Chainlink price poised to rebound amid LINK Reserve buying spree

Chainlink price was little changed on Thursday, despite some encouraging news regarding its exchange-traded funds and the ongoing accumulation through its Strategic LINK Reserves.

- Chainlink price has formed a bullish flag pattern on the four-hour chart.

- The Strategic LINK Reserves assets jumped by 84,309 tokens to over 1 million.

- The Grayscale LINK ETF added assets on Wednesday.

Chainlink (LINK) was trading at $13.55 today, down from this month’s high of $14.95 and about 17% above its November low.

In a statement, the developers noted that they purchased 84,309 tokens, valued at about $1.3 million. The purchases brought the total assets in these strategic reserves to over 1 million, which is equivalent to over $15.4 million.

The purchases continued even as the network’s fees fell. Data compiled by DeFi Llama shows that Chainlink’s fees dropped to $310,280 in November, down from October’s $394,642. It made over $434,516.

Meanwhile, SoSoValue data shows the Chainlink ETF inflows resumed on Wednesday after a two-day pause. Its inflows rose by $2.5 million, bringing the total inflows to over $54 million. The Grayscale LINK ETF now has $77 million in assets, a figure that will likely continue growing.

Chainlink price wavered as the network growth continued. The network’s Cross-Chain Interoperability Protocol (CCIP) is the exclusive bridging solution for all Coinbase-wrapped assets, including cbBTC, cbDOGE, cbLTC, and cbXRP. In a statement, Josh Leavitt, a senior director at Coinbase, said:

Chainlink price technical analysis

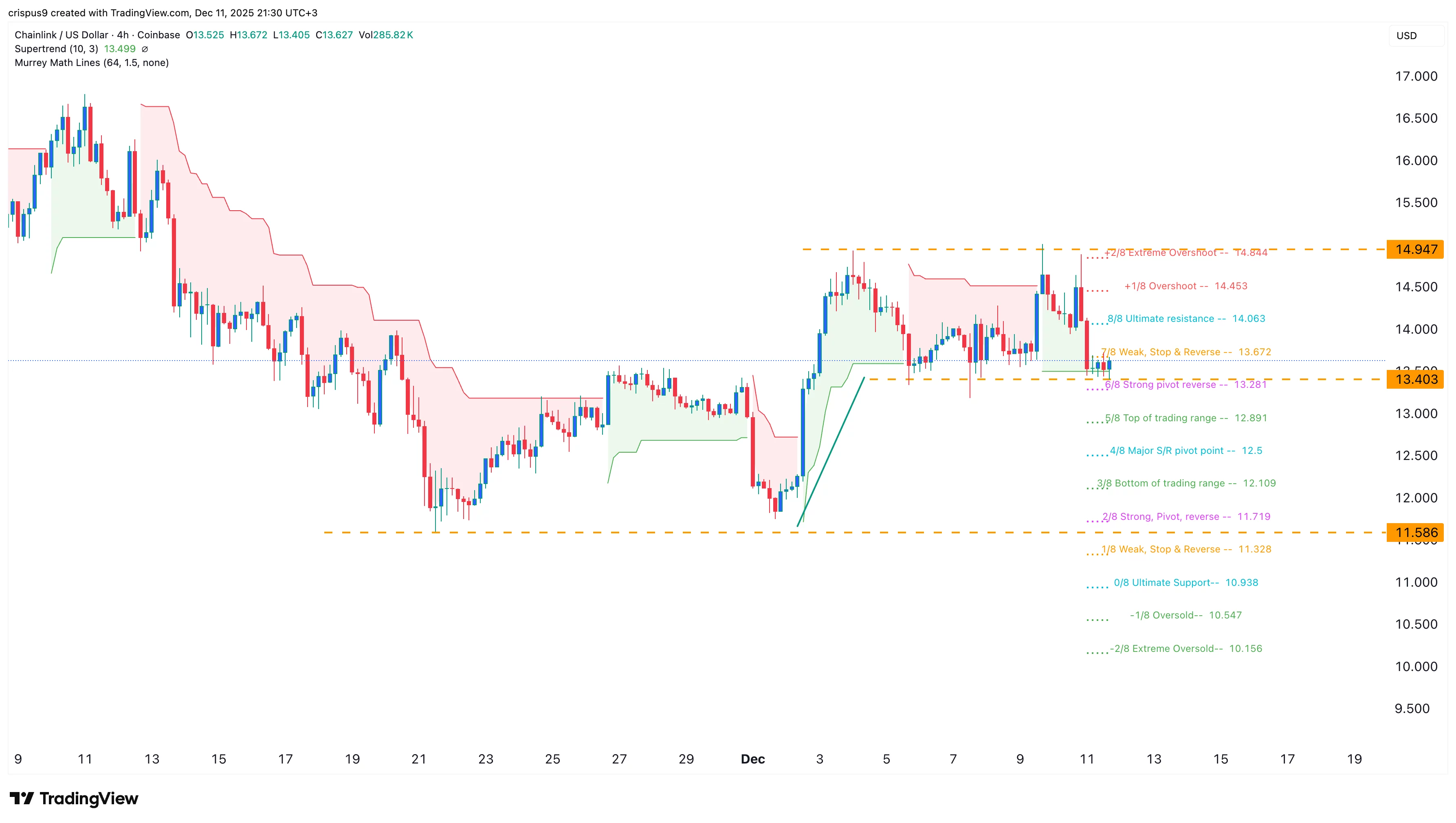

The four-hour chart shows that the LINK price has rebounded in the past few weeks, moving from a low of $11.58 in November to the current $13.6.

A closer look shows the token is forming a bullish flag pattern, consisting of a flagpole and a horizontal channel. It is now hovering near the lower side of the flag.

The token has also settled at a strong pivot-reverse point on the Murrey Math Lines tool.

Therefore, the most likely Chainlink price forecast is bullish, with the initial target at the upper channel boundary at $14.95. This target also coincides with the extreme overshoot level. A move above that level will signal further gains toward the psychological level at $20.

You May Also Like

Crypto markets are down, but corporate proxies are doing far worse

Although crypto treasury companies have enjoyed short-term price gains, most have underperformed the underlying assets they hold. Crypto asset prices retraced this week, but the spot market is faring better than most digital asset treasury companies, which have lost over 90% of their value in some cases due to market saturation and investor concerns over the sustainability of the digital asset treasury business model.Strategy, the largest Bitcoin (BTC) treasury company, is down about 45% from its all-time high of $543 per share during intraday trading in November. Comparatively, BTC is up about 10% since hitting a high of over $99,000 over the same month.Additionally, BTC has printed successive new highs since December, hitting an all-time high of over $123,000 in August, whereas Strategy has failed to reach a new all-time high in 2024 or even recapture its previous all-time high during the same time period.Read more

SEC Approves DTCC’s Tokenization of Real-World Assets on Blockchain