Crypto market crash continues ahead of the US NFP report

The crypto market crash continued today, Jan. 8, as traders and investors anticipated the upcoming U.S. non-farm payrolls data, which will help to set the tone for the Federal Reserve.

- The crypto market crash continued for the third day as Bitcoin and altcoins dropped.

- This decline happened a day before the US non-farm payrolls data.

- Bitcoin is forming an ascending triangle pattern, pointing to more gains.

Bitcoin (BTC) price dropped from the year-to-date high of $94,5000 to $89,344, while Ethereum (ETH) fell below $3,057. As a result, the market capitalization of all coins dropped by 1.2% in the last 24 hours to over $3.17 trillion.

Daily volume dropped by 17% to $113 billion — the lowest level this week.

Additional data showed that futures open interest fell 1% to $139 billion, indicating that investors are reducing their leverage. Total liquidations rose to over $477 million, with Bitcoin and Ethereum bulls suffering the most liquidations.

The crypto market downturn is unfolding as traders await Friday’s non-farm payrolls report. Economists polled by Reuters expect the upcoming data to show the economy added more than 55,000 jobs in December. A Polymarket poll estimated that the country’s unemployment rate dropped from 4.6% to 4.5%.

The labor market is a key metric that crypto and stock market traders watch because of its impact on the Federal Reserve decisions, as it is part of the dual mandate. A weak report will be bullish for the crypto market, as it will raise the odds of the Fed cutting interest rates.

The crypto market crash is also happening after demand for Bitcoin and XRP ETFs waned. Spot Bitcoin ETFs shed over $486 million in assets on Wednesday, after shedding $243 million in assets a day earlier. These outflows mean that the funds have had just $429 million in inflows this month.

Spot Ethereum ETFs had over $98 million in outflows, while XRP funds shed $40 million in assets for the first time since their launch in November.

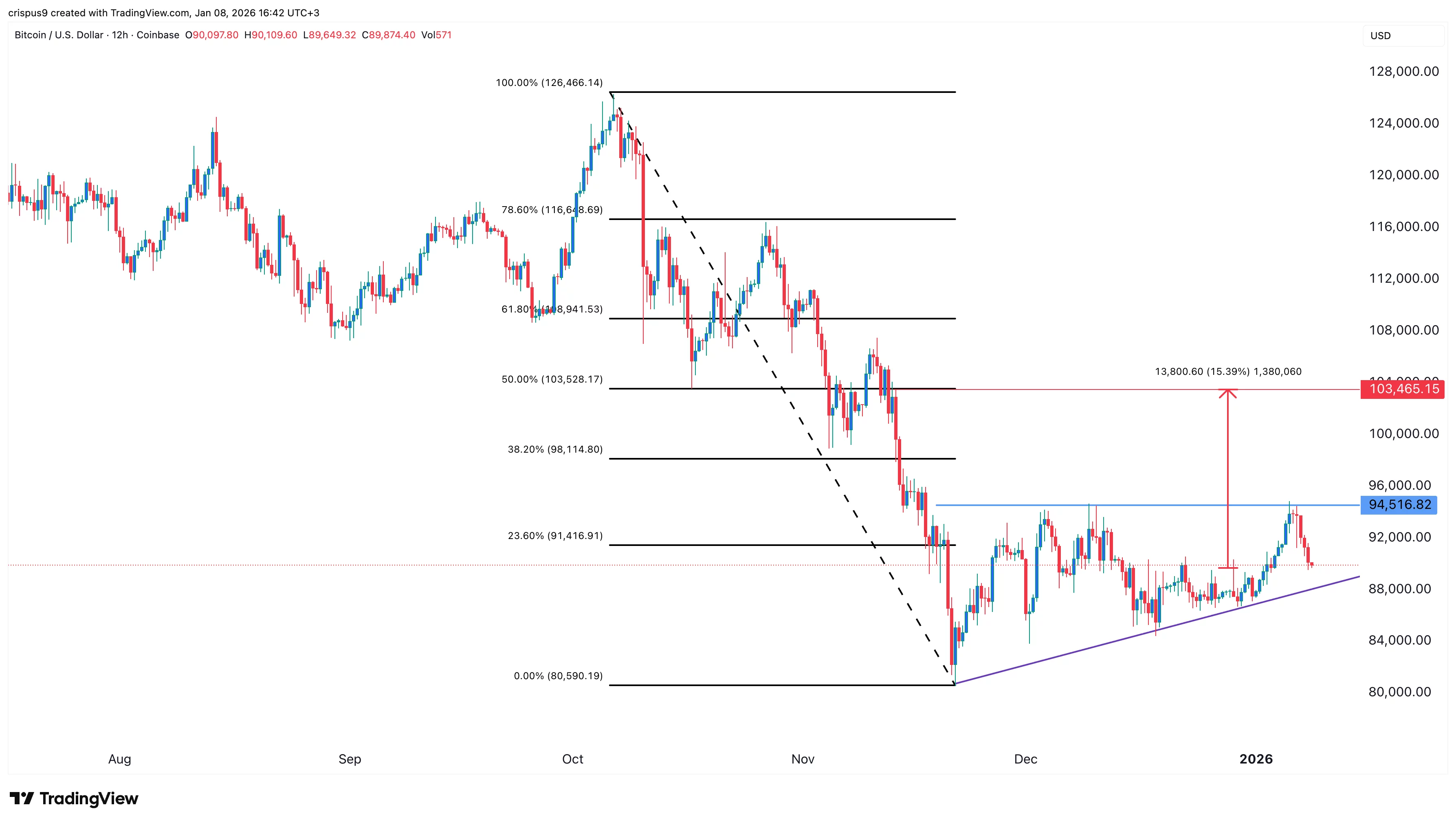

Bitcoin price rising triangle pattern

On the positive side, the 12-hour chart above shows the coin has formed a rising wedge pattern, a common bullish continuation pattern.

The higher side of this pattern is at $94,516, while the diagonal trendline connects the lowest swings since November. As such, the ongoing decline may be due to the coin retesting the diagonal trendline.

Therefore, the Bitcoin price may rebound, pushing other altcoins higher in the coming months.

You May Also Like

Real Estate Tokenization: Why Legal Architecture Matters More Than Technology

Why Altcoins Could Be Primed for 5–10x Gains After Years of Consolidation