XRP’s $7 Path Gains Traction, Yet Ozak AI Prediction Shows a More Explosive Run

The post XRP’s $7 Path Gains Traction, Yet Ozak AI Prediction Shows a More Explosive Run appeared first on Coinpedia Fintech News

XRP is once again gaining strong traction across the crypto market as traders grow increasingly confident in its long-term recovery path and major analysts update their models to reflect a potential surge toward the $7 region. With growing institutional interest, renewed ecosystem activity, and anticipation around global settlement adoption, XRP’s outlook is stronger than it has been in years.

Yet even with this powerful bullish setup, many analysts are shifting their highest-ROI forecasts toward Ozak AI, a fast-rising AI-native token whose early-stage positioning, rapidly growing presale momentum, and deep technological foundation point to a far more explosive long-term trajectory.

XRP

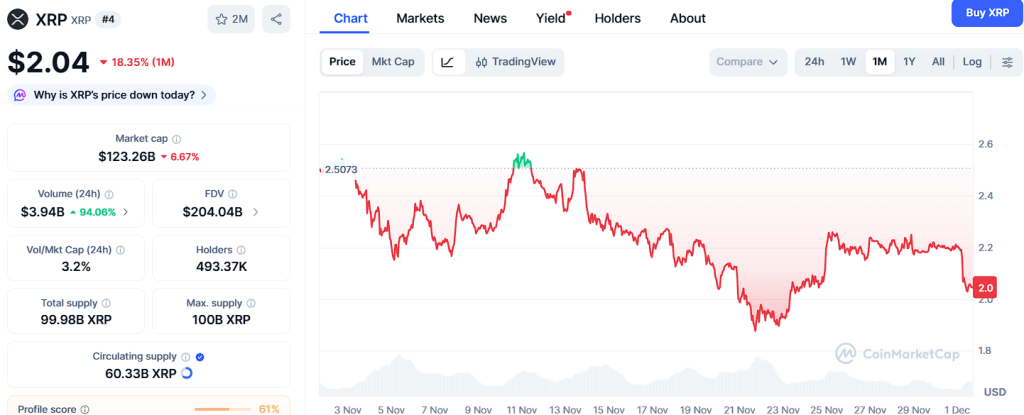

XRP, trading near $2.00, maintains a strong technical foundation fueled by consistent accumulation from long-term holders and renewed demand from traders looking for assets with clear upside potential heading into 2025. The token has established reliable support at $1.94, $1.87, and $1.79, each level demonstrating firm buying pressure during recent market pullbacks. As long as XRP stays above these zones, analysts expect bullish continuation.

Youtube embed:

How Much Will Ozak AI Grow By 2027? $OZ Overview

To ignite a major upward expansion, XRP needs to break resistance at $2.08, $2.16, and $2.27, with the final level marking a key breakout point toward a multi-month rally. These thresholds have historically acted as launchpads for XRP’s strongest moves, especially during periods of rising utility and favorable market sentiment. With broader liquidity improving and cross-border settlement innovations accelerating, XRP’s journey toward the $7 range is increasingly seen as achievable rather than speculative.

