Lista DAO Closes 2025 With Strong Growth and Major Product Milestones

[PRESS RELEASE – Toronto, Canada, January 23rd, 2026]

LISTA DAO CLOSES 2025 WITH STRONG GROWTH AND MAJOR PRODUCT MILESTONES

Closing out 2025, Lista DAO finalized a series of major product developments, including Smart Lending, a native Swap interface, and Fixed-Rate Borrowing. Rolled out toward the end of the year, these additions cap a period of sustained growth and signal a clear shift toward building a more comprehensive and capital-efficient DeFi stack.

A Year of Significant Growth

2025 marked Lista DAO’s evolution from a liquid staking provider into the Capital Routing Layer of the BNB ecosystem. By empowering users to manage their portfolios as active balance sheets, the protocol achieved exponential growth and absolute market dominance.

Key Performance Highlights:

- Record-Breaking TVL: The protocol’s TVL peaked at an all-time high of over $4.5 Billion earlier this year, marking a 179.40% growth year-over-year.

- Leading BNB Staking Market Share: Lista DAO now commands nearly 50% of the entire BNB Chain staking market. Over 12 million BNB are staked directly through Lista DAO, cementing its status as the undisputed infrastructure leader.

- Lending Market Explosion: Since its launch, the Lending sector has gone from zero to a massive $1.35 Billion in TVL, proving the protocol’s ability to successfully diversify its product lines beyond staking.

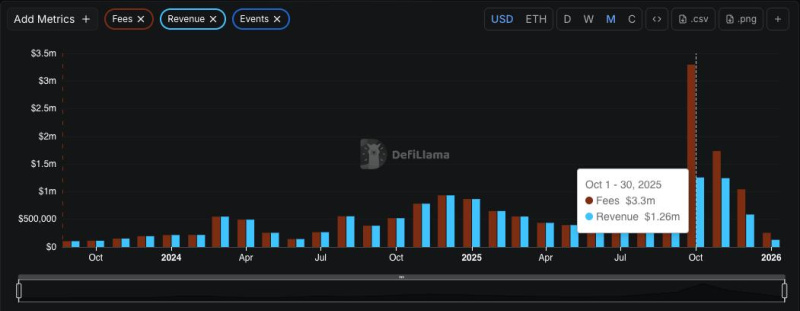

Beyond TVL growth, Lista DAO demonstrated revenue scalability, surpassing $1 million in monthly protocol revenue twice in H2 2025, reinforcing its position as a sustainable, yield-generating DeFi infrastructure.

Smart Lending & Swap Function: Ending the Era of Idle Assets

Smart Lending & Swap Function: Ending the Era of Idle Assets

With the launch of Smart Lending and its native Swap interface, Lista DAO introduced a new capital efficiency layer that fundamentally changes how collateral is utilized.

Instead of remaining idle while securing a loan, deposited assets are now actively deployed as liquidity within Lista’s internal markets. This allows users to maintain full borrowing functionality while simultaneously earning trading fees, transforming collateral from a passive guarantee into a yield-generating component of the protocol.

For slisBNB holders, Smart Lending enables a triple-yield structure built around a single asset:

- Liquid Staking Yield: slisBNB continues to accrue base BNB staking rewards.

- Trading Fee Income: By participating in slisBNB/BNB liquidity through Smart Lending, users earn DEX trading fees via slisBNBx.

- Binance Ecosystem Rewards: slisBNB remains eligible for Binance ecosystem incentives, including Launchpool, Megadrop, and HODLer Airdrops.

By consolidating staking yield, trading fees, and ecosystem rewards into a unified flow, Smart Lending & Swap represent a meaningful step toward higher capital efficiency and more flexible asset utilization across the BNB Chain.

Fixed-Rate & Fixed-Term Loans: Predictable Borrowing by Design

To meet the needs of users seeking certainty over capital costs, Lista DAO introduced Fixed-Rate & Fixed-Term Loans within its Lending CDP Zone.

In variable-rate lending systems, borrowing costs fluctuate with utilization and market conditions, creating uncertainty for users who rely on precise cost control. Fixed-Rate & Fixed-Term Loans remove this exposure by allowing borrowers to lock in both interest rates and loan duration at the time of minting lisUSD.

- Fixed Maturities: 7-day, 14-day, and 30-day terms

- Supported Collateral: BNB, slisBNB, and BTCB

- Key Benefit: Fully predictable borrowing costs over the entire loan period

By eliminating rate volatility, this module supports use cases such as structured hedging, interest-rate arbitrage, and portfolios that require strict balance-sheet planning.

For long-term holders of BTC, ETH, and BNB, this feature is a game-changer. It allows strategic investors to engage in cross-cycle investing with zero risk of rate shocks. By precisely calculating interest costs upfront, users can safely leverage their mainstream assets without the fear of liquidation caused by sudden interest rate spikes in a volatile market.

2026 H1 Roadmap

In 2026, Lista DAO will continue to expand its role as core financial infrastructure on BNB Chain and beyond. Key priorities include scaling Smart Lending into a leading stableswap hub by trading volume, expanding to the Ethereum mainnet, and broadening supported trading pairs. Lista will also deepen its RWA offering by introducing bond-backed collateral, corporate bonds, and yield-generating RWA products, while expanding on-chain utility for RWA assets.

At the protocol level, Lista plans to pioneer on-chain credit lending through its proprietary credit framework and deliver a unified lending experience by integrating Lending and CDP at the smart contract layer. In parallel, Lista will explore prediction market–derived products, enabling new vault strategies and low-risk, revenue-linked products in collaboration with ecosystem partners.

About Lista DAO

Lista DAO is the leading BNBFi protocol on BNB Chain, offering overcollateralized decentralized stablecoin (CDP), BNB LST, Lista Lending, and innovative solutions that allow users to earn rewards from Binance Launchpool, Megadrop, and HODLer Airdrops.

As the first to have its DeFi BNB recognized for Binance Launchpool, Lista DAO has achieved a TVL growth of 1,000% year-to-date, reaching an all-time high of $4.5B, making it the largest protocol on BNB Chain by TVL. LISTA is the native token of Lista DAO, tradable on major exchanges such as Binance, Bitget, Coinone, and more.

The post Lista DAO Closes 2025 With Strong Growth and Major Product Milestones appeared first on CryptoPotato.

You May Also Like

Eric Trump bets Fed rate cut will send crypto stocks skyrocketing

Vlna BitcoinFi boomu sa začína s HYPER