Smart Money Exits Solana’s Seeker Token After 200% Rally as Whale Accumulation Grows

TLDR

- Smart money reduced Seeker holdings by 56.48% amid a price drop.

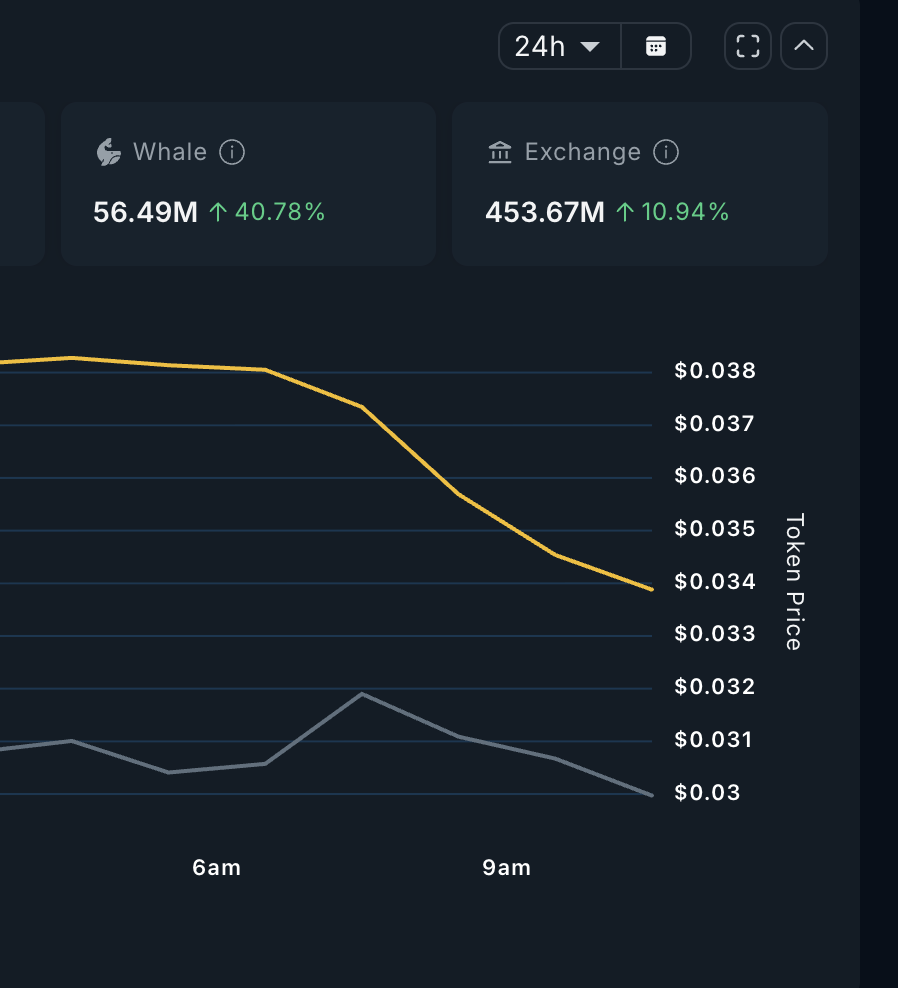

- Whale accumulation increased by 40.78% as the price dropped.

- On-Balance Volume trends downward, signaling weak buying momentum.

- Exchange inflows grew by 10.94%, suggesting retail profit-taking.

Solana’s Seeker Token, after a massive 200% rally, is now facing critical price pressure as smart money exits and whale accumulation intensifies. Despite a surge in whale holdings, exchange inflows and a decline in On-Balance Volume (OBV) suggest growing selling pressure. With key support levels at risk, Seeker’s future remains uncertain unless it can overcome resistance and restore investor confidence in the face of rising market volatility.

Smart Money Exits Seeker Token After 200% Rally

Seeker token has experienced a 200% price rally recently, but signs of weakness are emerging as smart money begins to exit. Over the past 24 hours, data from on-chain analysis reveals a sharp decline in Seeker holdings by smart money wallets.

These investors reduced their SKR positions by 56.48%, which equates to around 8.5 million SKR. This significant sell-off comes after the token’s recent price struggles, particularly after the Seeker token price broke below its Volume Weighted Average Price (VWAP).

The breakdown below VWAP, which is an indicator of average trading prices, signals a shift from a bullish to a bearish market structure. According to analysts, this loss of price support was followed by a large-scale exit from short-term smart money investors who sought to preserve capital amid growing uncertainty.

Whale Accumulation Increases Despite Smart Money Exit

While smart money exits, whales are accumulating Seeker tokens. Whale wallets increased their holdings by 40.78%, bringing their total SKR holdings to approximately 56.49 million. This increase occurred even as Seeker’s price continued to trend lower. The price drop, coupled with a rise in the Money Flow Index (MFI), indicates that whales are capitalizing on what they see as a temporary pullback in the market.

The MFI, which tracks buying and selling pressure using both price and volume, showed a divergence where the price fell, but the MFI rose. This divergence is typically a signal of accumulation, suggesting that large investors are taking advantage of lower prices to add to their positions. Despite the accumulation by whales, however, this does not guarantee an immediate price increase, especially as selling pressure remains high from retail investors.

Exchange Inflows Add to Selling Pressure

Despite whale accumulation, the Seeker token price continues to face downside risks due to a significant increase in exchange inflows. Data shows that over the past 24 hours, exchange balances increased by 10.94%, equating to approximately 44.8 million SKR moving onto exchanges. This suggests that retail investors are taking profits or liquidating their positions, which has contributed to the overall increase in selling pressure.

The influx of SKR onto exchanges creates a situation where the token is more vulnerable to price declines, as it suggests that more supply is available for sale. On the four-hour chart, On-Balance Volume (OBV), a metric that tracks volume in relation to price movements, is trending downward. This trend further confirms that Seeker’s price rallies have been driven by weaker buying pressure and could lead to a further decline in value if the trend continues.

Technical Outlook for Seeker Token

The technical outlook for Seeker token remains cautious as it faces both downward pressure from smart money exits and selling by retail investors. A clean break below the $0.028 support level would likely expose the token to further downside, potentially reaching $0.0120. In contrast, for Seeker to regain bullish momentum, it must first reclaim the $0.043 level. If the price can surpass this level, $0.053 will become the next critical resistance point.

However, the key challenge for Seeker is its ability to turn around the negative sentiment currently driving the price lower. Without a shift in volume behavior, including a strong increase in demand, the risk remains tilted to the downside.

The post Smart Money Exits Solana’s Seeker Token After 200% Rally as Whale Accumulation Grows appeared first on CoinCentral.

You May Also Like

Crypto News: Donald Trump-Aligned Fed Governor To Speed Up Fed Rate Cuts?

Korean Regulators Probe Bithumb After 620,000 Bitcoins Mistakenly Sent to Users

Highlights: Bithumb mistakenly sent 620,000 Bitcoins to 695 users during a promotion event. The exchange recovered 618,212 Bitcoins, covering almos