Bhutan Pledges $1 Billion in Bitcoin to Build ‘Mindfulness City’ Without Selling Reserves

Bhutan unveiled a national Bitcoin Development Pledge on Tuesday, committing up to 10,000 BTC, worth approximately $1 billion, to fund construction of Gelephu Mindfulness City without liquidating its sovereign digital asset reserves.

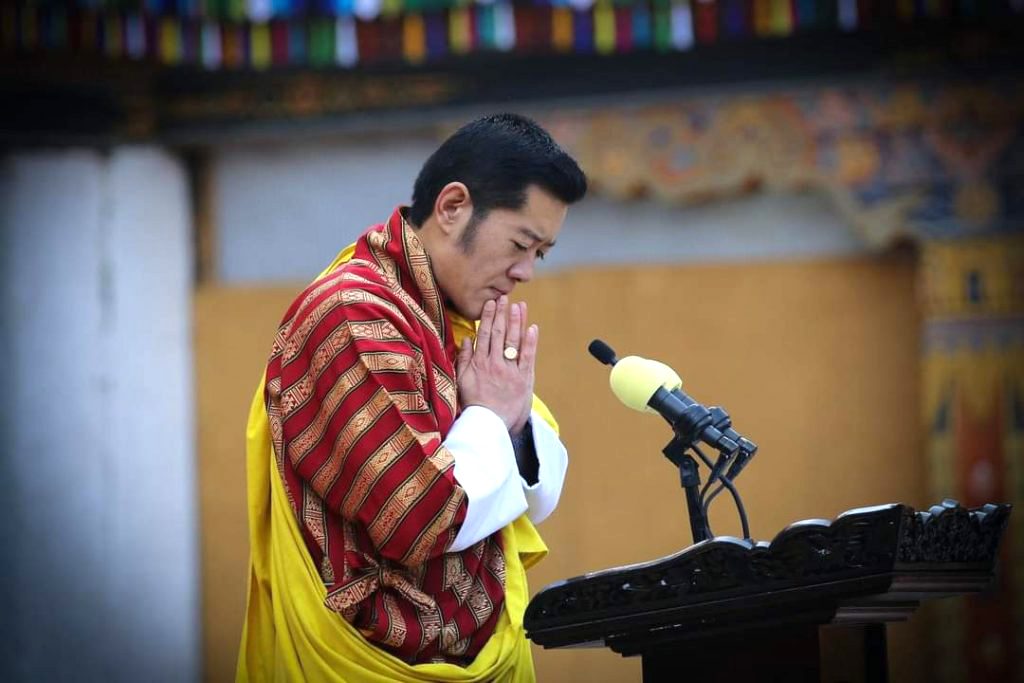

King Jigme Khesar Namgyel Wangchuck announced the allocation during his National Day Address, framing the commitment as a generational investment in youth employment and national prosperity tied to a new economic hub in southern Bhutan.

The pledge channels Bitcoin holdings into GMC development through mechanisms including collateralized lending, risk-managed yield strategies, and long-term holding approaches designed to preserve capital while financing infrastructure.

This development became possible due to a multi-year commitment to leverage Bitcoin’s compounding value over time, rather than converting reserves to cash.

Officials said the final implementation details are expected in the coming months, under governance frameworks that emphasize capital preservation, appropriate oversight, and transparency.

Source: Breathe Bhutan

Source: Breathe Bhutan

Sovereign Mining and Clean Energy Foundation

Bhutan ranks as the world’s fifth-largest government Bitcoin holder, having mined 13,011 BTC since 2021 using surplus hydroelectric power from Himalayan rivers.

The renewable energy-powered mining operation converts excess national grid capacity into digital assets without additional environmental impact, with crypto holdings now exceeding 11,286 BTC, valued at $1.28 billion, according to Bitbo data.

The Kingdom’s hydroelectric resources at times exceed domestic demand, enabling clean energy to be converted into long-term national assets through the national power generation utility.

This mining strategy accounts for over 25% of Bhutan’s GDP while maintaining environmental sustainability commitments central to the nation’s development philosophy, which balances economic progress with ecological stewardship.

The Kingdom established Green Digital Ltd through GMC to develop blockchain infrastructure and, recently, partnered with Cumberland DRW on digital asset trading frameworks, sustainable mining expansion, AI compute facilities, and national stablecoin development.

Gelay Jamtsho, Green Digital chairman, said the collaboration connects Bhutan’s renewable energy infrastructure with institutional-grade liquidity to support the country’s diversification agenda beyond traditional economic sectors.

Blockchain Integration Across National Systems

Beyond mining, Bhutan has deployed blockchain-based national identity systems serving 800,000 citizens on Ethereum after migrating from Polygon, with the transition completed in October, enabling Verifiable Credentials and digital signing capabilities.

Prime Minister Tshering Tobgay said leveraging Ethereum’s globally distributed network strengthens the security, transparency, and resilience of digital infrastructure serving nearly the entire population.

Back in May, the Kingdom enabled crypto payments across tourism merchants through partnerships with DK Bank and Binance Pay, allowing visitors to use over 100 cryptocurrencies for everything from airline tickets and hotel stays to roadside fruit stalls.

Over 100 local merchants now accept digital assets, with Damcho Rinzin, tourism director, describing the system as advancing innovation and inclusion while supporting sustainable development goals.

Most recently, Bhutan launched TER, a Solana-based token backed by physical gold reserves distributed through DK Bank, positioning the nation among the few experimenting with state-backed tokenized assets.

Mindfulness City as Economic Catalyst

Gelephu Mindfulness City operates as a Special Administrative Region designed to attract international capital through regulatory clarity and modern financial connectivity while preserving cultural values.

King Jigme Khesar Namgyel Wangchuck framed GMC as a shared national enterprise in which citizens function as stakeholders, with new land policies ensuring that Bhutanese from all regions benefit from development proceeds, since most acreage remains state-owned.

“As your King, I must ensure that every Bhutanese is a custodian, stakeholder, and beneficiary of GMC,” the monarch said. “Think of GMC as a company and landowners as its shareholders.“

Market Outlook Supports Strategic Holding

Bitcoin traded at $87,274 today, up 1.9% in Asian hours as exchange reserves hit record lows and traders awaited US inflation data.

Major asset managers, including Bitwise and Grayscale, project that Bitcoin will exceed its previous all-time highs in 2026, despite traditional cycle theory predicting corrections, as institutional capital inflows through platforms like Morgan Stanley and Wells Fargo accelerate adoption.

Bhutan’s pledge aligns with the growing sovereign and corporate adoption of digital assets, as global crypto ETPs have attracted $87 billion in net inflows since US products launched in January 2024.

You May Also Like

Woodway Assurance receives $1 million in funding for data privacy assurance solution EviData

OpenVPP accused of falsely advertising cooperation with the US government; SEC commissioner clarifies no involvement