Optimism Proposes Using Half Its Revenue to Buy Back OP Tokens

The Optimism Foundation announced plans to dedicate 50% of incoming Superchain revenue to monthly OP token buybacks starting February 2026, marking a fundamental shift in the network’s tokenomics strategy.

The proposal transforms OP from a pure governance token into one directly aligned with the Superchain’s growth, where the network captured 61.4% of the Layer-2 fee market and processes 13% of all crypto transactions.

The buyback mechanism would operate on collected sequencer revenue from chains including Base, Unichain, Ink, World Chain, Soneium, and OP Mainnet, which contributed 5,868 ETH over the past twelve months to a treasury managed by Optimism governance.

Based on comparable allocations from last year’s revenue, the program would deploy approximately 2.7k ETH, or roughly $8 million, in OP purchases at current prices, with the governance vote scheduled for January 22.

Revenue-Driven Token Evolution

The Foundation plans to partner with an OTC provider to execute monthly conversions of ETH to OP, beginning with January’s revenue in February.

Conversions will occur within predetermined windows regardless of price, though the program pauses if monthly revenue falls below $200,000 or if the OTC provider cannot execute under the maximum allowable fee spreads.

Purchased tokens will flow back into the collective treasury, where they may eventually be burned, distributed as staking rewards, or deployed for ecosystem expansion as the platform evolves.

The mechanism starts small but scales with Superchain expansion, where every transaction across participating chains expands the buyback base and creates structural demand for OP tokens.

The proposal also grants the Foundation discretion to manage the remaining ETH treasury assets to generate yield and support ecosystem growth, thereby reducing governance overhead that historically limited active treasury management.

While governance retains oversight over capital allocation parameters, this flexibility seeks to keep the Superchain competitive with peers that deploy capital more adaptively.

Superchain Dominance Fuels Growth Strategy

The buyback initiative comes as the Layer-2 landscape consolidates dramatically around Base, Arbitrum, and Optimism, which together process nearly 90% of all L2 transactions.

Base alone surpassed 60% market share by late 2025, while activity across smaller rollups dropped 61% since June, with many operating as “zombie chains” with minimal user activity.

Despite aggressive fee wars triggered by the Dencun upgrade’s 90% fee reduction, pushing most rollups into losses, Base generated approximately $55 million in profit during 2025.

The Superchain model leverages this concentration, where member chains contribute portions of sequencer revenue back to Optimism, creating a flywheel where usage generates revenue, revenue funds development, and development drives additional usage.

Meanwhile, Optimism continues building infrastructure for long-term sustainability, having selected Ether.fi as its strategic liquid staking partner on OP Mainnet in December, following a comprehensive RFP process.

The collective has earned 80.03 ETH in yield through staking operations, with the partnership designed to strengthen OP Mainnet’s position as a secure, liquid, and institutionally trusted DeFi environment.

Governance Debate and Implementation Timeline

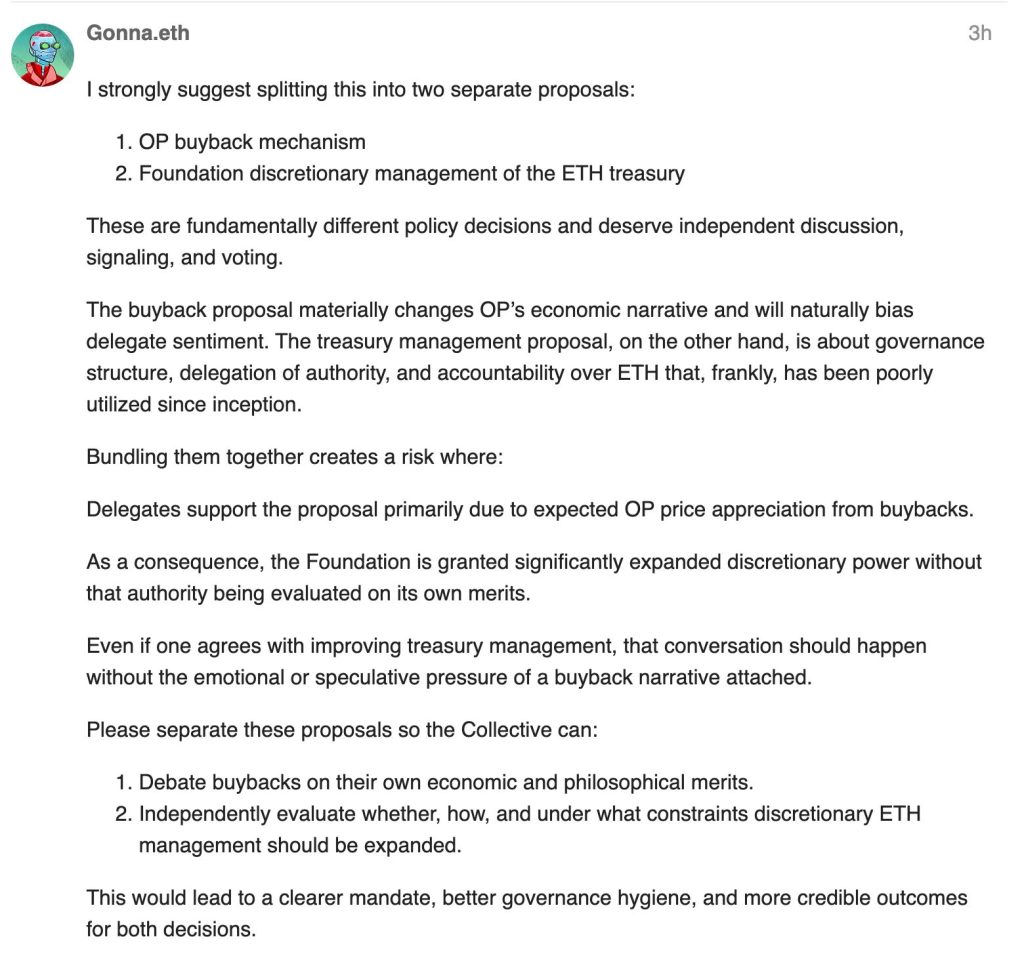

The proposal is facing some scrutiny from delegates concerned about bundling two distinct policy decisions into a single vote.

Community member Gonna.eth urged splitting the buyback mechanism from Foundation treasury discretion, arguing that bundling creates risks in which delegates approve expanded discretionary power primarily because of expected OP price appreciation rather than evaluating treasury management authority on its own merits.

Source: Optimism

Source: Optimism

The governance proposal moves to vote in Special Voting Cycle #47, requiring Joint House approval at a 60% threshold.

If approved, the Foundation will promptly enter into agreements with an OTC provider and publish an execution dashboard tracking fills, pacing, pricing, and balances for monthly conversions.

The program will continue for twelve months before re-evaluation, with initial operations executed by the Foundation under predetermined parameters, eliminating discretion.

Over time, the mechanism may move increasingly on-chain through Protocol Upgrade 18, which ensures all sequencer revenue from OP Chains gets collected on-chain without Foundation involvement.

At the time of publication, OP trades at $0.31, down 1% in the past 24 hours.

You May Also Like

Trading bots gain traction as crypto markets move sideways: HTX 2025 recap

The cryptocurrency exchange reported sharp growth in automated trading as vol

How to earn from cloud mining: IeByte’s upgraded auto-cloud mining platform unlocks genuine passive earnings