Best Meme Coins to Buy: Dogecoin Price Prediction

Dogecoin has struggled to gain significant momentum in the current market, largely due to the absence of a clear meme coin season and minimal attention from high-profile mentions, including those from influential figures.

Despite past periods of strong performance, the market for Dogecoin remains relatively subdued, with trading interest largely muted.

The recent launch of the Dogecoin ETFs by Grayscale and Bitwise has not sparked substantial inflows, highlighting a lack of investor enthusiasm compared with other altcoins like Litecoin or Chainlink.

Correlation with Bitcoin further limits independent movement, meaning Dogecoin tends to mirror Bitcoin’s trends, falling slightly more during declines and lagging on rallies.

This leaves market participants closely watching Dogecoin price prediction and questioning whether it will still be the best meme coins to buy ahead of 2026.

Source – Cilinix Crypto YouTube Channel

Dogecoin Price Prediction

From a technical perspective, Dogecoin is consolidating above a historically strong support level around $0.13. Analysts anticipate an initial move upward toward the first gap at $0.17, followed by a potential target near $0.19, assuming market conditions remain neutral.

The 50% decline since October 10 has positioned Dogecoin at key levels where buying interest may emerge, particularly as Bitcoin appears to form a local bottom. Price action is expected to remain stable in the near term, with upside potential tied to broader market recovery.

A break above the 7-day rolling VWAP could accelerate the rally, targeting the prior point of control around $0.162 and eventually the fair value gap near $0.17. While negative news could trigger further downside, current trends suggest consolidation before a meaningful recovery in early 2026.

Top Meme Coins to Buy as Dogecoin Alternatives for 2026

Given Dogecoin’s current lack of independent momentum and muted investor interest, early-stage presale meme coins present attractive alternatives.

Below are two crypto projects that combine strong presale funding with staking opportunities, offering higher upside potential compared with established coins like Dogecoin.

Maxi Doge (MAXI)

Maxi Doge is emerging as one of the standout meme coin presales at a time when the broader crypto market is largely stagnant and major assets lack momentum like Dogecoin.

Priced at a low entry level during its presale, the project has already raised $4.3 million. Its branding leans heavily into high-energy meme culture, using bold visuals and an aggressive narrative designed to capture attention quickly.

Source – Nazza Crypto YouTube Channel

This approach appears to be resonating with traders searching for opportunities outside slow-moving large-cap tokens. Market sentiment around Maxi Doge remains notably strong, with expectations centered on sharp post-launch volatility.

Maxi Doge is positioned as a hype-driven presale designed to thrive in a sideways market environment. Investors can buy the $MAXI token at $0.0002735, with staking APY of around 70%, making it one of the best meme coins to buy.

Visit Maxi Doge

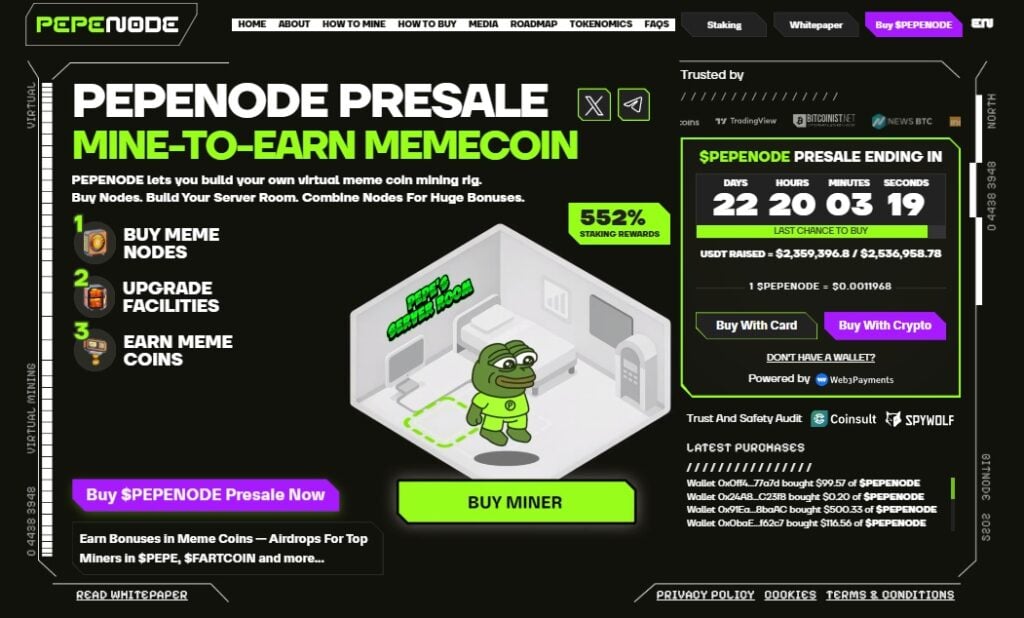

Pepenode (PEPENODE)

Pepenode is positioned as a utility-focused meme coin, designed to stand out as an alternative to $DOGE. The project is currently in its presale phase at a low entry price and has already attracted nearly $2.4 million in funding, with only 22 days remaining before its conclusion.

Instead of relying on viral marketing, Pepenode emphasizes a DeFi-driven ecosystem that includes virtual mining mechanics, staking rewards, and NFT-based functionality. One of its strongest selling points is the mine-to-earn models.

This approach appeals to investors looking for measurable fundamentals rather than short-lived momentum. Price projections point toward steady growth post-launch, with expectations for gradual appreciation through 2026 and beyond.

Visit Pepenode

Conclusion

Investors seeking growth should monitor presale tokens that show measurable on-chain activity and community engagement, as these factors can drive significant price appreciation once broader market sentiment improves.

While speculative, presale-stage meme coins allow investors to capitalize on early entry points that may outperform stagnant assets, making them best options for those looking beyond Dogecoin’s limited near-term potential.

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Crypto Market Cap Edges Up 2% as Bitcoin Approaches $118K After Fed Rate Trim

Vitalik Buterin Reveals Ethereum’s Long-Term Focus on Quantum Resistance