Why the PEPE Price Keeps Sliding Despite Bitcoin Bounce as Trader Confidence Fades

This article was first published on The Bit Journal.

PEPE price action has become a quiet signal that not every crypto asset benefits from a market rebound. While large-cap tokens reacted positively, PEPE continued to slide, showing that trader confidence remains thin despite improved sentiment elsewhere.

According to the source, the broader market response to the Bitcoin bounce has been selective. Bitcoin’s recovery created optimism, yet that momentum failed to extend into the memecoin sector, where selling pressure remained firm and speculative interest faded.

When Market Momentum Fails to Reach Memecoins

Bitcoin leapt 5% to around $89,700 from an $85,500 low over a short time period. Ordinarily, this impulse is felt across all altcoins. This time, that pattern broke. PEPE dropped another 2 percent over the past 24 hours and remained almost 21 percent below its December peak, based on publicly available pricing data.

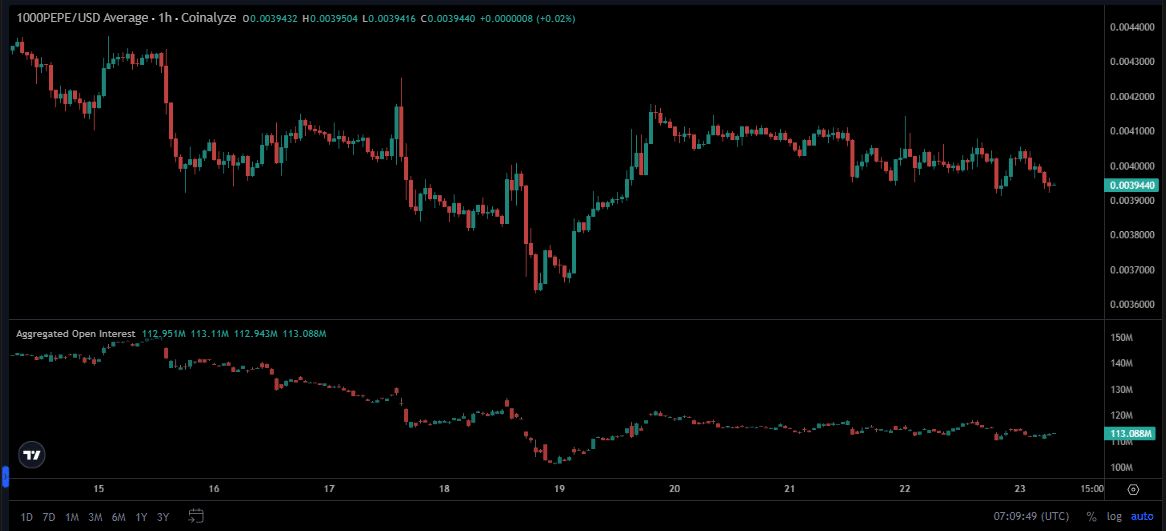

Derivatives data show why sentiment stayed weak. Open interest fell from $121.5 million to $114.5 million between December 20 and 23, instead of seeing a rise when prices were flat.

Market studies on derivatives behavior note that falling open interest during flat price action often signals capital exiting rather than preparing for a rally, as observed in recent crypto derivatives research available online.

Source: Coinalyze

Source: Coinalyze

PEPE Price Stalls Below a Critical Technical Barrier

PEPE Price Breaks Structure Near a Heavy Supply Zone

The PEPE price broke lower again after failing to reclaim the $0.000044 to $0.000050 range. This area has acted as a supply zone where sellers repeatedly overwhelm buyers. Technical traders often interpret repeated rejection from such zones as confirmation of trend continuation rather than consolidation.

Momentum indicators align with this view. The Relative Strength Index hovered near 40, reflecting weak buying strength. Meanwhile, the Accumulation Distribution indicator continued its steady decline, a sign that distribution has outweighed accumulation since early November. Chart-based studies of volume behavior show that sustained A/D declines often precede extended downtrends in speculative assets, reinforcing current market concerns.

Why the Bitcoin Bounce Failed to Lift PEPE

The Bitcoin bounce offered no meaningful lift for PEPE because correlation weakened at a critical time. Capital rotated toward higher-liquidity assets instead of speculative tokens. Behavioral finance research shows that memecoins rely heavily on momentum and narrative strength, both of which were absent during this rebound, as outlined in recent market psychology studies shared through academic crypto research portals.

Short-term charts reflect the same story. Over the one-hour timeframe, the PEPE price continued to form lower highs and lower lows. Volume stayed muted, and buyers showed little urgency even as Bitcoin stabilized. Repeated mentions of a Bitcoin bounce failed to change short-term trader behavior around PEPE.

Levels Traders Are Monitoring Closely

Analysts point to $0.0000420 as a crucial near-term resistance. A return to this level may attract sellers. If the price holds above it, Fibonacci retracement zones near $0.0000452 and $0.0000476 become relevant.

Still, caution dominates. The PEPE price has not reclaimed its broken structure, and indicators show no surge in demand. Even as headlines focus on the Bitcoin bounce, PEPE remains disconnected from broader optimism.

Conclusion

The PEPE price reflects a market that has grown selective. Bitcoin’s rebound mattered, but only where confidence already existed. For PEPE, selling pressure continues to outweigh hope, and resistance levels remain firm.

Until volume improves and structure resets, the Bitcoin bounce remains a background event rather than a catalyst. For financial students, analysts, and builders, this episode offers a clear lesson. In crypto markets, recovery is never automatic, and price action often speaks louder than sentiment.

Glossary of Key Terms

Open Interest: The total number of active derivative contracts, often used to gauge market participation.

Supply Zone: A price range where selling pressure historically outweighs buying.

RSI: A momentum indicator that measures the speed of price changes.

Fibonacci Retracement: A technical tool used to identify potential support and resistance levels.

FAQs About PEPE Price

Why is PEPE underperforming Bitcoin?

PEPE faces weak demand and volume, even during the broader market recovery.

Does a Bitcoin bounce always lift memecoins?

No. Correlation weakens when traders become selective.

Is PEPE in a long-term downtrend?

Current structure and indicators suggest continued weakness.

What level matters most now?

The $0.0000420 resistance remains critical.

Sources and References

Coinmarketcap

Coinalyze

Ambcrypto

Read More: Why the PEPE Price Keeps Sliding Despite Bitcoin Bounce as Trader Confidence Fades">Why the PEPE Price Keeps Sliding Despite Bitcoin Bounce as Trader Confidence Fades

You May Also Like

Trump criticized the unusual phenomenon of "good news not driving prices up" and warned dissidents not to even think about taking the helm of the Federal Reserve.

Is Doge Still The Best Crypto Investment, Or Will Pepeto Make You Rich In 2025