Crypto Enters A Pivotal Week For Bitcoin, Ethereum, And Macro Events

Crypto heads into the second week of January jam-packed with crucial events. Here’s what crypto holders need to know:

#1 BTC: Bank Of America Opens The Advisory Spigot

Starting January 5, advisers across Bank of America Private Bank, Merrill, and Merrill Edge can recommend “several crypto exchange-traded products (ETPs)” for client portfolios, removing prior asset thresholds and shifting advisers from execution-only to active allocation guidance.

In an early-December note tied to the rollout, Merrill’s Chris Hyzy framed the bank’s stance in portfolio-construction terms: “For investors with a strong interest in thematic innovation and comfort with elevated volatility, a modest allocation of 1% to 4% in digital assets could be appropriate.”

The market relevance is less about one day of flows and more about plumbing. Bank of America is one of the largest US wealth distribution networks; even a modest allocation over the long-term could have significant price impact.

#2 Ethereum Blob Capacity Steps Up Again

Ethereum’s latest scaling cadence continues on January 7 via the second “Blob Parameter Only” upgrade (BPO2), which increases the per-block blob target and maximum to 14 and 21, respectively, an incremental move designed to expand rollup data throughput without bundling the change into a larger named hard fork. The Ethereum Foundation has positioned the BPO track as a deliberately minimal, config-only mechanism to “safely increase blob throughput” after Fusaka.

For L2 users, the direct linkage is data availability pricing. More blob supply, all else equal, can pressure blob fees lower, which is the component many rollups pass through into end-user transaction costs. The nuance is that these gains are conditional: if demand for blobspace ramps as quickly as capacity, fee relief can be muted, and operators still have to validate stability as targets rise.

#3 Hyperliquid (HYPE) Token UnlockHyperliquid’s HYPE token has a scheduled supply event on January 6: Hyperliquid Labs team members are set to receive an initial 1.2 million HYPE allocation, valued at roughly $31.2 million. Core contributors hold rights to approximately 237 million tokens under a structured release plan, nearly one quarter of the total supply.

The setup for traders is straightforward: token unlocks are reflexively modeled as potential sell pressure, but the realized impact depends on recipient behavior and any offsetting mechanics.

#4 Stellar’s Privacy Track Moves To TestnetStellar is scheduled to upgrade its testnet to Protocol 25, branded “Stellar X-Ray”, on January 7 at 21:00 UTC, with the mainnet vote slated for January 22. In its developer guidance, Stellar explicitly calls out the operational requirement: SDK and infrastructure operators should upgrade ahead of the testnet date, with holiday timing cited as a reason for the unusually long runway between stable releases and activation.

On the product side, Stellar frames X-Ray as foundational privacy infrastructure: “laying the groundwork for developers to build configurable, compliance-forward privacy applications using zero-knowledge (ZK) cryptography,” while keeping the network’s transparency model intact.

#5 Macro Outlook

Macro is doing crypto no favors in terms of clean narratives. Over the weekend, US forces captured Venezuelan President Nicolás Maduro, a move that pushed Bitcoin and crypto prices higher. Oil initially jolted but then softened amid expectations that near-term supply disruption is limited.

Geopolitically, the spillover risk is in escalation rather than the single event. US President Trump raised the possibility of further interventions in the region, including language around Colombia. Overall, the weekly US market open will be crucial for the week.

Rates politics are the other macro overhang. Trump has repeatedly said he will name his pick to succeed Fed Chair Jerome Powell “early next year,” with Powell’s leadership term ending in May 2026; the process has turned into a live market variable because of what it implies about the White House’s preferred rate path and perceived Fed independence. With prediction markets explicitly trading on whether a nomination lands by January 9, some crypto desks will treat the date as a volatility waypoint even if mainstream reporting stays looser on timing.

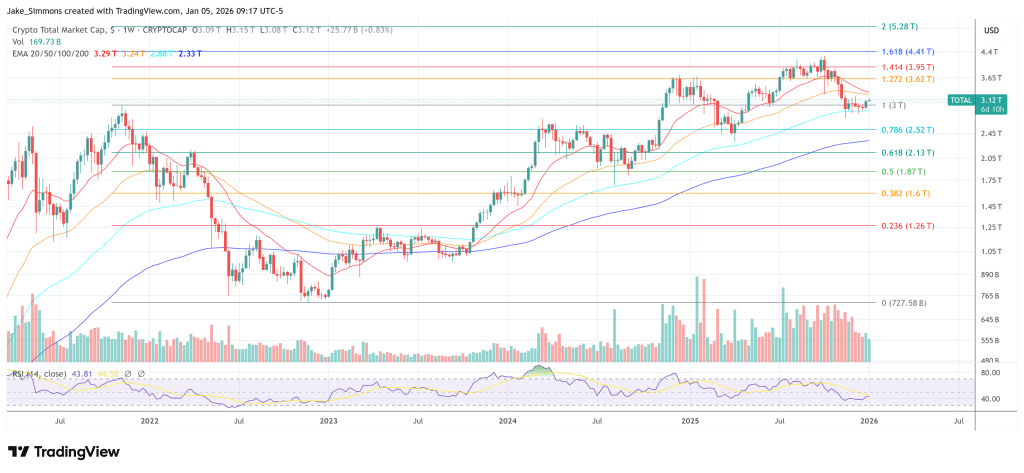

At press time, the total crypto market cap stood at $3.12. trillion.

You May Also Like

Trading bots gain traction as crypto markets move sideways: HTX 2025 recap

The cryptocurrency exchange reported sharp growth in automated trading as vol

How to earn from cloud mining: IeByte’s upgraded auto-cloud mining platform unlocks genuine passive earnings