Vitalik Buterin’s Milady Profile Photo Sparks 30% Jump in NFT Floor Price

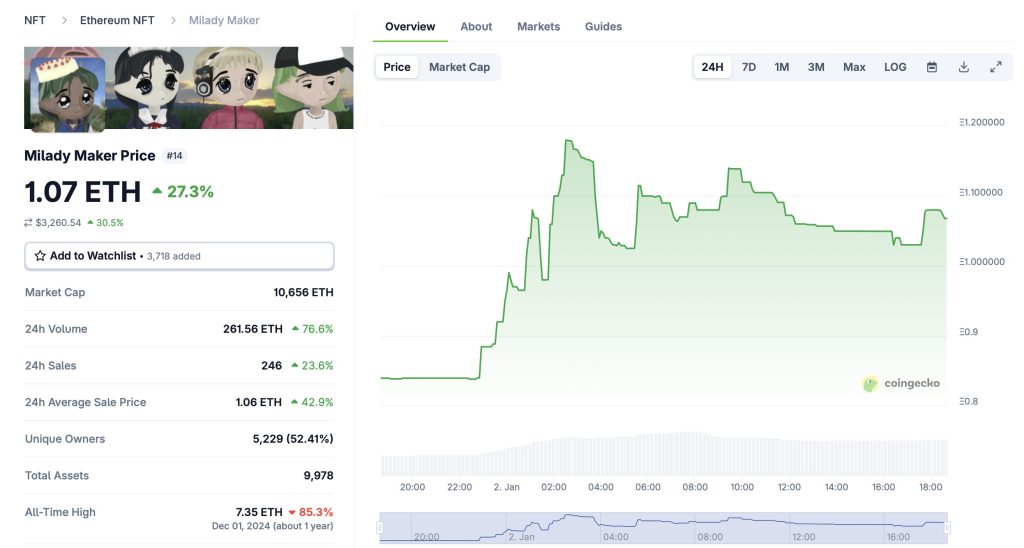

Ethereum co-founder Vitalik Buterin has once again stirred crypto markets after updating his profile photo on X to a Milady NFT helping push the collection’s floor price up nearly 30% within 24 hours.

Data from Coingecko NFT marketplaces show Milady Maker’s floor price climbing to around 1.07 ETH, with both trading volume and sales rising sharply following the profile change.

A New Year Message for Ethereum

The price move coincided with a New Year post from Buterin on X in which he reflected on Ethereum’s progress in 2025 and laid out his priorities for the year ahead.

“Welcome to 2026! Milady is back,” Buterin wrote, before pointing to a series of technical upgrades completed last year, including higher gas limits, expanded blob capacity, improvements in node software quality, and major advances in zkEVMs and PeerDAS.

He describes these milestones as some of Ethereum’s most important steps toward becoming a more powerful and scalable blockchain.

Beyond Hype: Ethereum’s Long-Term Mission

Buterin used the post to reiterate Ethereum’s broader mission, arguing that the network should not focus on short-term narratives or speculative trends, but instead serve as a foundational layer for a freer and more open internet.

He highlights the importance of decentralized applications that operate without fraud, censorship, or third-party interference, continue functioning even if their original developers disappear and protect user privacy. Such applications, he said, should remain stable regardless of political, corporate, or ideological shifts.

The Unusual Lore of Milady

The renewed attention has once again drawn focus to Milady’s unconventional history. Launched in August 2021, Milady Maker is a collection of 10,000 neochibi-style NFTs on Ethereum created by the Remilia Collective.

From the outset the project embraced irony, discomfort and intentionally broken aesthetics blending cute anime imagery with cryptic humor and insider references that many initially failed to understand.

Surviving Controversy and Volatility

Milady has weathered numerous controversies including public disputes involving its creators, legal battles between founders, allegations of misconduct and technical incidents that resulted in the loss of funds. Despite these challenges the collection has repeatedly rebounded.

In May 2023, a meme shared by Elon Musk triggered a surge in trading activity pushing Milady into the mainstream spotlight. Since then the ecosystem has continued to expand through new tokens, community initiatives and cultural events.

Culture Still Moves Markets

While the NFT market remains volatile, Milady’s latest rally underscores how cultural signals from influential figures can still move prices — particularly for projects rooted as much in internet subculture as financial speculation.

As members of the Milady community often note many NFT projects failed by trying too hard to explain themselves. Milady by contrast has survived by never doing so.

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

VIRTUAL Bearish Analysis Feb 10