On the value of holding the History of Bitcoin in your hands

Bitcoin Magazine

On the value of holding the History of Bitcoin in your hands

In Bitcoin culture, there is still a noticeable gap between the importance of the subject and the forms in which it is presented. Much of what exists is entirely digital, quick to disappear, or shaped by a purely functional aesthetic. Even projects that engage with Bitcoin’s history or its artistic dimension often end up looking more like documentation or marketing than something with cultural presence.

When I first saw History of Bitcoin in person at the Bitcoin Conference 2025 in Amsterdam, that contrast became quite clear. The physical object had a calm, deliberate quality that stood out in an environment dominated by screens and fast exchanges. It didn’t feel like something designed to be glanced at and set aside. It felt like something that expects to be revisited.

What stayed with me was not the rarity of the materials, but the intention behind the choices. In fields like design, architecture, and art publishing, substantial coffee-table books have long played a role in giving subjects a physical anchor. Major art publishers use this format because it creates a stable place for a topic to live. A well-made book slows the pace. It encourages repeated viewing and allows ideas to settle. That kind of physical presence is still unusual in the Bitcoin world.

Many Bitcoin-related books appear as softcovers. I understand why, but they often feel interchangeable and easy to overlook. They rarely give the impression that something is meant to be kept. My point isn’t that books should be luxurious. It’s that form and material can signal whether a subject is being treated with care.

Smashtoshi, History of Bitcoin (First Edition)

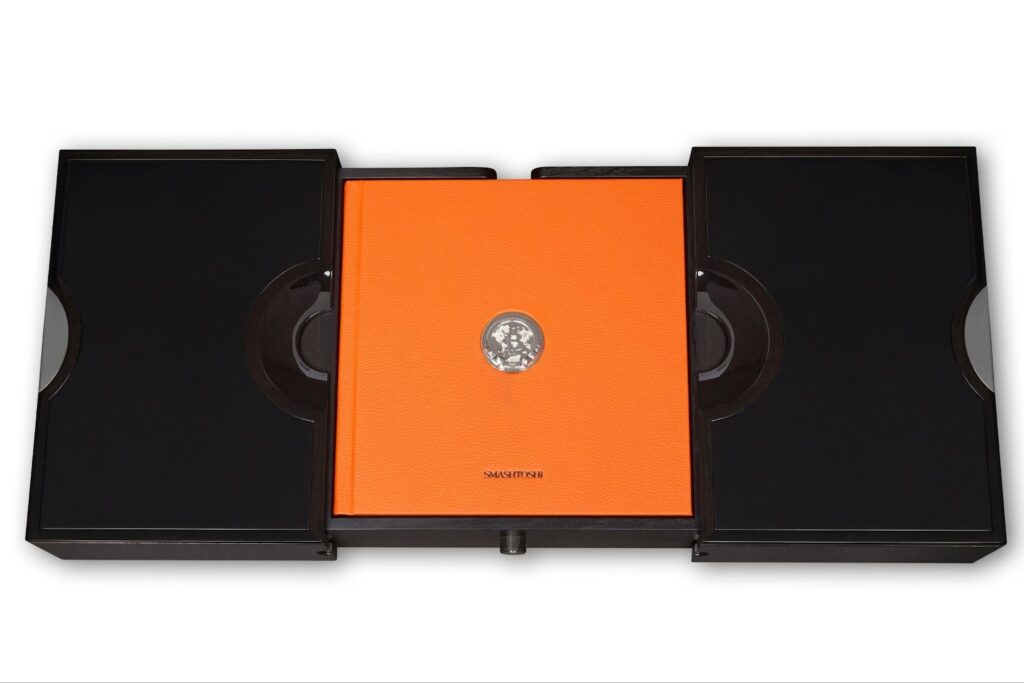

Seen from that angle, the First Edition of History of Bitcoin is a considered object. It comes in a case made from five-thousand-year-old fossilised black oak. The material is unusual, but the effect is straightforward: it gives the book a steady, quiet setting. Inside, the volume is bound in bull leather with a finely made silver emblem by Asprey Studio. None of this feels like decoration. It feels like someone thinking carefully about how an object should look if it is meant to last.

