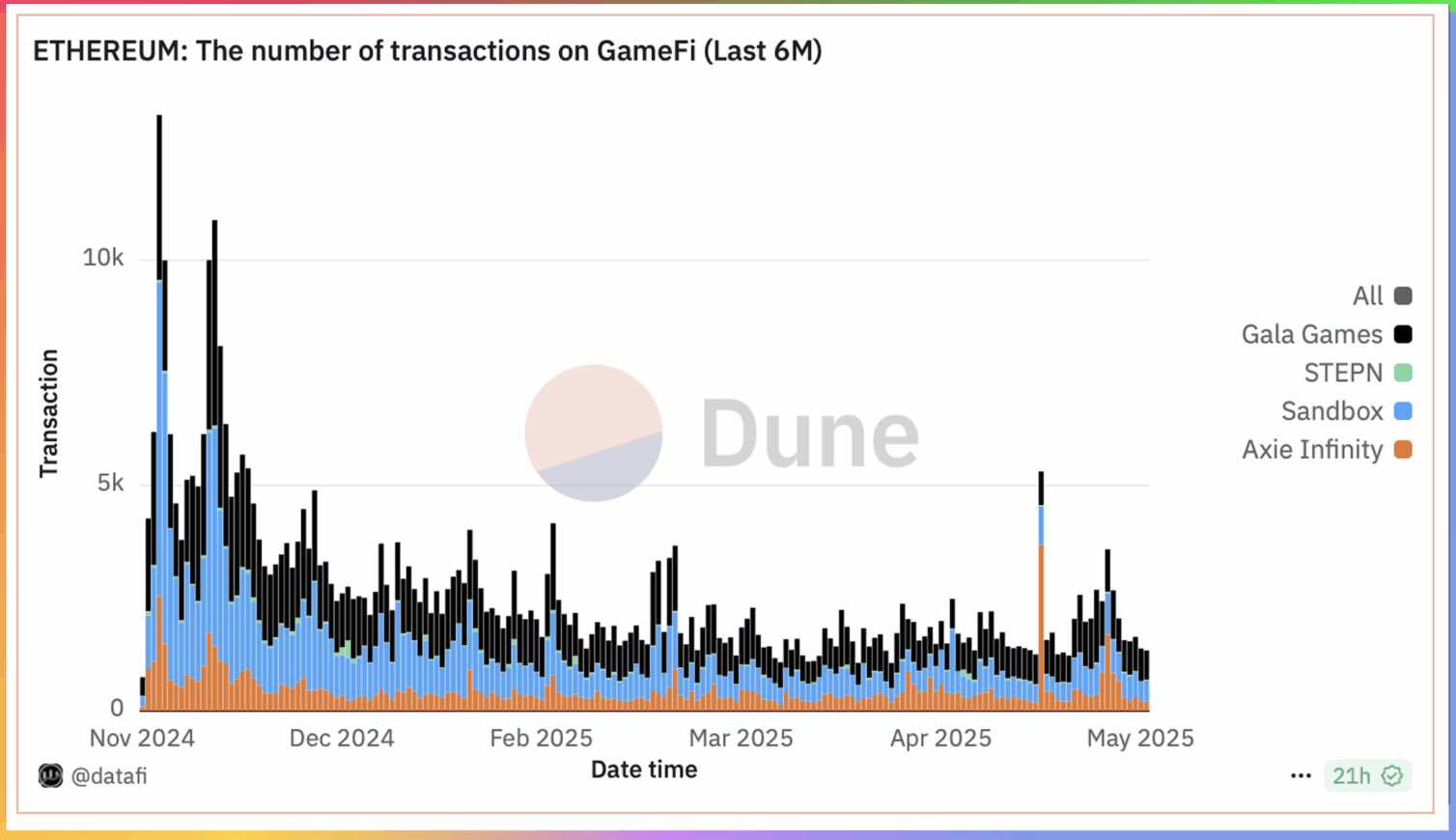

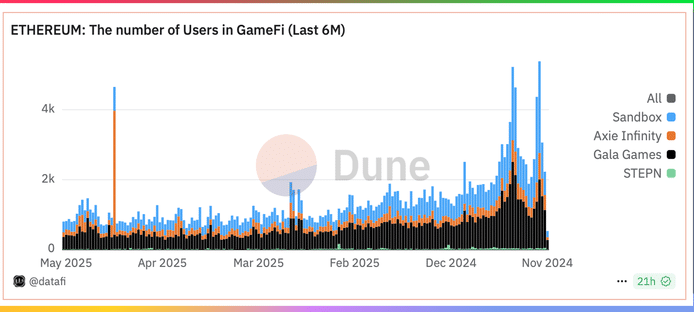

How do these trends relate to the crypto space? The data shows that GameFi is underperforming, though this may also be exacerbated by the fact that GameFi’s loyal user base is much smaller than the overall gaming market. Ethereum, the dominant blockchain in the space, has seen a significant drop in key metrics such as transaction volume and number of users, as shown in the chart below (the second chart should be read from right to left).

