ASTER vs HYPE: How CZ’s DEX Token Became a Whale Magnet | Research

Key Takeaways:

- Whale activity in the DEX segment was concentrated primarily around Hyperliquid and Aster during the period of Nov. 1 to Dec. 5, 2025.

- Hyperliquid recorded the highest total buy volume at $16.6 billion, while Aster ranked second with $5.7 billion.

- Aster delivered the largest single whale transaction at nearly $191 million, although Hyperliquid dominated in the number of large purchases.

- Aerodrome showed steady accumulation supported by growth in the Base ecosystem and increased attention ahead of the Dec. 17 Base and Coinbase announcement.

- PancakeSwap, Uniswap, and Solana ecosystem DEX tokens attracted smaller whale inflows, suggesting a more selective capital rotation among major players.

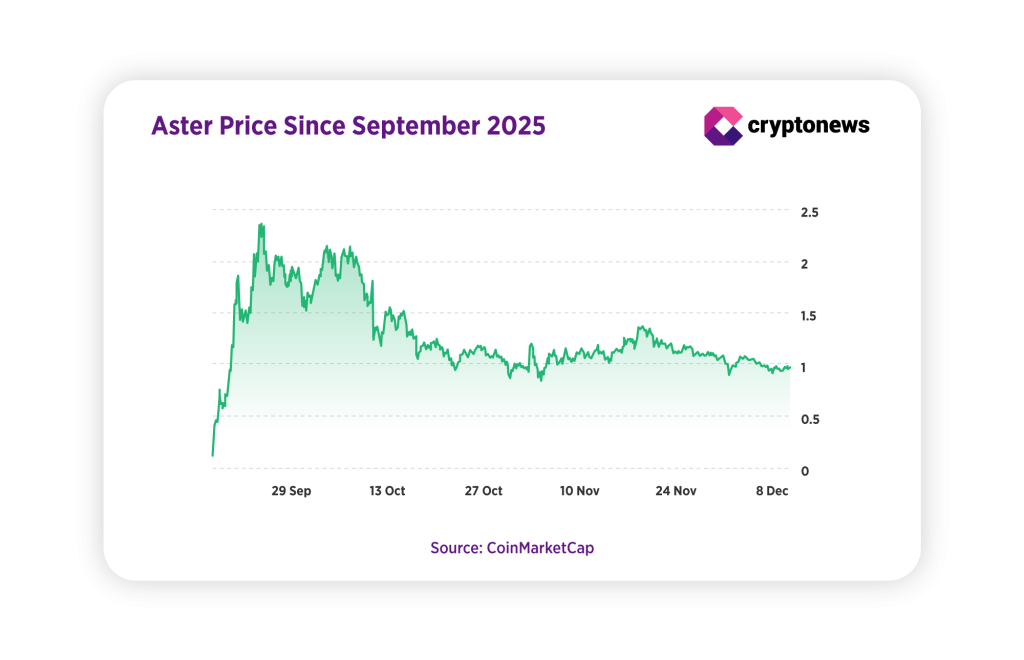

Aster (ASTER) is a newcomer to the market. The decentralized exchange (DEX) launched in September 2025 with the unofficial support of Changpeng Zhao, and that immediately shifted market sentiment. CZ had not backed new projects for quite some time, so Aster’s arrival came as a surprise.

The token reacted instantly. Its price climbed from $0.09 to $2.41, which is an increase of roughly 2580%. This rapid move earned Aster the nickname “CZ’s pet token.”

Things became even more interesting after that. Despite the wider market correction in October and November, ASTER has shown surprising resilience. The price occasionally drops below $1 but almost always returns to that level. So far, it has never revisited the $0.09 mark, which remains its all-time low. The chart may resemble early accumulation, although this is only one possible interpretation.

Aster’s rapid growth and CZ’s visible support sparked a new wave of discussion. The community revived the DEX narrative and started debating whether this segment could gain fresh momentum. At the same time, attention shifted toward larger players such as Hyperliquid (HYPE), which has combined the mechanics of centralized exchanges and decentralized finance in one model.

There are ongoing discussions that Changpeng Zhao may eventually want to replace Hyperliquid and position Aster as a new flagship DEX. This is speculative, and there are no clear signs that it is happening now, although CZ’s influence makes it impossible to rule out entirely.