The team behind the project described these choices in a way that adds another layer to this. For them, ancient materials weren’t chosen for rarity, but to reflect a belief that Bitcoin itself is built to endure for a very very long time. Placing a young technology inside something that has already lasted thousands of years creates a deliberate contrast. They also spoke of the First Edition as a kind of time capsule, an object made to outlive us and to offer future readers a way to encounter Bitcoin’s beginnings in a physical form.

The project continues this restrained approach. The physical book and the digital archive are designed to stand alongside each other. The archive provides access and the book provides presence. Together they make the material both reachable and grounded.

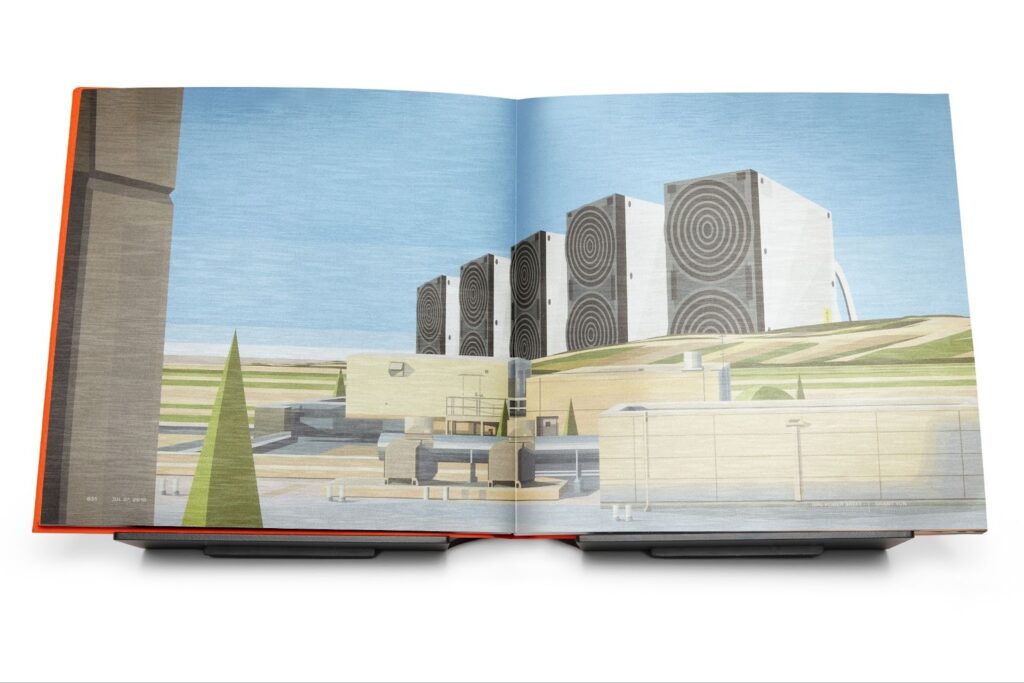

Grant Yun, GPU Power Shift

The 128 artworks in the book were created by different artists specifically for this project. Each one revisits a moment in Bitcoin’s history without trying to define a final interpretation. They open space for reflection. They invite conversation. That is one of the strengths of a good coffee-table book: it creates room for looking again.

The companion volume, the range of guest articles on the website, and even the small fragment of the original Bitcoin code included with each collector’s edition follow the same idea. They offer multiple entry points into the history rather than insisting on a single narrative.

My First Bitcoin, the nonprofit receiving the proceeds from the First Edition auction at Bitcoin MENA, teaches young people around the world. Connecting the book to this project links historical reflection with future education in a simple and meaningful way.

All of this suggests to me that presentation is not a secondary detail. It is part of the cultural work needed to give a subject depth. A carefully made book is not a decorative object. It is a way of turning something that might otherwise feel temporary into something that can endure.

That is, ultimately, why History of Bitcoin feels meaningful to me. It gives this history a form that can be kept close, something you can put down, return to, and live alongside. It doesn’t try to conclude anything. It simply gives Bitcoin a place to settle.

Hackatao, The World’s Most Famous Whitepaper

This post On the value of holding the History of Bitcoin in your hands first appeared on Bitcoin Magazine and is written by Steven Reiss.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

Oracle’s Larry Ellison Loses $31 Billion, Falls To No. 3 Richest