BNB Price Prediction: As Grayscale Seeks Approval For A BNB ETF

The BNB price is up 3.60% over the last week, outpacing the global cryptocurrency market, which is up 1% to a market capitalization of $3.195 trillion. In the last 24 hours, BNB price is up a fraction of a percentage trading at $895.95 as of 12:57 a.m. EST.

From a technical perspective, BNB is poised for a breakout, following Grayscale Investments’ procedural step of registering a statutory trust for a proposed BNB exchange-traded fund (ETF) in Delaware.

As buyers face resistance in the $900-$920 range, the focus now is on whether Grayscale’s endorsement will spark a sustained BNB surge.

Grayscale Registers BNB ETF In Delaware

Grayscale Investment registered a statutory trust for a proposed BNB ETF in Delaware on January 8, 2026, according to the State’s record.

The Wall Street firm seeking registration lays the groundwork for formal applications to federal regulators.

Moreover, ETF registration could open the door to increased institutional interest and greater market accessibility for BNB, thereby fostering its growth and acceptance as a legitimate investment vehicle.

As more investors recognize the potential of an ETF, they may reinvigorate their interest in BNB, which in turn could influence its market standing.

Can the BNB price pick up on this bullish outlook?

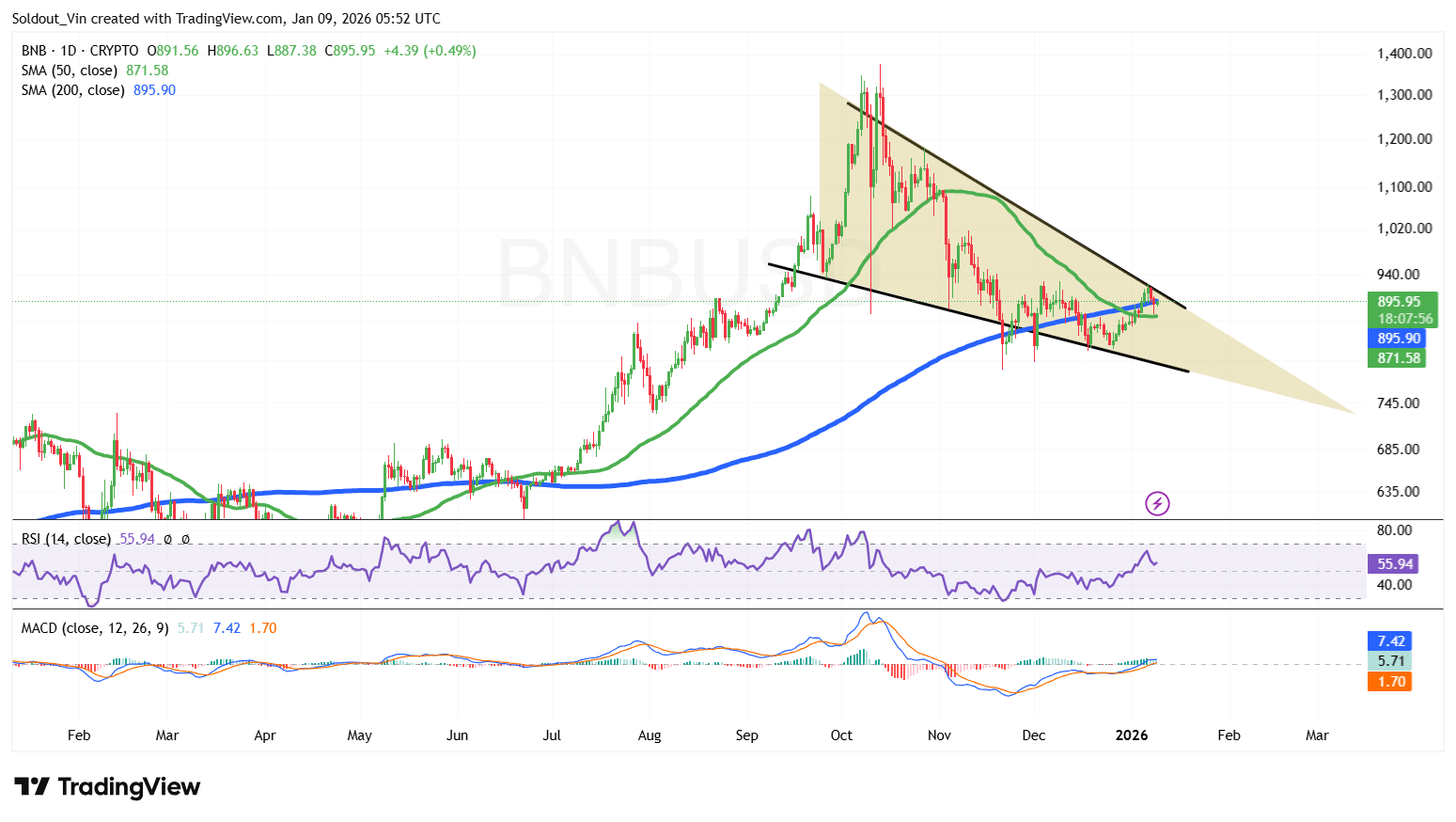

BNB Price Analysis: Falling Wedge Pattern Signals Potential Bullish Breakout

After a mid-year rally in 2025 that saw the BNB price soar to an all-time high of around $1,369 in October, the asset then entered a sustained downtrend, confined within a falling wedge pattern.

With the direction of the uptrend and the subsequent downtrend, the Binance Coin price is setting a foundation for an incoming uptrend above the wedge, as it now trades within the upper boundary of the wedge.

BNB has also crossed above both the 50-day and 200-day Simple Moving Averages (SMAs), $871.58 and $895.9, respectively, a signal that bullish pressure may be picking up.

The Binance Coin Relative Strength Index (RSI) has fallen from the 60 level but is now showing signs of a rebound, currently at 55, which may indicate that buyers are regaining momentum.

BNB/USD Chart Analysis Source: TradingView

BNB/USD Chart Analysis Source: TradingView

If buyers push the price of BNB above the $920 resistance and the upper boundary of the wedge, the next possible area of focus will be the previous demand areas around $1,008 and $1,114.

The Moving Average Convergence Divergence (MACD) fuels this sentiment, as the blue MACD line has now crossed above the orange signal line. At the same time, the green bars build above the neutral line, an indication of increased bullish pressure.

Conversely, if this resistance fails and bears regain control, the BSC ecosystem token could drop back to the $830 support area, which has been tested several times.

Related News:

You May Also Like

YUL: Solidity’s Low-Level Language (Without the Tears), Part 1: Stack, Memory, and Calldata

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC