Bitcoin Mining Recovers Quickly After China Crackdown Claims, Network Metrics Stay Strong

Bitcoin’s network quickly recovered after alleged large-scale mining shutdowns in Xinjiang on December 13, with data showing only a brief, modest impact on hashrate on December 18, contrary to early social media reports.

Reports of a sweeping Xinjiang crackdown knocking 100 exahashes per second (EH/s) off Bitcoin BTC $85 731 24h volatility: 0.1% Market cap: $1.71 T Vol. 24h: $52.52 B network have been challenged by pool-level data indicating a much smaller, temporary disruption. The scare began after Nano Labs founder and former Canaan co-chair Jack Jianping Kong posted on X that inspections in Xinjiang had triggered the shutdown of at least 400,000 mining rigs and an 8% drop in hashrate in a single day.

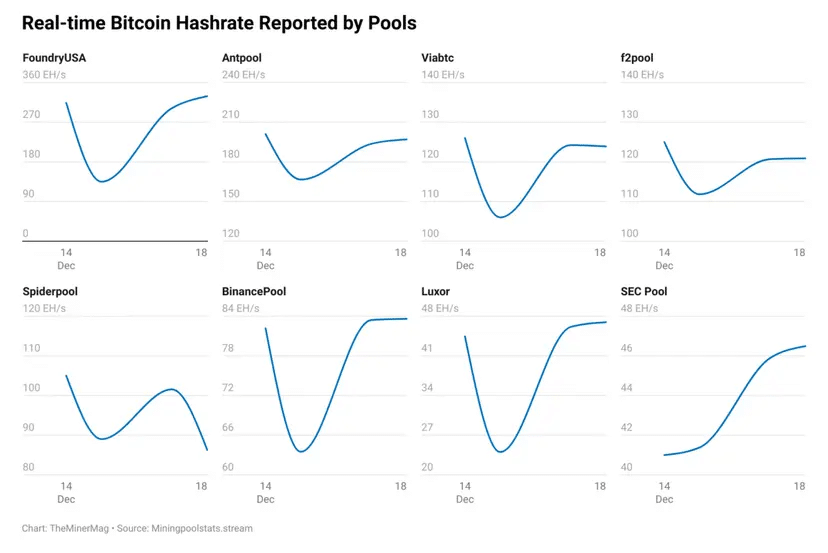

The dip in mining power did happen, but numbers from large mining groups show most of it happened in North America, not mainly in China. Foundry USA saw its mining power fall by about 180 EH/s over just a few hours, and another US group, Luxor, saw its mining power drop as well. Together, these made up roughly 200 EH/s of the fall, likely because power was cut during cold weather in some parts of the US.

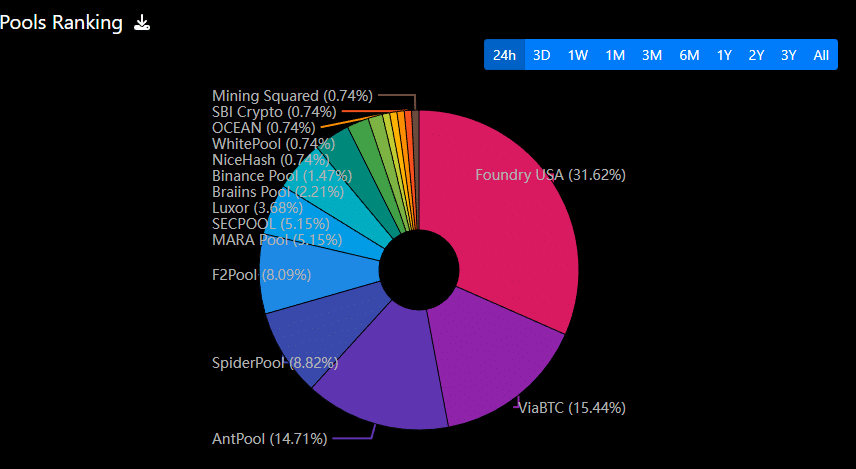

Pools ranking charts | Source: Mempool Space

Chinese-origin pools such as Antpool, F2Pool, ViaBTC, SpiderPool, and Binance Pool showed a combined decline of about 100 EH/s, roughly matching the figure circulated on social media but not confirming that all of it came from Xinjiang. These pools route hashrate from multiple regions, including Bitmain-linked US operations that may also have faced weather-related constraints, complicating efforts to attribute the drop to a single Chinese province.

