Best Crypto Presales to Buy: 3 High-Potential ICOs During Market Dip

Crypto markets face pressure as Bitcoin dips below $86K, sparking concerns of a deeper downturn or controlled reset. The pullback reflects liquidity stress, cautious positioning ahead of key economic data, and crypto-specific de-risking rather than outright panic.

Despite the downward momentum, market structure remains intact, with volume well below true capitulation levels. Choppy conditions dominate, leaving short-term direction uncertain and keeping traders focused on key price edges instead of chasing breakouts.

Many investors are moving away from large-cap tokens that mirror Bitcoin, instead seeking selective opportunities. This shift is driving interest in the best crypto presales to buy, where early-stage pricing and unique narratives offer exposure beyond the current market stagnation.

Why Warren Buffett’s Inflation Concerns Are Fueling Interest in Bitcoin

Warren Buffett has repeatedly warned that governments naturally debase currencies over time, making long-term cash holdings a losing strategy for preserving purchasing power. This concern is increasingly relevant as inflation erodes the real value of fiat money, even during periods of economic stability.

Buffett’s comments highlight why assets with scarcity and durability are often favored during uncertain monetary cycles. Despite holding record levels of cash, the underlying message is that capital must eventually move into assets that can resist devaluation.

This environment has pushed investors to reconsider alternative stores of value beyond traditional equities and bonds. Bitcoin’s fixed supply directly contrasts with fiat systems that expand through policy decisions and debt growth.

As trust in long-term currency stability weakens, decentralized assets gain relevance as hedges against monetary dilution. In this context, crypto stands to benefit as investors seek transparent, scarce, and globally accessible alternatives to traditional money systems.

Top Crypto Presales to Buy Today Before the Next Bull Market

As seasoned investors rethink their strategies in a market full of uncertainty, early-stage crypto projects are drawing increasing interest. These presales offer access to tokens with strong utility, staking rewards, and growth potential before mainstream adoption hits.

Below is a list of three best crypto presales to buy ahead of the anticipated bull run in 2026.

Source – Borch Crypto YouTube Channel

Maxi Doge (MAXI)

Maxi Doge has emerged as a hype-driven presale token capturing attention through its community-focused and meme-centric approach. Unlike traditional crypto emphasizing utility or DeFi functionality, Maxi Doge thrives purely on excitement, social engagement, and viral content.

The project leverages highly creative marketing, including videos and memes that depict traders hunting for massive gains, which resonates strongly with retail investors seeking high-risk, high-reward opportunities. Current presale pricing at $0.0002735 and staking APY around 70%.

The token’s momentum is fueled by its entertaining and exaggerated branding, designed to maximize engagement and attract a broad audience. Social media content is expected to amplify organic growth, potentially reducing the need for extensive paid marketing.

Despite its lack of intrinsic utility, Maxi Doge demonstrates how community and hype can drive early adoption. The project exemplifies how retail-driven narratives can shape presale performance and market perception.

Visit Maxi Doge

Pepenode (PEPENODE)

Pepenode is emerging as a unique entry in the meme coin landscape by combining gamification with staking mechanics. Unlike traditional mining, Pepenode allows users to build virtual mining rigs, purchase nodes, and strategically combine them to maximize token yields.

Each node functions as a distinct asset, which can be upgraded, sold, or realigned to enhance productivity. Early investors benefit not only from $PEPENODE yields but also from potential bonuses in other popular meme coins like Pepe and Fartcoin.

With only 23 days left and $2.3 million raised in its early presale stage, the project remains highly accessible to new investors. The approach integrates both fun and financial strategy, making it one of the best crypto presales to buy now.

As blockchain-based gamified staking continues to attract attention, Pepenode demonstrates how innovative tokenomics and community-driven incentives can redefine early crypto opportunities.

Visit Pepenode

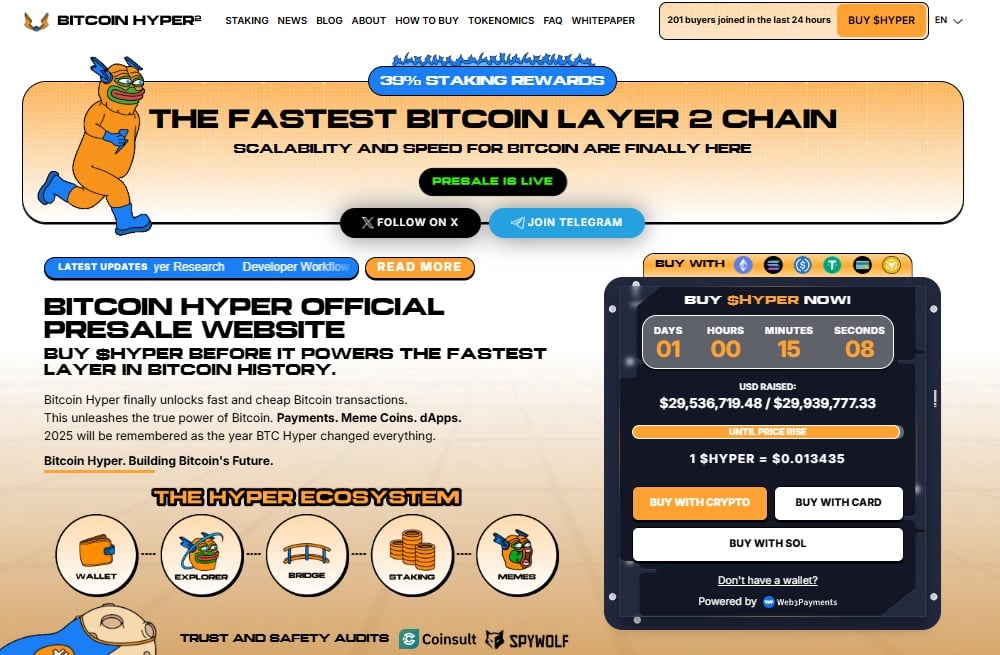

Bitcoin Hyper (HYPER)

Bitcoin remains the dominant crypto asset, but its speed and cost limitations have sparked the development of new solutions. Layer 2 projects like Bitcoin Hyper aim to overcome these challenges.

They offer faster transactions, lower fees, and expanded functionality while maintaining Bitcoin’s decentralization and security. This creates a broader ecosystem for payments, DeFi applications, and meme coins, enhancing Bitcoin’s utility beyond a simple store of value.

Despite being the first and most recognized blockchain, Bitcoin alone cannot meet the growing demand for scalability and flexibility. Investors and developers are now exploring ways to bridge Bitcoin with Bitcoin Hyper, leveraging zero-knowledge proofs and other advanced technologies.

The introduction of such layers opens opportunities for more complex applications while staying aligned with Bitcoin’s ethos. The project has already raised a massive $29.5 million, with each token priced at $0.013435 and staking APY up to 39%.

Warren Buffett’s view on the declining value of cash highlights the need to diversify into assets with real utility, such as Bitcoin Hyper. This forward-looking crypto pave the way for wider adoption and deeper integration into the financial ecosystem.

Visit Bitcoin Hyper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Crypto Market Cap Edges Up 2% as Bitcoin Approaches $118K After Fed Rate Trim

Vitalik Buterin Reveals Ethereum’s Long-Term Focus on Quantum Resistance