Monero (XMR) Drops 17% in 24 Hours, Extends Pullback from All-Time High

Monero XMR $499.0 24h volatility: 12.9% Market cap: $9.22 B Vol. 24h: $312.35 M dropped 17% over 24 hours to $485.69. The decline extends its retreat from the all-time high of $797.73 set on Jan. 14.

The privacy coin’s 24-hour trading volume reached $322 million according to CoinGecko data. XMR is currently trading 39% below its all-time high and sits at the lowest point of its seven-day range. The token’s market cap stands at $8.95 billion, which places it at rank 21 among cryptocurrencies.

XMR/USDT 1-hour chart | Source: TradingView/Kraken

Exploit Context and Technical Breakdown

The decline follows a $282 million social engineering attack that occurred on Jan. 10. On-chain investigator ZachXBT documented that a victim lost 2.05 million LTC and 1,459 BTC due to a hardware wallet scam. The attacker converted the stolen assets to Monero via multiple swap services, which ZachXBT said caused XMR price to increase sharply.

Separately, technical analyst @ArdiNSC identified trend support loss at approximately $560 and observed the trend indicator flipped bearish for the first time since XMR traded at $430.

Broader Market Conditions

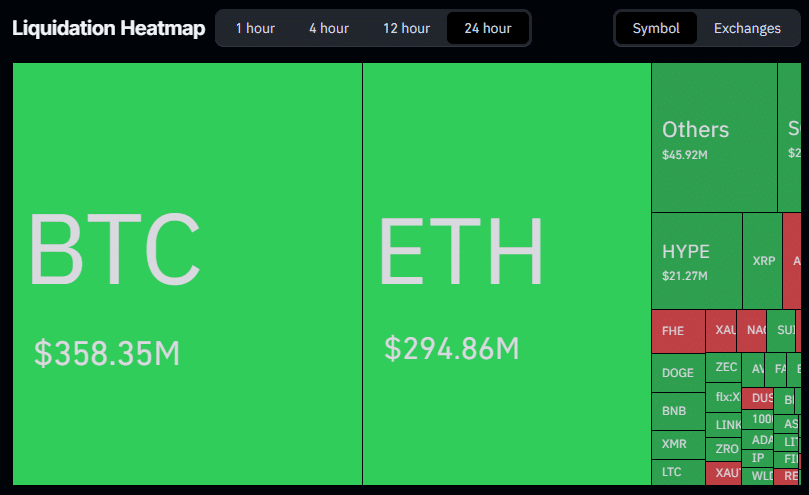

Derivatives data from Coinglass showed total market liquidations reached $857 million over 24 hours, up 130% from the prior day. Longs accounted for $750 million of that figure, while shorts made up $107 million. XMR-specific derivatives activity fell 14.15% to $214.27 million.

24-hour crypto liquidation heatmap | Source: CoinGlass

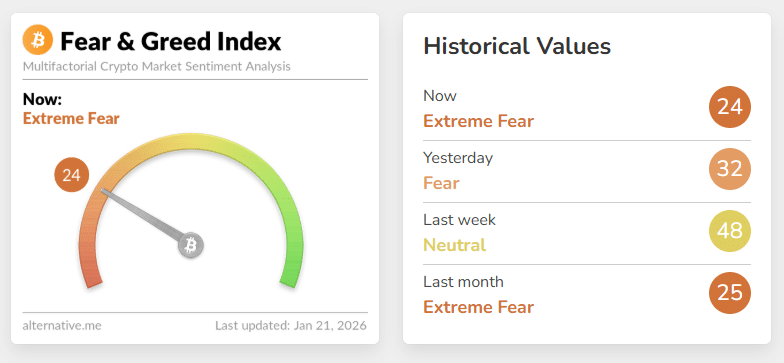

The Fear & Greed Index registered 24, extreme fear territory, down from 32 the previous day. The broader market declined 2.16% to a total capitalization of $3.09 trillion.

Crypto Fear & Greed Index | Source: Alternative.me

Monero falls within the privacy coin category. It gained 129% in 2025. Veteran trader Peter Brandt had compared XMR’s breakout pattern to silver’s historic rally just days before the correction began. The token’s growth earlier this month pushed the privacy coin sector above $20 billion in total value.

nextThe post Monero (XMR) Drops 17% in 24 Hours, Extends Pullback from All-Time High appeared first on Coinspeaker.

You May Also Like

Vitalik Buterin Reveals Ethereum’s (ETH) Future Plans – Here’s What’s Planned

SON DAKİKA: Kara Gecede Sürpriz Altcoin İçin Spot ETF Başvurusu Geldi!