Bitcoin ETFs Bleed $1.62B in Four Days — Are Hedge Funds Dumping BTC?

Bitcoin spot exchange-traded funds have experienced steep outflows over four trading days, losing a combined total of $1.62 billion.

The exit has raised a question on whether hedge funds are withdrawing their Bitcoin exposure as the market conditions change.

The withdrawals occur as Bitcoin fails to regain momentum around critical price points, while a once-popular institutional arbitrage strategy steadily loses its appeal.

BlackRock’s IBIT Leads Bitcoin ETF Outflows as BTC Slips Below $90K

As of January 22, 2026, US-listed spot Bitcoin ETFs recorded net daily outflows of $32.11 million, extending a streak of redemptions that peaked at $708.71 million on January 21, following $483.38 million on January 20, Sosovalue data shows.

In the last one week, net outflows amounted to 1.22 billion.

Trading activity stayed strong on January 22, with Bitcoin spot ETFs recording $3.30 billion in volume, even as assets under management dipped to $115.99 billion, about 6.49% of Bitcoin’s market cap.

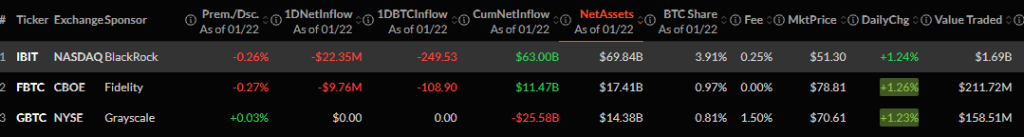

BlackRock’s iShares Bitcoin Trust led daily outflows, with $22.35 million redeemed, equivalent to roughly 249.5 BTC.

Despite the withdrawal, IBIT remains the dominant product, holding $69.84 billion in assets and nearly 4% of the Bitcoin supply represented in ETFs.

Bitcoin ETFs data Source: Sosovalue

Bitcoin ETFs data Source: Sosovalue

Fidelity’s FBTC followed with $9.76 million in outflows, while Grayscale’s GBTC reported flat daily flows but remains deeply negative overall, with $25.58 billion in cumulative net outflows as investors continue rotating away from its higher 1.5% fee.

Other issuers, including Bitwise, Ark and 21Shares, VanEck, Invesco, Valkyrie, Franklin, and WisdomTree, recorded largely unchanged flows, showing a pause rather than broad panic selling.

The ETF pullback has unfolded alongside weakness in Bitcoin’s price.

BTC was trading around $89,982 on January 22, down 1.3% on the day and nearly 5% over the past week, after briefly dipping to $88,600.

Trading volume has also cooled, falling nearly 28% to $37.77 billion, a sign that market participation is thinning as prices consolidate below $90,000.

Compressed Yields Trigger Hedge Fund Exit From Bitcoin ETFs

Market observers point to hedge fund positioning as a key driver behind the ETF outflows.

Amberdata shows that yields on the Bitcoin basis trade, a strategy that buys spot Bitcoin via ETFs while selling futures to capture price spreads, have dropped below 5%, down from around 17% a year ago.

As returns compress and approach the yield available on short-dated US Treasuries, fast-moving capital has less incentive to stay deployed.

Analyst noted that while hedge funds likely represent only 10% to 20% of ETF holders, their activity can overwhelm flows in the short term when the trade stops working.

Bloomberg data shows that the unwind is visible in derivatives markets as well.

Bitcoin futures open interest on Chicago Mercantile Exchange (CME) has fallen below Binance’s for the first time since 2023, showing reduced participation in cash-and-carry trades by US institutions after ETFs launched there.

One-month annualized basis yields now hover near 4.7%, barely clearing funding and execution costs, as spreads tighten and arbitrage opportunities fade.

CryptoQuant indicators show apparent demand turning negative, whale and dolphin wallets shifting from accumulation to distribution.

Also, the Coinbase premium remained deeply negative, suggesting weaker appetite from US institutions.

At the same time, leverage in Bitcoin futures has climbed to its highest level since November, increasing the market’s sensitivity to sharp moves in either direction.

Flows in other crypto ETFs underline that the sell-off is not uniform.

Ethereum spot ETFs also recorded heavy outflows this week, including $41.98 million on January 22, while XRP and Solana-linked products saw modest inflows, pointing to selective institutional repositioning rather than a wholesale exit from digital assets.

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

XRP Ledger Unlocks Permissioned Domains With 91% Validator Backing