| Disclosure: This content is promotional in nature and provided by a third-party sponsor. It does not form part of the site’s editorial output or professional financial advice. |

Global markets are holding near $3.23 trillion, but the Solana price plateau and Chainlink crypto saturation are limiting the potential for explosive ROI. Can these market leaders really produce the massive wealth generation that bold investors are looking for right now?

Zero Knowledge Proof (ZKP) is completely changing the way we handle data security. It works as a DePIN where Proof Pods protect AI data right from your home, making mining easy for everyone to join. Experts predict 5000x gains because of a looming supply shortage, while recent coin burns have already pushed the price up 300% to $0.0008, meaning the era of cheap entry is ending.

This utility-backed rarity makes ZKP a better choice than older assets, providing much higher growth potential. Because of this, it is ready to become the most popular cryptocurrency for investors who want the highest possible profits in this market cycle.

Zero Knowledge Proof (ZKP): The DePIN Shift Protecting AI Data

Zero Knowledge Proof (ZKP) is creating a major change by mixing privacy-focused cryptography with the fast-growing artificial intelligence industry. Built on the strong Substrate blockchain system, this project lets people prove data is real without showing private details, fixing big privacy problems in today’s data world.

The project is unique because it is a bold Decentralized Physical Infrastructure Network (DePIN). Special Proof Pods let regular people protect AI data from their own homes. Analysts say this easy access will make it the most popular cryptocurrency system for new and hungry miners.

Experts believe this open access will cause a huge supply shortage as more people join globally. Because of this, researchers expect 5000x gains, fueled by high use and a low supply, which creates a strong and lasting economic engine for future growth.

The early sale numbers already show how much investors want this. News about upcoming coin burns has already forced the price to jump 300% to $0.0008. This system makes sure that early buyers get a big share of the network’s rising value and rarity.

As the “cheap” buying phase ends quickly, the chance for massive returns is fading. With demand for the tech growing faster than the supply, researchers believe ZKP will beat slow legacy assets, proving it is the most popular cryptocurrency for smart portfolios in 2026.

Solana Price Review: Comparing Network Gains to Market Trends

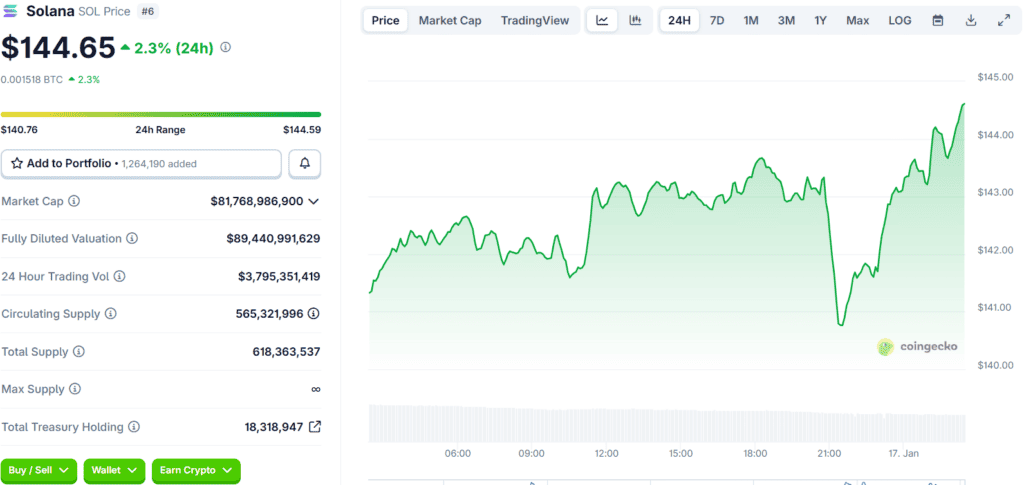

Solana is giving different signals as we start 2026. While the Solana price currently stays between $141 and $145, the network’s health is actually very strong. The blockchain now boasts over 60 million active users, which is more than any of its rivals. Also, the trade volume on its own markets reached $100 billion lately, beating Ethereum and BNB Chain together. This massive activity shows the network is growing fast even if the price is staying flat for now.

Source: Coingecko

Source: Coingecko

Investors are still very interested despite recent price drops. Big funds put $23.57 million into Solana ETFs last week, proving that “smart money” is still buying. However, the Solana price is hitting a wall near $148. Analysts say that falling below $140 could lead to a drop, but breaking $148 could start a run toward $162. The huge number of users provides a very strong floor for future gains once the market picks up.

Chainlink Crypto Sparks a Wall Street Gold Rush

Chainlink is currently trading near $13.75, but the big news is the massive wave of institutional buying hitting the market. The CME Group just said it will launch official Chainlink crypto futures in February, a major move that makes the asset official for Wall Street. Furthermore, the new Bitwise ETF saw over $2.5 million in buys on its very first day. These big events are putting a lot of pressure on the price, even while it stays in a quiet zone.

Wealthy investors are already making their move before the public notices. Data shows that “whales” moved over 695,000 LINK tokens off exchanges in only 48 hours, which means they expect the price to go up soon. With the big CCIP v1.5 update now live, Chainlink crypto is getting stronger just as demand is peaking. If the price can break through the $14.50 barrier, experts believe a fast climb toward $16 could happen very quickly.

Smart Portfolio Moves for 2026

While the Solana price stays steady above $140 and Chainlink crypto gets historic support from banks through new ETFs and futures, both assets are now older, safer plays with limited immediate upside. Their current quiet phases suggest slow and steady growth rather than the massive profits often wanted by bold investors this year.

Zero Knowledge Proof (ZKP) changes this entire picture. By letting users earn rewards through “Proof Pods,” it builds a real-world infrastructure network that experts say will cause a massive supply shock.

With 5000x profit goals and a 300% early jump already in the books, ZKP provides the huge potential that older coins just don’t have. Analysts believe it is set to become the most popular cryptocurrency for building wealth in 2026.

Find Out More about Zero Knowledge Proof:

Website: https://zkp.com/

Auction: https://auction.zkp.com/

X: https://x.com/ZKPofficial

Telegram: https://t.me/ZKPofficial

| Disclaimer: The text above is an advertorial article that is not part of coinlive.me editorial content. |