Trump Jails ‘Venezuela Leaker’: Suspicious Polymarket Whales Go Silent After Accurate Bets

US President Donald Trump’s claim that a “leaker on Venezuela” has been found and jailed after a group of unusually well-timed bets on Polymarket following the arrest of Venezuelan President Nicolás Maduro.

Speaking in the Oval Office this week, Trump said the individual responsible for leaking sensitive information related to Venezuela was “in jail right now” and could face a long prison sentence.

While Trump did not name the person or reference betting markets directly, his comments immediately renewed scrutiny of a cluster of Polymarket accounts that placed large, highly profitable wagers on Maduro’s removal from power shortly before the news became public.

Smart Trades or Leaked Intelligence? Questions Grow as Polymarket Wallets Go Dark

Blockchain analytics firm Lookonchain said that two of the three wallets previously linked to those Venezuela-focused bets have become inactive.

Lookonchain noted that these wallets stopped trading around the same period Trump suggested the leaker had been detained.

The firm highlighted that one account, identified as 0xa72DB1, turned a $5,800 stake into roughly $75,000 by betting that Maduro would be out of office by January 31, 2026.

Another wallet, 0x31a56e, reportedly invested about $34,000 and walked away with more than $400,000 before disappearing from the platform around January 8.

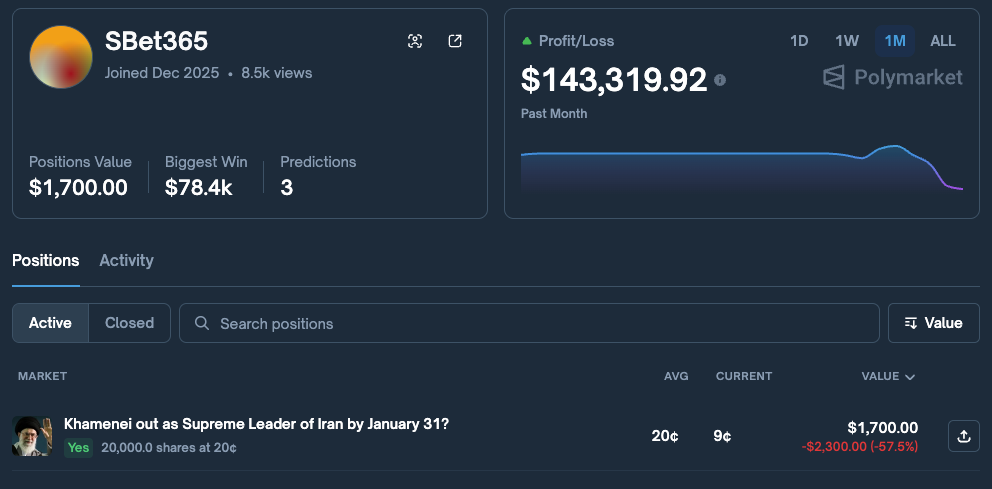

A third wallet, known as SBet365, remains active, as Lookonchain noted that this account placed a new wager two days ago predicting that Iran’s Supreme Leader Ayatollah Ali Khamenei would be removed from office by the end of January.

Source: Polymarket

Source: Polymarket

The same wallet had previously earned around $145,000 from Venezuela-related bets.

In early January, Lookonchain reported that the three wallets had been created and funded days in advance, then suddenly placed large bets just hours before Maduro’s arrest.

The timing of those trades has intensified concerns about insider information flowing into prediction markets.

Legal experts note that leaking classified or sensitive government information can carry severe penalties under U.S. law, particularly the Espionage Act.

Depending on the nature of the information, intent, and potential harm, sentences can range from several years in prison to decades, alongside substantial fines and permanent loss of security clearance.

Recent enforcement actions linked to Venezuela-related leaks suggest authorities are treating such cases aggressively.

Polymarket’s Growing Pains Spark Calls for Prediction Market Reform

While Polymarket markets are open to the public, critics argue that access to nonpublic government or military information undermines trust in platforms that blend elements of finance, gambling, and political forecasting.

Trump himself suggested there could be more than one leaker, saying officials would “let you know about that” if others are identified.

The controversy comes as Polymarket faces separate backlash over its handling of Venezuela-related contracts.

On January 7, the platform said it would not settle millions of dollars in wagers tied to whether the United States would invade Venezuela, despite Maduro’s capture during a U.S. operation.

Polymarket argued that the raid did not meet its contractual definition of an “invasion,” which it said requires military action intended to establish control over territory.

Over $10.5 million was bet on the result, and the ruling was not welcomed well by many traders, who accused the platform of changing its understanding of the rules retrospectively.

On January 6, Representative Ritchie Torres also stated he would introduce the Public Integrity in Financial Prediction Markets Act of 2026.

The legislation proposed would prevent federal officials and political appointees from trading prediction market contracts that are based on government actions or a political outcome when they hold material nonpublic information or have access to such nondisclosed information..

You May Also Like

GBP/USD rises as Fed rate cut odds boost Sterling

Crossmint Partners with MoneyGram for USDC Remittances in Colombia