Why Ozak AI’s Forecast Appears Far More Explosive

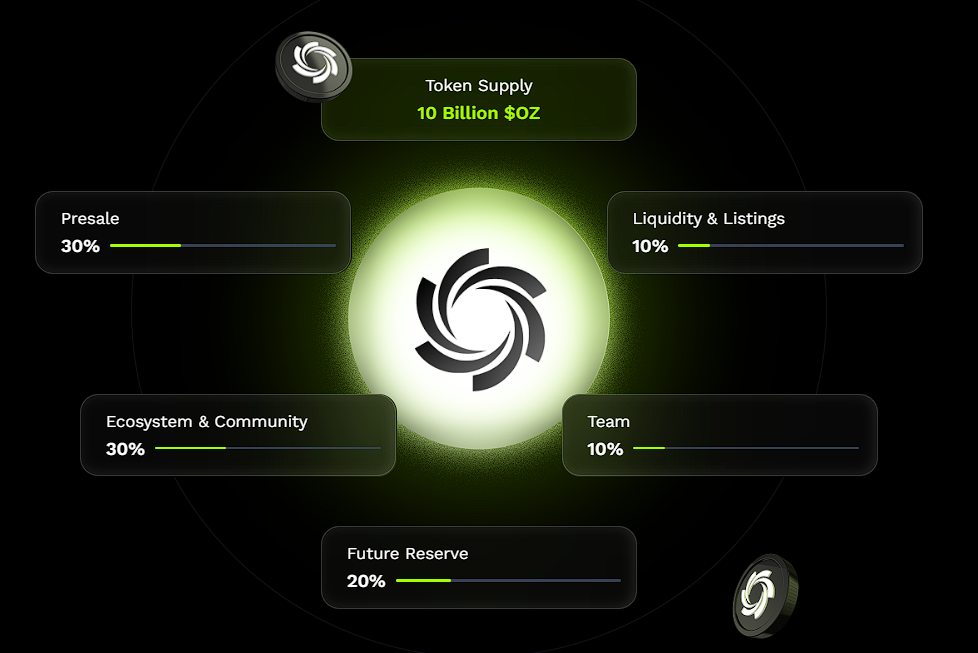

While XRP’s fundamentals support a strong climb, Ozak AI (OZ) offers something entirely different: early-stage accessibility combined with deeply functional AI-native utility, giving it a much steeper multiplier potential. Ozak AI is not a traditional altcoin—it is an emerging intelligence layer designed to power real-time decision-making across Web3. Its infrastructure integrates millisecond-speed AI prediction engines, cross-chain intelligence that scans multiple blockchains simultaneously, and ultra-fast 30 ms market signals enabled through its HIVE partnership.

Beyond these capabilities, Ozak AI’s SINT-powered autonomous agents allow users to execute complex tasks automatically—such as running trading strategies, analyzing market conditions, executing commands through voice interaction, and automating workflows across decentralized applications. This places Ozak AI at the intersection of the fastest-growing global narrative: AI applied directly to blockchain and real-time automation.

Because Ozak AI is still in its early OZ presale phase, analysts argue that its multiplier potential is dramatically higher than XRP’s. Early-stage tokens with strong utility historically outperform large-cap assets simply because they start from a much smaller base and enter the market with far more aggressive growth curves.

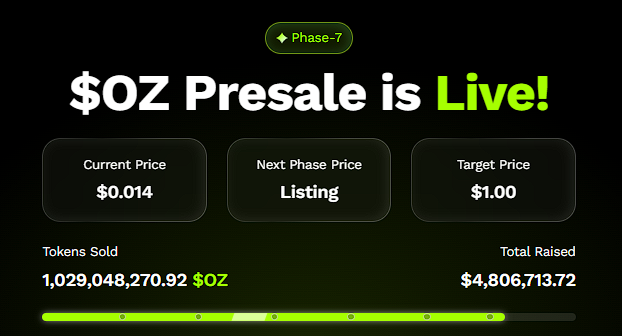

Presale Momentum Confirms Ozak AI’s Breakout Potential

Ozak AI’s presale performance further reinforces its explosive outlook. With over $4.8 million raised and more than 1 million tokens sold, the project is attracting rapid global attention and early demand similar to projects that later delivered massive multi-cycle returns. This fast adoption signals that traders, developers, and investors recognize Ozak AI’s role within the rising AI-crypto convergence.

While XRP’s next run may be powerful, Ozak AI is positioned at the beginning of a far larger technological shift—one where AI-driven automation becomes a core pillar of the crypto and Web3 ecosystem.

XRP Looks Strong, but Ozak AI’s Run Could Be Far Bigger

XRP appears well-positioned for a major breakout, with strong support, a clear resistance roadmap, and a growing narrative centered around global settlement and institutional utility. Its path toward $7 is becoming increasingly realistic as market conditions improve.

However, Ozak AI’s forecast stands out as significantly more explosive, driven by early-stage affordability, deep AI-native functionality, and rapidly accelerating presale demand. XRP may deliver strong gains, but analysts expect Ozak AI to outperform it by a wide margin thanks to its parabolic early-growth curve and expanding role in the future of AI-powered blockchain automation.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a generation platform that specializes in predictive AI and superior information analytics for financial markets. Through machine learning algorithms and decentralized network technology, Ozak AI permits real-time, correct, and actionable insights to assist crypto enthusiasts and businesses in making the proper decision.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi

You May Also Like

Unlocking Massive Value: Curve Finance Revenue Sharing Proposal for CRV Holders

Best Crypto To Buy Now: Pepeto vs BlockDAG, Layer Brett, Remittix, Little Pepe, Compared