In this Cryptonews research, we examine the behavior of large wallets in the DEX token segment. We look at whether major players are buying these assets, which projects attract the most capital, and whether Aster shows signs of concentrated interest from large holders. The analysis covers on-chain data from Nov. 1 to Dec. 5, 2025. Tokens were selected based on market capitalization from CoinGecko and exchange TVL from DeFiLlama. The dataset includes capital movement through large transactions on decentralized exchanges.

- In This Article

-

ASTER vs HYPE: Whales Deciding Where to GoWhere Whales Were Most ActiveWhat This Means for DEX Tokens

- In This Article

-

ASTER vs HYPE: Whales Deciding Where to Go

-

Where Whales Were Most Active

-

What This Means for DEX Tokens

ASTER vs HYPE: Whales Deciding Where to Go

Looking at the broader picture, HYPE clearly leads ASTER in large buyer activity. Hyperliquid’s total buy volume stands at $16.6 billion, which is much higher than Aster’s $5.7 billion. The average purchase size is also larger. For HYPE, it is $5,480, and for ASTER, it is $1,620, which shows that whales generally spend more per transaction on Hyperliquid even though interest in Aster is growing.

Aster, however, overtakes Hyperliquid when it comes to the single largest transaction. The biggest ASTER purchase was made by wallet 0xf17d957f71b4c7670928db6804cdf061fbdb3bfd, which bought almost $191 million worth of tokens. This is the largest individual transaction in the entire dataset.

Among other projects, Aerodrome (AERO) stands out. Its total buy volume is $494.6 million, reflecting steady interest from traders. The average purchase size remains moderate, although the project continues to grow alongside rising activity in the Base ecosystem.

PancakeSwap (CAKE), the main DEX in the Binance ecosystem, also shows notable volumes. Its buy volume is $362.6 million. The price behavior of CAKE often resembles ASTER, including gradual recovery after pullbacks. This may reflect renewed interest and returning liquidity within the ecosystem.

Uniswap (UNI), the largest decentralized exchange by TVL, does not appear among the most accumulated tokens. Its buy volume is $216 million. Whales may view UNI as a more mature and less speculative asset that offers fewer opportunities for large short-term rotations.

Solana ecosystem DEXs such as Jupiter (JUP) and Raydium (RAY) rank near the bottom of the list. Their buy volume stands at $204.342 million and $142.223 million. This suggests that whale interest during this period was concentrated mainly around Hyperliquid, Aster, and several projects. Activity on the Solana side is present but significantly weaker.

We can also see that on decentralized exchanges, HYPE consistently leads by volume among DEX tokens. ASTER remains in second place, while the third position shifts between the remaining tokens depending on the day.

Where Whales Were Most Active

Data on the largest transactions shows that the peak of whale activity came in November. The most notable entries belong to Hyperliquid and Aster. HYPE recorded several purchases above $120 million. ASTER appeared slightly later but immediately delivered a record entry of almost $191 million, the largest single trade in the dataset.

Activity softened slightly in early December, although interest in these projects remained strong. On the chart, November clearly stands out as the most active month for large transactions, with Aster and Hyperliquid continuing to compete for whale attention.

Data analyzed by Cryptonews shows that Hyperliquid leads by the total sum of large buys. From Nov. 1 to Dec. 5, HYPE accumulated roughly $1.28 billion. ASTER attracted less in total volume but delivered significantly larger individual purchases, with about $520.54 million accumulated. This difference shows that Hyperliquid attracts a steady flow of large entries while Aster receives fewer but heavier transactions.

It is also notable that no other DEX tokens appear in the large transaction list. Only Hyperliquid and Aster dominate this segment.

What This Means for DEX Tokens

The analysis shows that Hyperliquid and Aster are the two main destinations for large DEX token capital. Both projects attract significant whale activity but the patterns differ. Hyperliquid receives consistent, stable inflows, while Aster stands out with rare but very large transactions.

Aster’s status as “CZ’s pet token” gives the project both advantages and risks. This type of backing helps support the price and can amplify upside moves, but it also creates the possibility of a sudden, sharp drop. The chart may resemble accumulation, although this should be interpreted with caution and with all scenarios in mind.

Aerodrome also shows accumulation, although not at the scale of HYPE or ASTER. The project is tightly connected to the Base ecosystem and may intersect with Coinbase’s strategic interests. On Dec. 17, Base and Coinbase are expected to announce something important, and this could increase attention toward AERO and the broader ecosystem around it.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

You May Also Like

IP Hits $11.75, HYPE Climbs to $55, BlockDAG Surpasses Both with $407M Presale Surge!

The HackerNoon Newsletter: Hard Problems Are Easier, Once You Think Like This (12/10/2025)