Tether Posts Largest Crypto Revenue in 2025: $5.2B From Stablecoin Dominance

Tether emerged as the most profitable crypto entity in 2025, generating an estimated $5.2 billion in revenue as stablecoins overtook all other protocol categories in earnings.

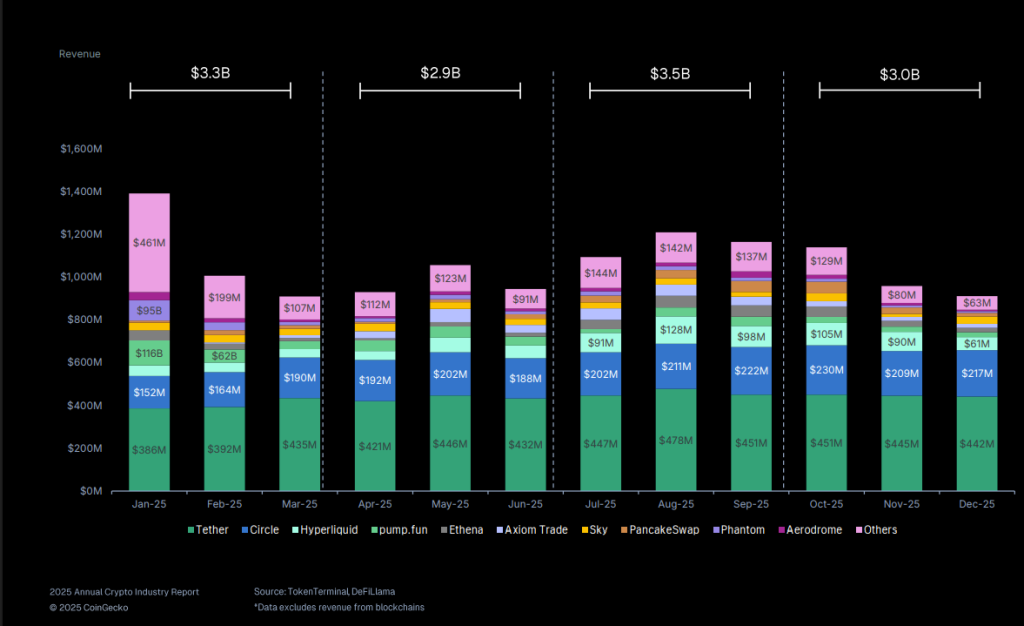

According to the latest Coingecko annual crypto industry report, Tether alone accounted for 41.9% of all stablecoin-related revenue in 2025, outpacing competitors such as Circle, Hyperliquid, Pump.fun, Ethena, Axiom, Phantom, and PancakeSwap.

The results show that dollar-backed digital currencies have become the most durable revenue engine in crypto, even as market conditions fluctuated throughout the year.

Tether Leads Stablecoin Issuers To Capture Crypto Revenue Crown

Among more than 168 crypto protocols tracked in 2025, stablecoin issuers collectively generated the highest revenue, with Tether firmly at the center.

Its $5.2 billion haul placed it well ahead of Circle and other major players, reinforcing USDT’s position as the industry’s primary settlement asset.

Within the top ten revenue-generating protocols, just four entities, led by Tether and Circle, produced 65.7% of total earnings, equivalent to roughly $8.3 billion.

Source: Coingecko

Source: Coingecko

The remaining six protocols in the top ten were all trading-focused platforms, highlighting a sharp divide between stable revenue streams and market-dependent income.

That contrast became clear as trading revenues swung widely with investor sentiment during the year.

Phantom, for example, recorded $95.2 million in revenue in January at the height of the Solana meme coin frenzy, only to see earnings fall to $8.6 million by December as speculative activity cooled.

The broader stablecoin market expanded rapidly, with total market capitalization rising by $6.3 billion in the fourth quarter alone to reach a record $311.0 billion.

That marked a 48.9% year-over-year increase, adding $102.1 billion as adoption accelerated across regions.

Tether maintained clear leadership with 60.1% of the total stablecoin market cap, or about $187.0 billion, followed by Circle’s USDC at 24.2%, equivalent to $72.4 billion.

Tether is now the world’s third-largest digital asset by market value at $186.8 billion, up roughly 50% from a year earlier.

While the top players strengthened their grip, shifts within the top five reflected changing risk appetites.

Ethena’s USDe experienced the sharpest reversal, with its market cap plunging 57.3%, or $6.5 billion, after a mid-October depeg on Binance undermined confidence in high-yield looping strategies.

Other stablecoins posted mixed but notable moves as capital rotated within the sector.

PayPal’s PYUSD surged 48.4%, adding $1.2 billion to reach $3.6 billion and briefly claiming the fifth spot before World Liberty Financial’s USD1 reclaimed it by nearly $1.

Additional high-growth tokens included Ripple’s RLUSD, which expanded 61.8% to add $488.2 million, and USDD, which climbed 76.9% with a $366.8 million increase.

Inside Tether’s $500B Valuation Path and Expanding Investment Empire

Looking ahead, Bitwise CIO Matt Hougan recently suggested that Tether could become the world’s most profitable company if its trajectory continues.

“There’s a chance that many emerging market countries will convert from primarily using their own currencies to using USDT,” Hougan said, pointing to Tether’s near-total dominance outside Western markets.

Based on projected interest income, calculations indicate that custody of $3 trillion in assets could generate annual revenue exceeding the $120 billion earned by Saudi Aramco last year.

Tether CEO Paolo Ardoino previously told Cryptonews he remains confident USDT will retain its lead due to the company’s deep understanding of real-world usage.

Beyond stablecoins, Tether has expanded aggressively into traditional assets and investments.

The company recently became the second-largest shareholder in Italian football club Juventus and has reportedly explored raising $20 billion for a 3% stake, a deal that would imply a valuation near $500 billion and place Tether among the world’s most valuable firms.

You May Also Like

Microsoft Corp. $MSFT blue box area offers a buying opportunity

Marathon Digital BTC Transfers Highlight Miner Stress