Ripple News Today: U.S. Research Paper Names XRP a Trusted Ledger

The post Ripple News Today: U.S. Research Paper Names XRP a Trusted Ledger appeared first on Coinpedia Fintech News

A little-known U.S. government research paper from 2018–2019 is now gaining community attention, as it sees Ripple (XRP) as a trusted ledger for its role in a regulated financial environment.

The paper was written for government and aerospace use, not for crypto trading or speculation, making its findings especially important for Ripple XRP’s future.

US Research Paper Separates Blockchain From DLT

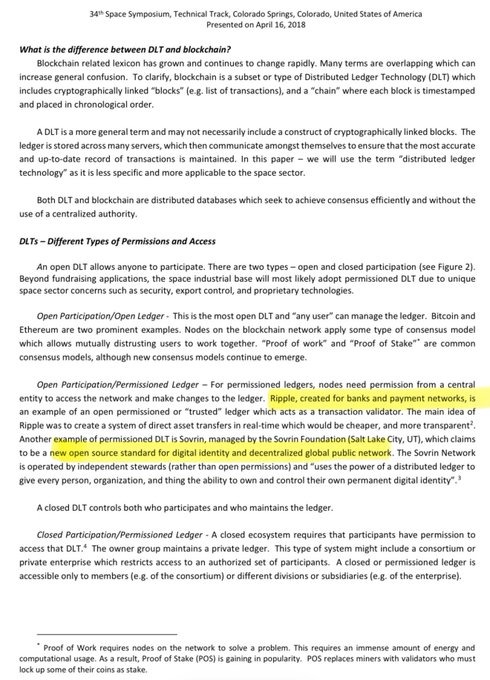

According to the research presented at US Space Symposiums, governments do not focus only on “blockchain.” Instead, they care more about Distributed Ledger Technology (DLT) as a whole.

The report explains that while blockchain works well for open and public networks, governments and regulated institutions often need something different.

The paper highlights that DLT can exist without public mining, open access, or anonymous users. This makes it suitable for governments, which require systems with clear rules, identity checks, control, and compliance with existing laws.

Ripple Named for Trusted and Regulated Systems

When the paper discusses permissioned and trusted ledgers, it directly points to Ripple’s architecture as a working example.

Unlike Bitcoin and Ethereum, which are mentioned as open and permissionless systems, Ripple is designed for banks, payment companies, and institutions that need built-in trust and control.

Source: NoLimit X Post

Source: NoLimit X Post

The research shows that Ripple can help with things like managing identities, sharing data safely, settling payments, and handling licenses or certifications. These are practical, real-world needs for governments and big organizations that cannot risk system failures or legal problems.

- Also Read :

- Why Macro Analysts Are Talking About XRP and BlackRock Again

- ,

Ripple Real World Usage

Ripple’s payment network is now used by hundreds of financial institutions across more than 90 countries for faster and cheaper global transfers.

Institutions that use Ripple’s tech for cross-border payments include major banks like Santander, Standard Chartered, SBI Holdings in Japan, PNC Bank, and CIBC (Canada). These organizations leverage Ripple solutions to speed up international payment settlement and cut costs compared with traditional systems.

Other global players like American Express and regional fintech firms such as Tranglo and BeeTech integrate XRP-enabled infrastructure to help move money quickly between different countries.

XRP Fits Long-Term Adoption, Not Hype

Meanwhile, Ripple XRP’s strength is not in short-term hype but in long-term use. Governments and institutions move slowly, but once they choose technology, they stick with it for years.

This research suggests XRP is designed for that world. While many projects focus on trends, Ripple and XRP continue to appear in serious, regulated systems that most people never notice.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Governments prioritize systems that allow identity verification, regulatory compliance, and controlled access. DLT provides these capabilities without relying on public, permissionless networks.

If more institutions adopt Ripple for regulated payments, it could set a precedent for trusted, permissioned ledgers, influencing regulatory frameworks and reducing reliance on volatile public cryptocurrencies.

Banks, payment providers, and large enterprises benefit through faster cross-border transactions, secure data sharing, and minimized legal and operational risks.

Governments and agencies may pilot Ripple for identity management, licensing, or inter-agency payments, gradually expanding use if compliance and efficiency goals are met.

You May Also Like

Huawei goes public with chip ambitions, boosting China’s tech autonomy post-Nvidia

Tron Makes Bold Moves in TRX Tokens Acquisition