Animoca ’s B2B layout

In this environment, Animoca’s profitability has almost tripled in a year. How did it do it? By becoming the primary liquidity engine, or market maker, for GameFi. Siu believes that for Animoca, providing financial infrastructure support to these companies, such as an over-the-counter trading desk, is more stable, safer, and potentially more profitable than launching more games in an already crowded environment. “This is the evolution of the business,” he said. “We know that a lot of small companies launching games lack this infrastructure and don’t know how to do it. We buy their tokens and provide capital market support.” It sounds like a financial business, but it’s actually just an extension of the so-called issuance business.

How does this affect Animoca’s business? In 2023, the company generated the majority of its revenue from Web3 operations, including wholly owned projects such as virtual worlds, chess games, and online education platforms. But that revenue fell 39.5% from 2023 to 2024, an extremely boom year for cryptocurrencies. Yet the company’s profits soared 185% year-over-year. The reason? A 114% increase in its digital asset advisory business, where all capital markets activity is concentrated.

Can this situation continue?

Delta-neutral strategies such as market making are profitable both in and outside of crypto, and the data suggests that Animoca has found product-market fit in its unique area of expertise. But investors in this business need to believe that the company can continue to grow this aspect of revenue, especially as GameFi's key metrics continue to be sluggish.

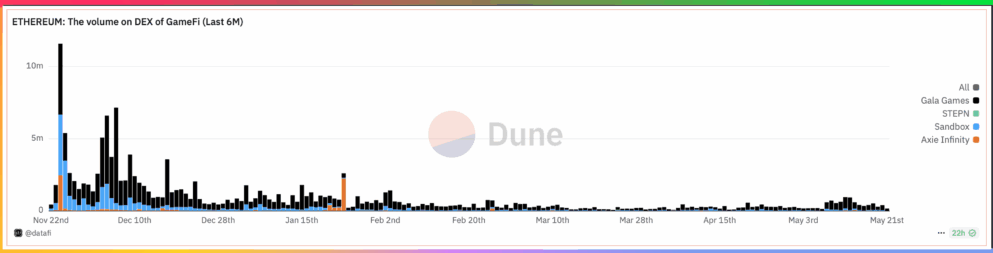

This is a difficult question to answer. One telling indicator is the volume of GameFi tokens on DEXs. As shown in the chart below, which focuses only on Ethereum-based tokens, the overall trend is downward, although daily trading volume does reach several hundred thousand dollars. Other blockchains such as Polygon and BNB also show the same trend.

This is important because DEX volume is a truer reflection of actual user demand for certain tokens, while CEX volume is more often seen as speculative. It is unclear what percentage of this volume is derived from work Animoca does for its clients, which is a significant blind spot for investors.

The optimistic reading of Animoca’s performance is that the company has found a way to operate profitably until it can catch the next GameFi wave, if and when it arrives. To that end, Siu said Trump’s support for the crypto market will be particularly important, as the poor regulatory environment in the U.S. has prevented major U.S. gaming companies from getting involved in the space.

“We work with large institutions and we’re actually guiding them into crypto,” Siu said. “It’s somewhat credible to do that [globally], but in the U.S. it can be difficult to talk to the big gaming companies. They do talk to us a lot and say, ‘Tokens are interesting, we’ve got to look into this.’ But… if the legal nature of something [the legality of tokens] isn’t completely clear, then you have to listen to the lawyers’ speculation.” Siu’s implication is that his call for his involvement in crypto will be rejected.

If Siu and Animoca can get a giant like EA Sports on board (a big if, of course), then perhaps another major problem with crypto gaming can be solved: poor playability and a lack of enthusiasm from players about the industry’s over-financialization. “When you force a mechanism into the normal gaming experience that’s just for profit and doesn’t improve the gaming experience, players are going to resent that kind of corporate-led monetization strategy,” says analyst Mike Hicke.

Related reading: A look at 17 Web3 games that will be discontinued in 2025: The decline of blockchain games is due to financial difficulties and a crisis of confidence

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

The Next Bitcoin Story Of 2025