The way mining power bounced back also challenges the idea of a long-term drop of 100 EH/s. By December 17, most big mining groups had recovered and were back above their pre-peak levels, with the total only 20 EH/s below past levels—showing the problem was brief, not a long-lasting loss, according to TheMinerMag.

Comparison of the hashrate between Bitcoin mining pools | Source: TheMinerMag

The Bitcoin Mining Strength Persists in 2025

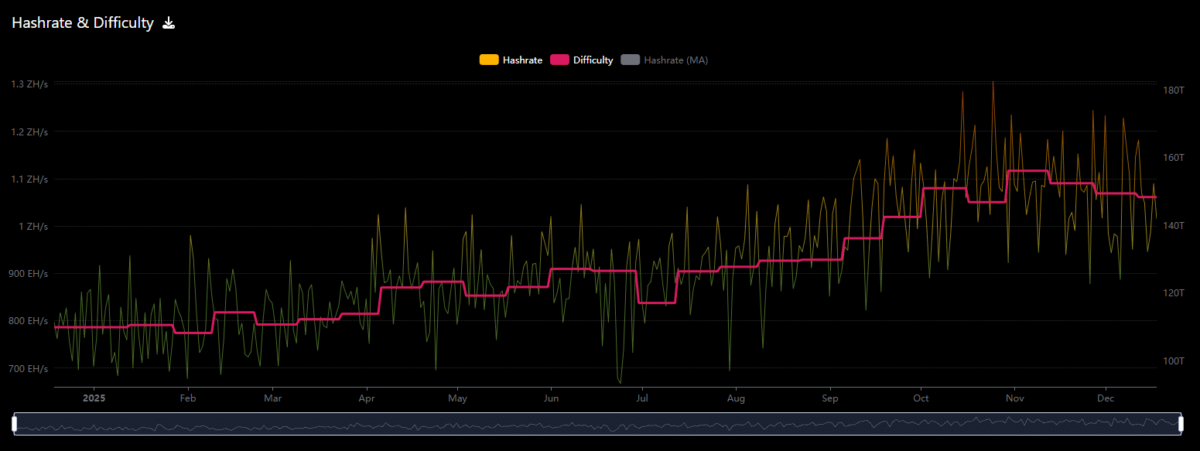

Broader metrics show the Bitcoin mining sector remains robust despite the recent hiccup. Hashrate Index data for mid-December indicates the network’s 7-day simple moving average hashrate slipped only marginally over the week, while 30-day averages remain just below recent highs, and a modest downward difficulty adjustment is expected to offer some relief to miners facing weak hashprice.

In 2025, Bitcoin’s mining power rose from the 700 EH/s range to above 1 ZH/s (1,000 EH/s), largely because big mining companies are upgrading their equipment and operating in more locations. At the same time, the network is still hard to mine, with some signs that the pressure is easing a bit for smaller miners as they compete.

Hashrate and difficulty of mining in the Bitcoin network on 1 year | Source: Mempool Space

The situation in Xinjiang shows that local rules can create noise in short-term numbers, but Bitcoin mining is now so widespread worldwide that one area’s rules matter less. At the moment, the network follows Bitcoin’s price more closely, and even though mining power is still close to historical highs and the system is set to adjust as conditions change, the network remains safe even as rules in China and other countries tighten.

nextThe post Bitcoin Mining Recovers Quickly After China Crackdown Claims, Network Metrics Stay Strong appeared first on Coinspeaker.

You May Also Like

U.S. Court Finds Pastor Found Guilty in $3M Crypto Scam

MSCI’s Proposal May Trigger $15B Crypto Outflows