Trump strikes deal to unblock crypto bills in House, GENIUS Act set for vote

- Donald Trump announced on Wednesday that 11 of the 12 House representatives have agreed to support the GENIUS Act.

- The GENIUS Act, which outlines a regulatory framework for stablecoins, could face a full vote as early as Wednesday.

- This follows the House’s 196-222 vote on Tuesday to reject a procedural motion that would have allowed consideration of several crypto-related bills.

US President Donald Trump steps in to revive momentum for crypto legislation in the US House of Representatives. On Wednesday, Trump announced that 11 of the 12 House representatives have agreed to support the GENIUS ACT bill. This bill allows for the establishment of a regulatory framework for stablecoins, and the move comes after the House voted 196–222 against advancing the bill on Tuesday, temporarily stalling progress on a broader crypto legislative package. A full vote on the GENIUS Act could now take place as early as Wednesday.

Trump steps in to revive crypto regulations

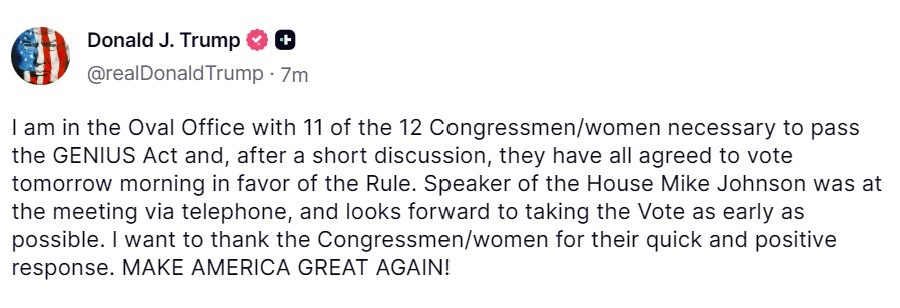

Donald Trump announced on his Truth Social post on Wednesday that the GENIUS Act is ready to pass through the House of Representatives during the legislative “Crypto Week.”

Trump said, “I am in the Oval Office with 11 of the 12 Congressmen/women necessary to pass the GENIUS Act and, after a short discussion, they have all agreed to vote tomorrow morning in favor of the Rule.”

He continued, “Speaker of the House Mike Johnson was at the meeting via telephone, and looks forward to taking the vote as early as possible. I want to thank the Congressmen/women for their quick and positive response.”

This announcement comes after lawmakers failed to pass a procedural motion that would have allowed the three bills —GENIUS, CLARITY, and Anti-CBDC—to move forward for deliberation on Tuesday. The motion was defeated by a vote of 196 to 223, as several Republican members joined Democrats in voting against it.

The US Senate passed the GENIUS Act in June, aiming to regulate stablecoin issuers in the US and help establish a legal framework that could enhance their legitimacy and facilitate wider adoption.

In addition to the GENIUS Act, the House lawmakers will also discuss the CLARITY bill and the Anti-CBDC Surveillance State Act, all in the same week, “Crypto Week,” boosting expectations that crypto regulations will reach President Trump’s desk before the August recess.

You May Also Like

UBS CEO Targets Direct Crypto Access With “Fast Follower” Tokenization Strategy

When Will Altcoin Season Start? FED Rate Cut Fuels Bitcoin, but Ethereum Still Lagging