Bitcoin Coinbase Premium Gap Enters Deep Red Territory — What’s Happening?

Since the market-wide crash in early October, the Bitcoin price has struggled to resume any significant movement to the upside. The flagship cryptocurrency has continued to fall even deeper into bearish territory, breaching multiple support zones in the process.

With the crypto market’s situation painting a bleak picture, the prevailing sentiment around its leader can hardly be said to be bullish. Interestingly, a recent on-chain evaluation puts into perspective the key players behind Bitcoin’s weakness.

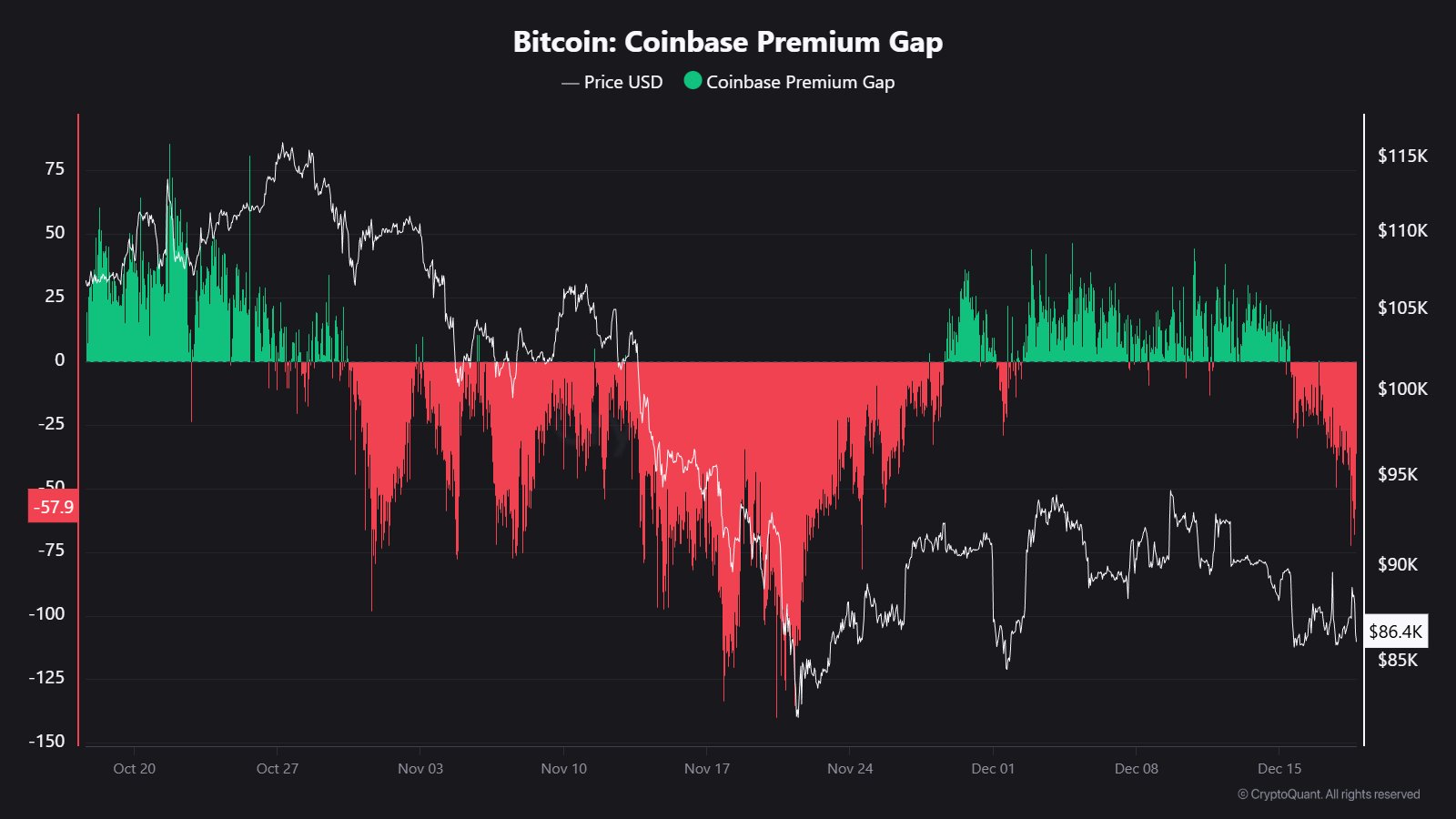

BTC Coinbase Premium Gap Reads –$57

In a recent post on the social media platform X, on-chain analyst Maartunn shared that a substantial portion of sell pressure seen in the Bitcoin market might be from the activities of US investors. This on-chain observation is based on the Coinbase Premium Gap metric, which measures whether US based investors are buying or selling Bitcoin more aggressively than the rest of the global market.

For context, the metric tracks the price gap between Bitcoin on Coinbase and Bitcoin on major offshore exchanges (for example, Binance). A positive reading typically indicates that Bitcoin is more expensive on Coinbase, meaning that US traders are buying aggressively. On the other hand, negative readings are interpreted as increased sales or reduced interest among investors in the United States.

According to the analyst, the Coinbase Premium Gap recently dropped to a -$57 reading. As has been earlier implied, this deep negative value reveals that traders from the US are actively offloading, rather than accumulating Bitcoin.

Interestingly, this heightened selling activity accompanies Bitcoin’s price momentum towards lower levels. Thus, it becomes clear that the sell-pressure reflected on Bitcoin’s price is due mainly to the absence of US demand.

BTC Market Outlook

According to historical data, Bitcoin’s direction in the long-term could go either way. While a negative Coinbase Premium Gap reading is usually indicative of a bearish phase in the short term, the long-term perspective is a little less straightforward.

In past cycles, prolonged periods of negative readings have preceded the formations of market bottoms, after which prices saw recoveries to the upside. This often happens when sell-side pressure dwindles, and fresh demand enters the Bitcoin market.

Hence, if this negative reading deepens and there is no fresh demand in the market, the Bitcoin price could follow suit and continue south. However, a reversal of the Coinbase Premium Gap to the upside — pushing it towards neutral or positive levels — could prove pivotal for the world’s leading cryptocurrency.

As of this writing, Bitcoin holds a valuation of $88,260, reflecting no significant price movement in the past day.

You May Also Like

Quick Tips for Passing Your MyCPR NOW Final Exam

Top Altcoins To Hold Before 2026 For Maximum ROI – One Is Under $1!