Crypto.com Hires Internal Market Maker for Predictions – Is the Exchange Trading Against Users?

Crypto.com is moving deeper into prediction markets with plans to staff an internal market-making desk, a step that is drawing renewed attention to how these platforms operate and whether exchanges may end up trading directly against their own users.

The Singapore-based cryptocurrency exchange is recruiting a quantitative trader to join a team responsible for buying and selling financial contracts tied to the outcomes of sporting events on its prediction market platform.

Liquidity or Conflict? Crypto.com’s Market-Making Role Sparks Debate

According to a recent Bloomberg report, the role would sit on Crypto.com’s market-making desk and involve actively trading against customer orders to support liquidity across sports contracts and other derivatives offered on the company’s U.S. platform.

The hiring effort comes as prediction markets expand rapidly across both crypto and traditional finance.

These platforms allow users to trade contracts that settle based on real-world outcomes, such as sports results or political events, with prices reflecting the market’s implied probability.

While prediction markets have long presented themselves as neutral venues where participants trade against each other, the use of in-house market makers has raised questions about conflicts of interest.

Market making has become a sensitive issue for event-contract exchanges, particularly those operating under U.S. federal oversight.

Critics argue that when an exchange or its affiliate takes the opposite side of customer trades, the structure begins to resemble a traditional sportsbook that profits from customer losses.

Those concerns have already surfaced elsewhere in the industry. Kalshi, one of the most prominent regulated prediction market operators, runs an internal unit known as Kalshi Trading.

Polymarket, a major decentralized platform, is also reported to be building its own internal market-making team.

Crypto.com’s job listing states that the new hire would seek to “maximize profits while carefully managing risks,” language that has fueled debate over whether the firm is effectively trading against its users.

In response, in a report, a Crypto.com spokesperson said the company does not rely on proprietary trading as a revenue source and described its business model as providing customer access to digital assets and event contracts for a fee while remaining risk neutral.

The spokesperson added that the internal market maker does not receive preferential access to customer order flow or proprietary data and operates under rules disclosed to the Commodity Futures Trading Commission, which oversees derivatives markets in the U.S.

Prediction Markets Hit Record Volumes, but Trading Rules Stir Concerns

The exchange has also taken steps to attract external liquidity providers. Like its competitors, Crypto.com has sought to bring in professional trading firms to ensure continuous buying and selling, particularly in high-volume sports markets.

However, company rules grant designated market makers on sports contracts a three-second head start over smaller traders, a policy that has drawn scrutiny for potentially allowing large participants to adjust prices ahead of retail users.

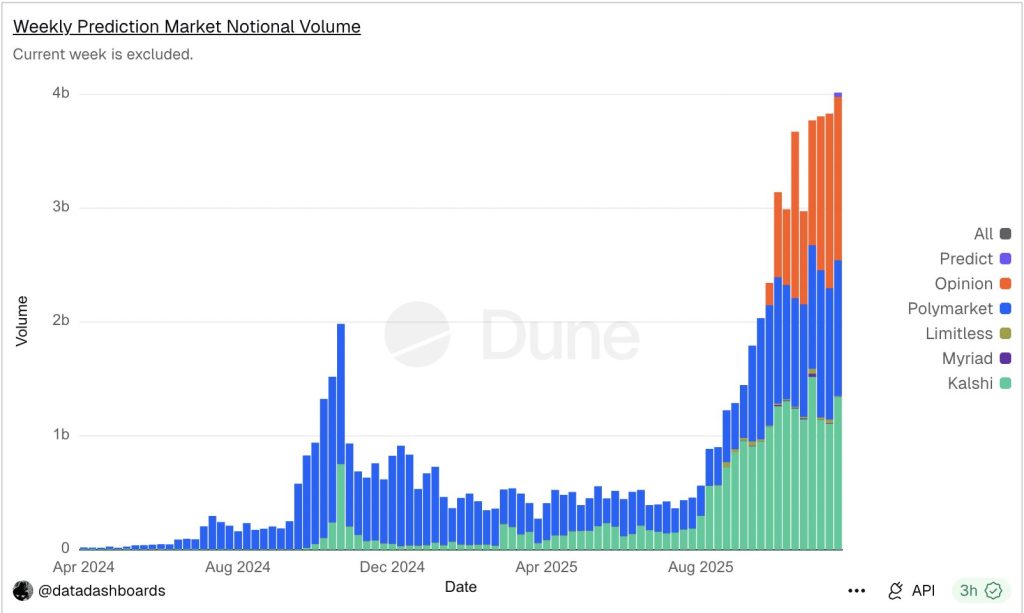

The broader industry continues to grow despite these concerns, with prediction markets linked to sports and politics having driven much of the recent surge in activity.

Platforms including Kalshi, Polymarket, and Limitless recorded a combined $44 billion in trading volume this year, with Kalshi reaching roughly $1 billion in weekly volume at its peak.

Source: Dune Analytics

Source: Dune Analytics

On-chain prediction markets have expanded even faster, with monthly volume climbing from under $100 million in early 2024 to more than $13 billion, according to joint research from Keyrock and Dune Analytics.

Major crypto firms are also entering the space. Coinbase recently rolled out prediction market trading on its platform and agreed to acquire The Clearing Company as part of its push to scale regulated event-based markets. The move followed Kalshi’s $300 million Series D raise at a $5 billion valuation, showing investor interest in the sector.

You May Also Like

Solana Hits $4B in Corporate Treasuries as Companies Boost Reserves

SHIB Price Prediction: Mixed Signals Point to $0.0000085 Target by February End