New ChatGPT Predicts the Price of XRP, Ethereum and Solana By the End of 2026

OpenAI’s groundbreaking AI, ChatGPT, predicts ambitious end-of-year price targets for three of the largest cryptocurrencies, XRP, Ethereum, and Solana, offering a glimmer of hope for investors who expect big things from crypto this year.

According to the AI model, the emergence of a full-scale bull market supported by US regulators could push these assets to new all-time highs (ATHs) over the next cycle.

Here is ChatGPT suspects these major digital assets could perform during a 2026 bull run.

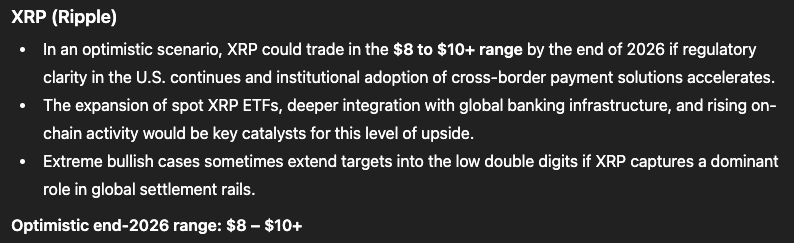

XRP (XRP): ChatGPT Sees XRP Reaching $10 by 2027

Ripple’s XRP ($XRP) opened the year with strong momentum, posting a 19% gain in the first week. In the last 24 hours, XRP rose 4% to hit $2.15. ChatGPT suggests that if bullish conditions persist, XRP could reach $10 by 2027.

Source: ChatGPT

Source: ChatGPT

XRP ranked among the top-performing large-cap cryptocurrencies for much of last year. In July, it recorded its first new ATH in seven years, reaching $3.65 after Ripple secured a decisive victory in its legal battle with the U.S. Securities and Exchange Commission.

That ruling significantly eased regulatory uncertainty surrounding XRP and reduced fears that the SEC count treat similar altcoins as securities.

While XRP has climbed 15% since New Year’s Eve, its Relative Strength Index (RSI) remains a neutral 54.

However, the road to ChatGPT’s bullish projection would require significantly more steam; XRP would need to rise roughly 365% to hit $10.

The recent rollout of spot XRP exchange-traded funds (ETFs) in the U.S. is drawing new institutional inflows, echoing the strong demand seen following the approval of Bitcoin and Ethereum ETFs.

Ethereum (ETH): ChatGPT Models a Potential Rally Toward $9,000

Ethereum ($ETH), the foundation of smart contracts, decentralized applications, and the broader DeFi ecosystem, remains the leading platform for Web3 innovation.

With a market capitalization of nearly $400 billion and over $75 billion in total value locked (TVL) across DeFi protocols, Ethereum continues to be crypto’s biggest hub of commercial activity.

DEthereum’s proven security, reliable settlement infrastructure, and central role in stablecoins and real-world asset tokenization position it as one of the likeliest candidates for increased institutional adoption, particularly if U.S. lawmakers advance comprehensive crypto regulation.

Ethereum currently trades at $3,290, with strong resistance around $5,000—it’s ATH is $4,946.05 posted back in August.

If ChatGPT’s bull case comes to fruition, a clear breakout above $5,000 could pave the way for a new ATH between $6,000 and $9,000.

Solana (SOL): ChatGPT Projects SOL at $600

Solana ($SOL) heads into 2026 as one of the fastest-growing smart contract platforms in the crypto sector. The network now supports approximately $9.2 billion in TVL and boasts a market capitalization well above $81 billion, alongside rapidly expanding developer and user activity.

The launch of Solana-focused ETFs by asset managers such as Bitwise and Grayscale has reignited investor interest, with many drawing comparisons to the early ETF adoption cycles of Bitcoin and Ethereum.

After experiencing a steep pullback in late 2025, SOL has rebounded into a key support range, gaining 5% over the past week to trade near $144.

In a highly bullish outlook, ChatGPT estimates Solana could climb to $600 in 2026, representing a roughly 200% increase from current levels and doubling its previous ATH of $293 recorded last January.

Solana’s narrative remains one of the strongest among altcoins. Rising institutional interest in real-world asset tokenization on Solana, led by firms such as Franklin Templeton and BlackRock, continues to hint at SOL’s long-term growth potential.

Maxi Doge (MAXI): High-Risk Meme Coin Play With Explosive Upside Potential

Outside of ChatGPT’s purview, the presale market continues to offer speculative early-stage opportunities.

Maxi Doge ($MAXI) is one of January’s most talked-about presales, raising more than $4.4 million ahead of its anticipated exchange debut.

The project introduces a swaggering, muscle-bound spin on Dogecoin’s Doge. Loud, unapologetic, and deliberately absurd, Maxi Doge embraces the irreverent spirit that originally defined meme coin culture.

After years of sitting on the sidelines watching his cousin DOGE blow up, Maxi Doge is mobilizing a degen army united by meme conviction, max-leveraged trading strategies, and a fearless attitude toward volatility.

MAXI is an ERC-20 token built on Ethereum’s proof-of-stake network, giving it a significantly lower carbon footprint than Dogecoin’s proof-of-work model.

The current presale stage offers staking rewards of up to 69% APY, though yields decrease as participation rises. MAXI is priced at $0.000278 in the latest round, with automatic price increases planned for subsequent phases. Tokens can be purchased using MetaMask or Best Wallet.

Maxi is sending Dogecoin back to the kennel with his tail between his legs!

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Website Here

You May Also Like

Markets await Fed’s first 2025 cut, experts bet “this bull market is not even close to over”

Trump Owns $870 Million Bitcoin Amid Crypto Market Meltdown